Fitch Ratings of London has issued a stable credit outlook for global gold producers, citing their strong financial metrics and debt reduction despite higher inflation, interest rates and geopolitical risk.

Gold prices have remained historically high due to geopolitical influences and big-investor demand despite rising interest rates over the past 18 months, the agency said in a Nov. 2 report. Fitch analysts expect gold prices to level yet stay above the base assumption of US$1,500 per oz. in 2024 and 2025.

“Gold prices are expected to remain elevated, relative to Fitch’s midcycle expectations in 2024 and 2025, driving a profitable operating environment for miners,” wrote senior director and co-author of the report Moncia Bonar.

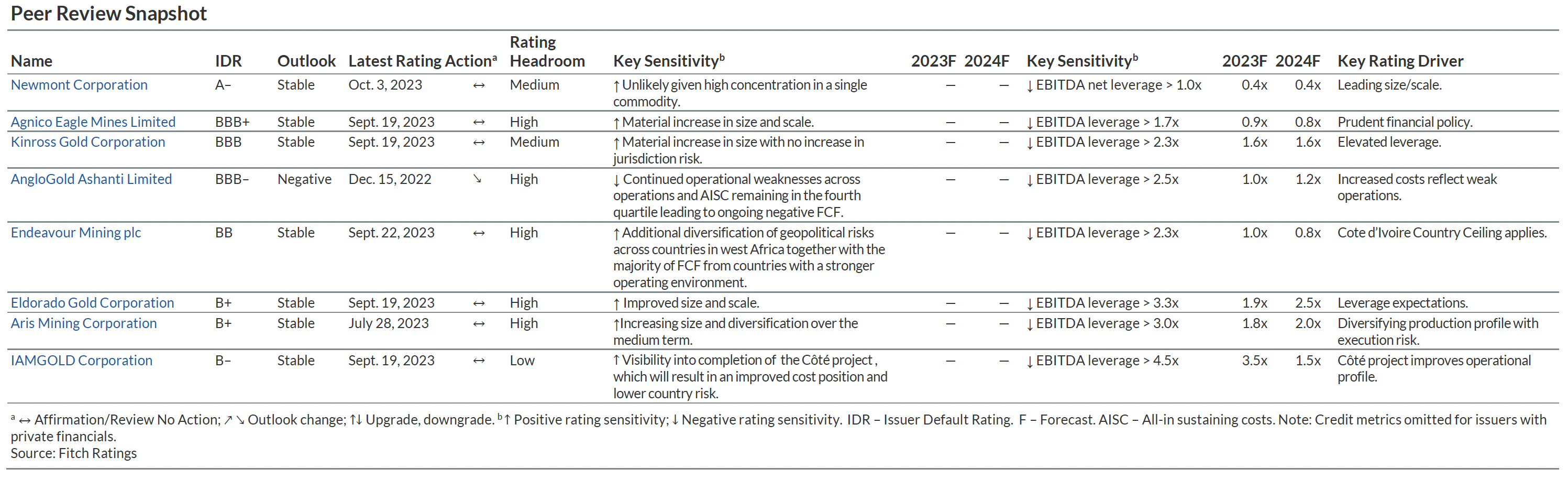

While miners’ margins face pressure from higher costs, the companies remain relatively strong for their ratings, supported by healthy balance sheets. The prevalence of mergers and acquisitions (M&A), a demand for scale and growth, and cost-cutting are several key factors shaping the credit ratings of several notable industry players, the report says.

