The surging U.S. dollar in the wake of the Brexit vote has set aside for now all that talk of an imminent interest-rate hike by the U.S. Federal Reserve Board.

As lower rates tend to increase the value of precious metals by making them more competitive with yield-bearing assets, that has naturally been good for gold prices, which have held above US$1,300 per oz. since the day after the Brexit vote on June 24, even as stock markets around the world pretty much recovered to pre-Brexit levels.

The U.K. pound, meanwhile, has dropped even further to a 31-year low of US$1.30, after trading as high as US$1.50 in mid-June.

While gold’s move has been powerful, it’s silver that has caught the eye of many a precious metals investor in recent days.

Tallying the performance of commodities in the first half of the year, a casual observer might be surprised to see that silver was the best performer of all the significant commodities, rising 44% in the past six months to outpace even Brent oil (up 36%) and zinc (36%). (The worst performer of the first half among the commodities was uranium oxide, down 22% to beat out corn and coal, which both declined 9%.)

And that excitement around silver doesn’t even include the first weekend of July, when silver prices soared to a two-year, intraday high of US$21.13 per oz., before easing back at press time to US$19.88 — still up 21% over 30 days, and up more than 50% since the five-and-a-half-year lows last December.

For technical traders, silver emphatically smashed through the long-held resistance level of US$18.50 per oz. on June 30, and has stayed above it ever since.

At the more practical level, market watchers point to Chinese traders, who used the long weekend in the U.S. to buy large amounts of physical silver and place heavy bets on silver in the futures market. As for the traders’ motives, analysts conclude they relate to investors’ desires for safe-haven assets and speculation there will be more monetary easing worldwide.

Half of all silver purchased is used in industrial contexts, and the rest is turned into bars, coins, silverware and jewellery.

With U.S. futures markets closed for the July 4 holiday, the most traded silver futures on the Shanghai Futures Exchange rose for the fourth straight session to hit its 6% daily maximum at opening to reach 4,419 yuan (US$663) a kilogram.

As an indication of the heated trading, the Shanghai Gold Exchange now says that if trading was one-sided during the session’s last five minutes, it will raise to 11% its current 8% daily limit for silver.

It also says it will raise its margin requirement to 13% from 9% due to the “strong upswing of silver prices.”

Now that we’re past the halfway point of 2016, it’s also time for investment funds to recalibrate their holdings.

The broad expectation is that they will find their precious metal assets are underweighted, and will have to go into the market in the third quarter to buy gold and silver assets to rebalance portfolios.

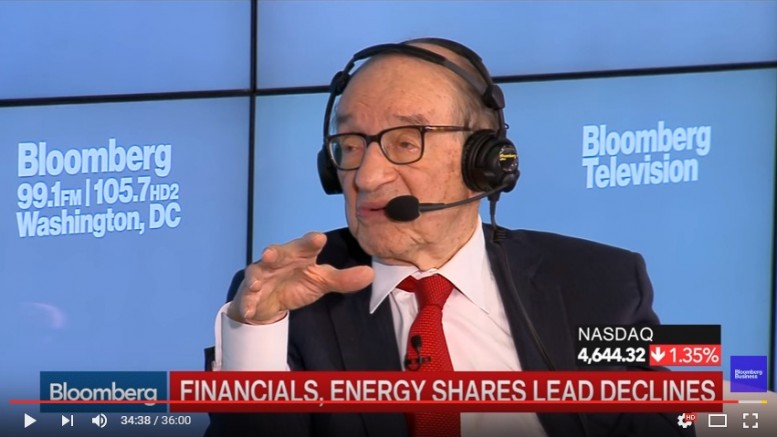

Gold’s reputation even got a lift in recent days from long-suspected gold bug Alan Greenspan, former chairman of the U.S. Federal Reserve Board from 1987 to 2006.

Interviewed on Bloomberg TV after the Brexit vote — which he called a “terrible outcome in all respects” — Greenspan said it was only a matter of time before inflation takes off in the face of a steady and large increase in the U.S. money supply, and the U.S. would be better off with gold.

“If we went back on the gold standard and we adhered to the actual structure of the gold standard as it existed prior to 1913, we’d be fine,” Greenspan said. “Remember that the period from 1870 to 1913 was one of the most aggressive periods economically that we’ve had in the U.S., and that was a golden period of the gold standard. I’m known as a gold bug and everyone laughs at me, but why do central banks own gold now” if it isn’t important?

“I don’t know when [inflation] is coming,” Greenspan commented, saying to “wait” and watch for the inevitable surge, and that we are in the “early days of a crisis.”

Watch the full 36-minute interview here (including interruptions by the host whenever Greenspan brings up gold!)

https://youtu.be/ec9i_iGCj80

Be the first to comment on "Editorial: Silver starts to outshine gold, and Greenspan goes full goldbug"