An affiliate of China’s Zijin Mining Group is investing about $130 million in Solaris Resources (TSX: SLS; US-OTC: SLSSF) for a 15% in the company, which owns the Warintza copper project in southeast Ecuador.

Zijin agreed to buy around 28.5 million common shares of Solaris in a private placement for $4.55 each, a 14% premium to the closing price at the end of day on Jan. 10. Its minority stake will give Zijin the right to appoint a member of the board.

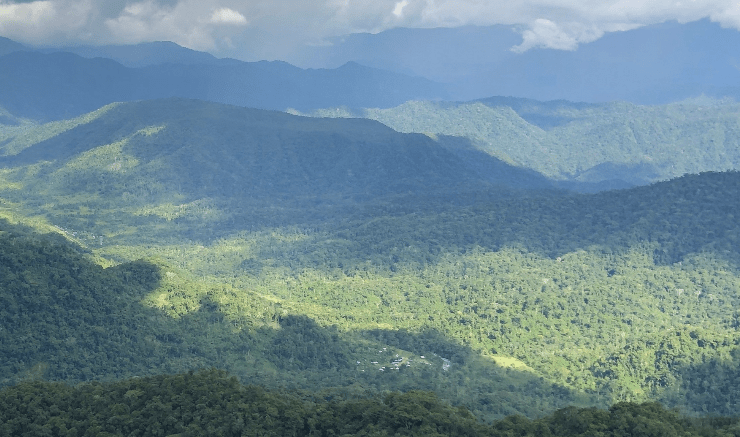

“We take tremendous pride in announcing our new strategic partnership with Zijin and look forward to leveraging its deep technical expertise and financial capacity in delivering the full potential of one of the last remaining greenfield copper districts at low elevation and adjacent to infrastructure available globally,” said Solaris president and CEO Daniel Earle.

Zijin’s investment will add to its significant footprint in South America, where it holds partial or whole interests in projects in Colombia, Suriname, Guyana, Peru and Argentina in various commodities including gold, copper and lithium. However it is subject to approval under the Investment Canada Act, which the federal government tightened in 2022, targeting acquisitions by state-owned enterprises. It then ordered three Chinese companies to divest their stakes in three lithium juniors.

The Warintza property is located close to all infrastructure, including the hydroelectric power grid. The central resource is estimated at 579 million indicated tonnes grading 0.47% copper, 0.03% molybdenum, and 0.05 gram gold per tonne (0.59% copper equivalent). The inferred resource is 887 million tonnes at 0.39% copper, 0.01% molybdenum, and 0.04 gram gold (0.47% copper equivalent).

Solaris has also outlined a high-grade starter pit at Warintza central of 180 million indicated tonnes grading 0.67% copper, 0.03% molybdenum, and 0.07 gram gold (0.82% copper equivalent). There are also 107 million inferred tonnes at 0.64% copper, 0.02% molybdenum, and 0.05 gram gold (0.73% copper equivalent).

The company says it plans to publish updated resource numbers by the middle of this year.

The Warintza deposit was discovered by David Lowell in 2000 but sat dormant for two decades due to a breakdown in social acceptance from local communities.

In mid-2019, Solaris undertook extensive dialogue to understand the root causes of the conflict and to resolve them. An impact and benefits agreement was signed in 2020 and updated in 2022.

Solaris shares were up 5.2% to $4.21 apiece in Toronto on Thursday afternoon, valuing the company at $634.8 million. Its shares traded in a 52-week range of $3.96 and $7.53.

Be the first to comment on "Zijin invests $130M in Solaris and its Warintza copper project"