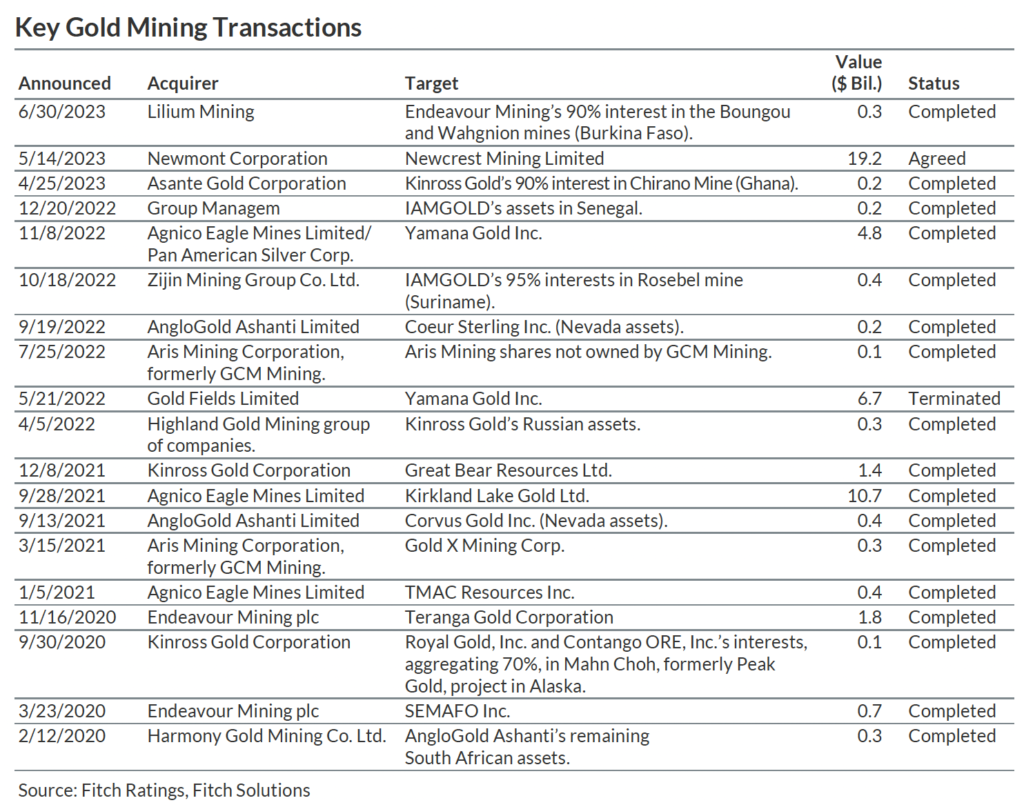

M&A activity among gold companies over the past year was mainly aimed at expanding or optimizing their asset bases and operational scales.

Fitch says these moves are seen as strategic, helping companies shore up their reserves and expand their footprint. For instance, Newmont (TSX: NGT; NYSE: NEM) acquired GT Gold Corp and assets from Yamana Gold (TSX: YRI; NYSE: AUY; LSE: AUY), while Kinross Gold (TSX: K, NYSE: KGC) opted to purchase Great Bear Resources.

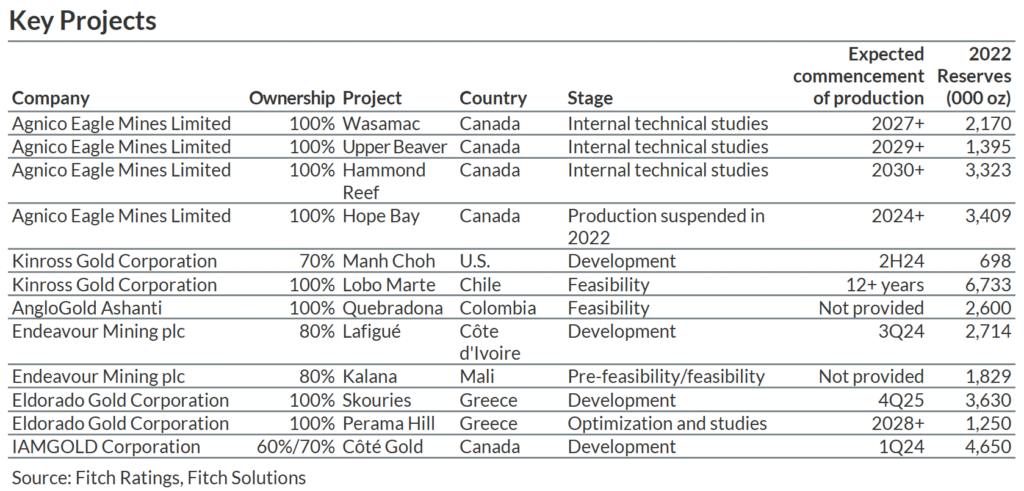

Mergers and divestitures are expected to continue as gold miners aim to improve efficiencies based on asset location and exploitation expertise. The completion of near-term projects like those at Côté, Endevour’s Lafigué in Côte d’Ivoire, and Kinross’ Manh Choh in Alaska are expected to boost reserves.

While M&A is a viable avenue for growing depleting producer reserve bases, several companies are developing major projects. Eldorado Gold (TSX: ELD) and Iamgold (TSX: IMG; NYSE: IAG) are companies expecting a temporary uptick in debt, followed by a surge in earnings once these projects reach completion.

Iamgold’s Côté project in Ontario stands out, expecting the company’s operational and financial indicators to realign with standard benchmarks after its successful ramp-up.

Looking for scale

Fitch also highlights that miners have sought to scale strategically, significantly influencing their financial and operational flexibility.

