Bunker Hill Mining (CSE: BNKR) says the Export-Import Bank of the United States may loan it US$150 million to help restart and expand the past-producing Bunker Hill silver mine project in Idaho.

The financing from the federal agency could be for a 15-year term, the Vancouver-based company said on Monday. No interest rate was given. It follows a US$22.8-million streaming loan in two tranches this year from Phoenix-based Monetary Metals & Co. and a US$67 million funding deal with Sprott Private Resource Streaming and Royalty in May 2023.

The project is fully funded to start concentrate production by March or April using stockpiles, then ramp up mill throughput to 1,800 tonnes a day in about six months, Bunker Hill executive chairman Richard Williams told The Northern Miner by phone on Tuesday.

The new potential loan could help the mine expand to 2,500 tonnes a day. Depending on engineering studies due next year, the work may include a new 10,000-foot ramp, moving the crusher and installing underground conveyors, Williams said.

“We put a really great team on the ground in Idaho and the American government has paid attention,” he said. “Five years ago this site was rotting in a Superfund (cleanup program), didn’t have a processing facility and had no hope.”

Consolidation?

The expansion may encourage local M&A because it will dwarf nearby output by Hecla Mining (NYSE: HL) and Americas Gold and Silver (TSX: USA; NYSE USAS), Williams said.

“Why aren’t we doing all this together?” he said. “It’s not an accident we’re taking all these steps.”

Bunker Hill received a letter of intent from the bank which is to conduct due diligence on the project. The developer says it will submit a formal loan application to the bank by year’s end.

The first stage of the restart, due to begin by June, carries a US$54.8-million capital cost, according to a 2022 prefeasibility study. However, the company said this year it’s choosing a more expensive pressure filtration system for tailings, over the disk filter system in the study, for better environmental management and easier expansion.

Bunker Hill plans an updated resource in next year’s first quarter followed by more drilling as the company preps the initial 1,800-tonne-per-day operation. Expansion plan details are to be published next year and the project might eventually tap the US$150 million loan in late 2025 or 2026, Williams said.

Deeper veins

The expansion would increase mining and processing of the Quill-Newgard ore zones, the company said. It would later access the deeper, higher-grade silver-bearing galena veins that were extracted from the mine’s lower levels when Gulf Resources closed it in 1981, Bunker said.

Higher costs for environmental compliance and declining metal prices forced the shutdown, it said. Little production occurred under a new owner from 1988 to 1991, which also faced low metal prices.

“This the first positive statement of investment by the U.S. government into Silver Valley mining since the mine shut,” Williams said. “That’s huge for Hecla, that’s huge for Americas Gold and Silver. That’s huge for us.”

It’s also good for New York-based Electrum Group, a finance company that owns a majority of the nearby Sunshine mine that’s been on care and maintenance for several years, Williams noted. From 1904 to 2001 the mine produced 364 million oz. silver as one the country’s largest silver operations.

Shares in Bunker Hill traded at 16¢ apiece on Tuesday, valuing the company at $52.4 million. They’ve traded in a 52-week range of 9¢ to 19¢.

Coeur d’Alene

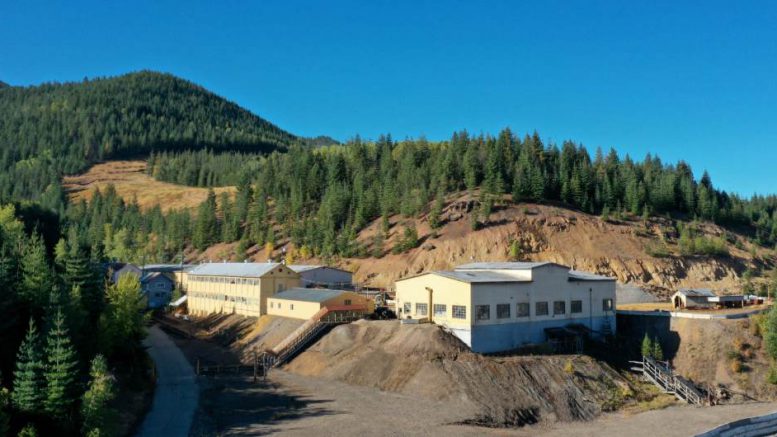

Bunker Hill mine, in Idaho’s historical Coeur d’Alene mining district, started in 1887 and produced 35 million tons of mineralization grading 8.76% lead, 3.67% zinc and 5.49 oz. per ton (188.2 grams per tonne) silver. The mine remained in care and maintenance until 2020 when Placer Mining took over the project, and sold it to Bunker Hill in 2022.

The new project has a five-year life, an after-tax net present value of US$52 million at an 8% discount rate and an internal rate of return of 36%, according to the 2022 prefeasibility study.

The site holds 3.2 million probable tonnes grading 1.12 grams silver per tonne, 2.59% lead and 5.81% zinc for 3.6 million oz. silver, 166 million lb. lead and 372.1 million lb. zinc, according to a 2022 resource.

”We are thrilled to announce this first step in a potential partnership with the Export Import Bank to rapidly expand Bunker Hill’s contribution to U.S. domestic production of critical zinc and silver,” Bunker president and CEO Sam Ash said in a release.

“In the face of competition from China, Bunker Hill is proud to play its part in strengthening the U.S. metals supply chain and creating new U.S. mining jobs within the disadvantaged Shoshone County of northern Idaho.”

Be the first to comment on "Bunker Hill in line for US$150M federal bank loan for Idaho silver project"