Chilean miner Antofagasta (LSE: ANTO) has secured US$2.5 billion to finance a second concentrator at its Centinela copper mine in the country’s north, which will add 144,000 tonnes a year to the company’s overall production.

The company said on Tuesday it had inked signed definitive agreements with a group of international lenders, including the Japan Bank for International Cooperation, Export Development Canada, the Export-Import Bank of Korea and several commercial lenders for the term loan. The financing has a four-year drawdown period and a 12-year term, Antofagasta said.

“The Centinela Second Concentrator project is a prime example of how Antofagasta can unlock value from its portfolio and our dedication to sustainable and responsible copper production,” chief executive Ivan Arriaga said in a statement.

The company has also signed a separate agreement granting Centinela the option to source water for its current and future operations from an international consortium. This group would acquire Centinela’s existing water supply system and extend it to serve the second concentrator. The international consortium is in the process of finalizing its financing to fulfill this agreement within the year.

As part of this deal, Centinela will transfer its current water transportation assets and rights for about US$600 million to be received in 2024. The consortium will handle the construction and related capital expenses amounting to US$380 million for the planned expansion of the water transportation system.

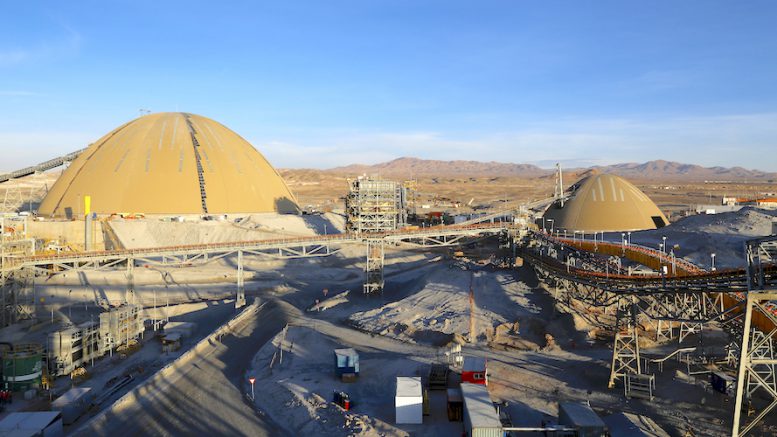

The US$4.4-billion second concentrator at Centinela, which was greenlit in December 2023, is expected to start operations in 2027.

Be the first to comment on "Antofagasta lands US$2.5B loan for Centinela copper expansion"