South Pacific-focused Lion One Metals (TSXV: LIO) has kicked off production at the Tuvatu gold project in western Fiji. It also reported a bonanza drill intercept in Zone 5, where infill and grade control drilling are underway. Its shares closed more than 12% higher.

Production entails the first remote bogging and long-hole stope blasting in Fiji which started in mid-May. The more consistent production tempo matches with upgrades to the mill for a throughput of 400 tonnes per day from the nameplate 300 tonnes envisioned in the 2022 preliminary economic assessment (PEA). The mill team implemented working improvements and debottlenecking initiatives to achieve better throughput, the company said in a release.

Tuvatu is slated to produce about 331,400 oz. per year over a five-year life, according to the PEA. It has an after-tax net present value (at a 5% discount) of US$121.7 million and an internal rate of return of 50.9%. The pre-production capital outlay came in at US$66.8 million.

The company believes the alkaline nature of the deposit makes it highly prospective for more discoveries. Tuvatu is comparable to Barrick Gold’s (TSX: ABX; NYSE: GOLD) 25-million oz. Porgera mine in Papua New Guinea (PNG), Newmont’s (TSX: NGT; NYSE: NEM) 40-million oz.-plus Lihir mine, also in PNG, the 11-million oz.-plus Vatukoula mine in Fiji and the 20-million oz.-plus Cripple Creek & Victor mine in Colorado.

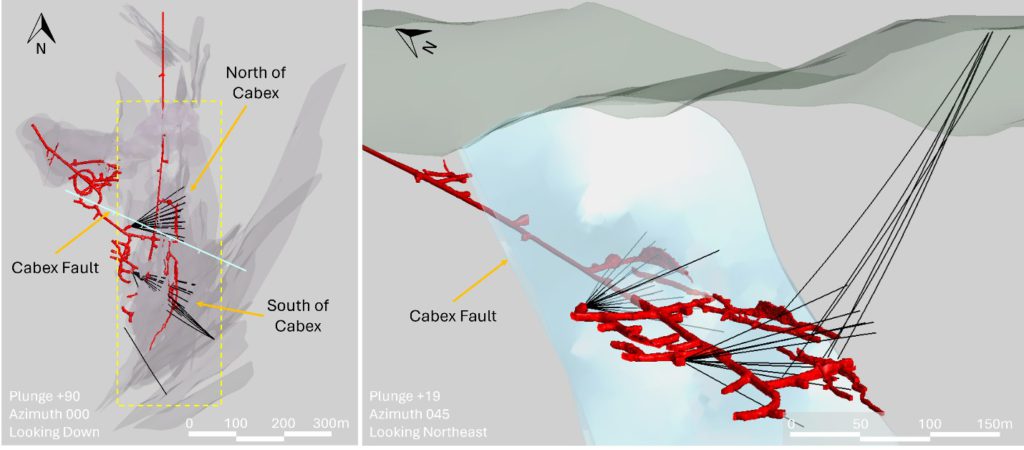

The location of Zone 5 drilling at Tuvatu. Credit: Lion One Metals

Lion One, the brainchild of serial mine entrepreneur Walter Berukoff, who owns 10.13% of the company, plans to expand the Tuvatu mill to 500 tonnes daily by September. This expansion includes installing a tower mill, a flotation circuit, and a third ball mill to increase gold recovery and processing capacity. These upgrades are slated for completion ahead of the third-quarter 2025 deadline, the company said.

Bonanza hits

Lion One also reported on Wednesday assay results for infill and grade control drilling in the Zone 5 area of Tuvatu.

The top new drill intersections include 393.01 grams gold per tonne over 1.2 metres (with 1,568.55 grams gold over 0.3 metres), 215.86 grams gold over 0.6 metres and 49.85 grams gold over 1.2 metres (with 63.35 grams gold over 0.3 metre).

These results come from the near-surface portion of the mine, focusing drilling efforts on the north and south of the Cabex fault. Drilling targeted the downdip extensions of the UR2 and URW3 lodes, both north and south of the Cabex Fault, which is a carbonate-healed, post-mineralization structure, the company said.

Narrow-vein mining is underway in Zone 2 and 5 at Tuvatu. Credit: Lion One Metals

Located along the main decline, Zone 5 includes several lodes that converge at a depth of 500 metres, forming the high-grade 500 Zone, interpreted as the feeder zone. The system remains open at depth, with the deepest high-grade intersects below 1,000 metres.

The infill and grade control drill data will underpin the mine model and inform stope design ahead of mining over the next 12 months.

Tuvatu hosts 1 million indicated tonnes grading 8.5 grams gold per tonne for 274,600 oz. of metal, according to a 2018 resource. It has another 1.3 million inferred tonnes at 9 grams gold for 284,000 oz. of metal.

The company’s Toronto-listed shares gained 12.5% to close at 54¢ apiece on Wednesday after touching 38¢ and $1.04 over the past 52 weeks. Lion One has a market capitalization of $125 million.

You go, Lion One!!!

I’m all in on Lion One. Can’t wait for them to get to the 500 Zone! I’m also waiting for other drill targets on their property and believe they will make some big discoveries.