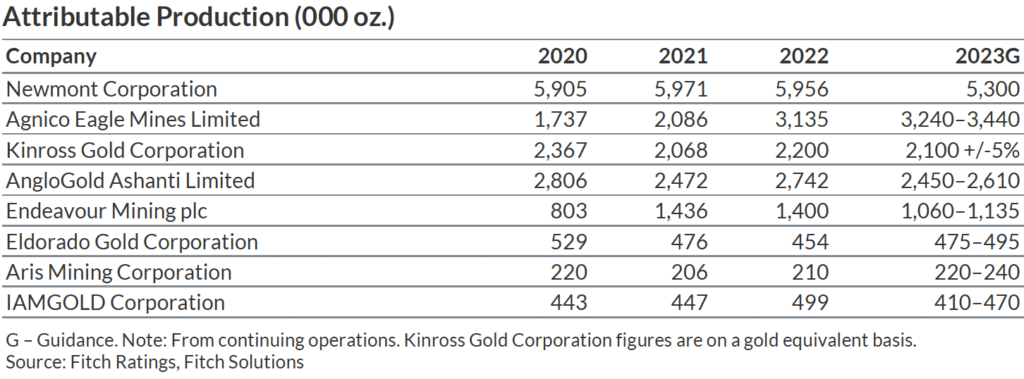

For these reasons, large-scale operations such as those owned by Newmont and Agnico Eagle (TSX: AEM; NYSE: AEM) are in advantageous positions. Notably, Newmont is projected to produce over 5.3 million oz. gold per year for the foreseeable future.

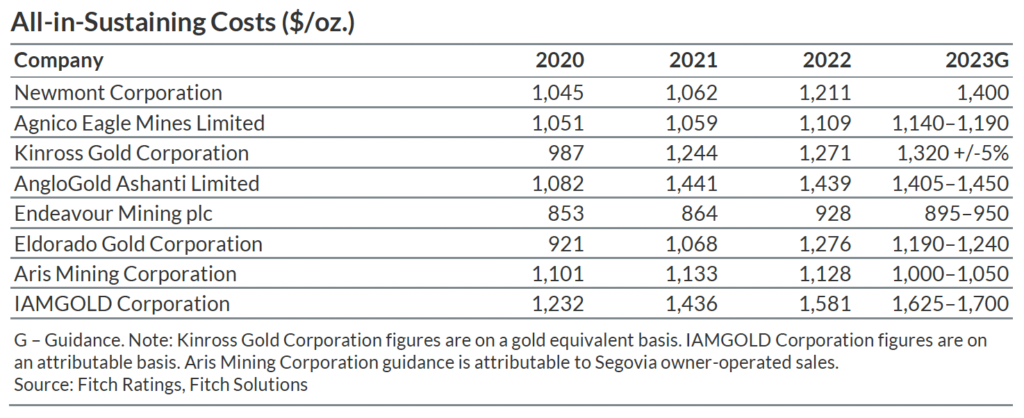

Meanwhile, Fitch notes that cost positioning, evaluated based on all-in sustaining cost per oz., is a key aspect that differentiates companies and their ratings. Fitch observes that most issuers are expected to sustain costs in the favourable second or low-third quartile of CRU Group’s global gold cost curves.

Fitch notes the cost curve for gold companies is relatively flat, with roughly a US$370 per oz. difference between the top of the first quartile and the bottom of the fourth quartile. CRU has pegged the 90th percentile all-in sustaining cost for 2023 at US$1,563 per ounce.

However, companies like AngloGold Ashanti (NYSE: AU) have encountered challenges such as increased costs from inflation and operational inefficiencies affecting their investment-grade ratings.

Also, geopolitical risk can hold down ratings. Endeavour Mining (TSX: EDV; LSE: EDV), for instance, operates in Senegal, Burkina Faso, and Côte d’Ivoire, and its rating is constrained by Côte d’Ivoire’s ‘BB’ so-called ‘country ceiling’ – the maximum creditworthiness of an issuer like a company or a government.

Financial resilience

Profitability is a moderately important factor for ratings, with Fitch emphasizing the importance of stable and sustainable earnings. The focus is on the ability of gold companies to generate free cash flow (FCF) consistently.

While investment-grade issuers are anticipated to generate positive FCF, high-yield equity issuers, such as Endeavour, may undergo periods of negative FCF as they fund growth projects.

The report also notes the significance of financial ratios and financial flexibility to the ratings of gold companies.

Fitch generally expects a more conservative financial profile from gold issuers due to the volatility in cash flows. Fitch expects leverage to normalize over the next three years, emphasizing that conservative financial behaviour is considered credit-positive.

Despite its expectation that gold prices will level from cycle highs, Fitch foresees the group of gold miners’ balance sheets to remain healthy. Most issuer outlooks have been classified as stable, reflecting an expectation of companies adhering to existing financial policies.

Be the first to comment on "Credit rater Fitch upbeat on gold majors’ resilience amid hazy markets"