Aluminum prices are expected to stay elevated this year owing to a tightening market balance on the back of strong growth in global demand outpacing supply, says BMI, a unit of Fitch Solutions Group.

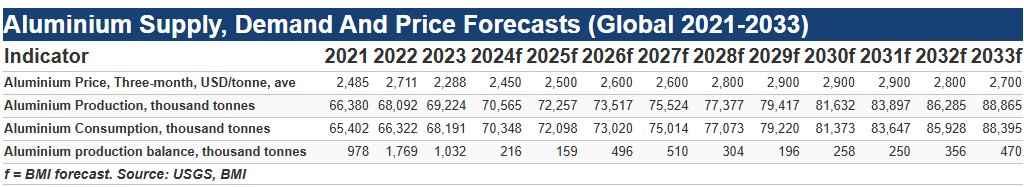

In a report released this week, the analytics firm said it expects aluminum demand to rise 3.2% year-on-year in 2024 to 70.4 million tonnes, compared to a projected 1.9% growth in supply to 70.6 million tonnes.

The demand growth, BMI noted, will be propped up by less traditional sources, specifically China’s clean energy sector. China is the largest consumer of aluminum by far and is expected to take up 63.5% of this year’s global demand, it added.

On the supply side, BMI said it is more optimistic than before due to solid production growth between January-August and an improvement in weather conditions in China’s Yunnan province, a key producing region. Still, it flagged recent disruptions in the raw material market, which have the potential to constrain aluminum output growth, particularly in China.

Despite stronger demand, the primary global aluminum market is still expected to remain in surplus this year, albeit a surplus that’s four times less than previously projected (96,000 tonnes instead of 384,000 tonnes), BMI said.

The aluminum price is expected to respond, with the firm anticipating a 6% increase in average price levels this year. That represents a notable turnaround from last year, where weaker factors drove prices down by 15.6% compared to 2022 levels.

This renewed optimism stems from two key factors: growing supply concerns in the raw material market and broader economic developments, BMI stated.

BMI analysts also raised its 2024 aluminum price forecast from US$2,400 per tonne to US$2,450 per tonne to reflect these expectations, but noted that they do not expect prices to reach the heights seen earlier this year, when supply woes fuelled a short-lived rally to a year-to-date high of US$2,768 per tonne.

Long-term outlook

Beyond this year, BMI expects aluminum prices to remain elevated, as demand is supported by the accelerating shift to a green economy.

Aluminum is classified as a critical mineral by the U.S., EU and Canada, highlighting growing concerns over supply in the longer term, which is set to drive growth as major economics introduce measures to boost aluminum production growth, it said.

As a result, the firm forecasts global aluminum consumption to increase from 70.5 million tonnes this year to 88.2 million tonnes by 2033, while average annual output will grow 2.5% during that period.

Be the first to comment on "Strong demand to boost aluminum price, despite surplus this year: Fitch"