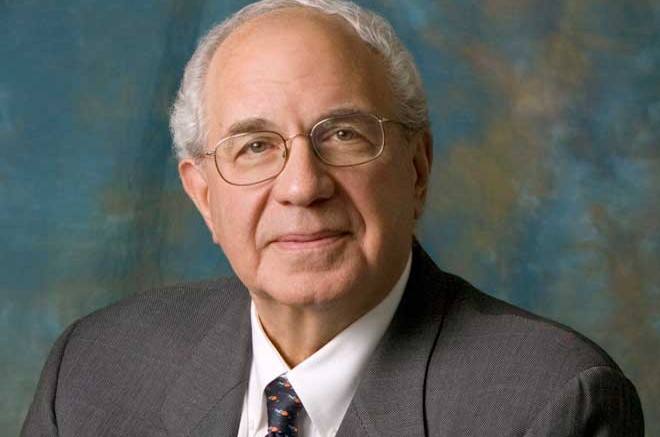

“If you think it’s all about money, if you think it’s all about gold, you’re right,” Ned Goodman, president and CEO at Dundee Corp. (TSX: DC.A), declared at a luncheon during the Prospectors & Developers Association of Canada convention in Toronto on March 3. “But in the world that we live in today, it’s all about China.”

Holding a red book aloft called: “When China rules the World: The end of the Western World and the birth of a New Global Order,” Goodman urged the audience to go out and buy a copy. The book — written by Martin Jacques, a British economist with a PhD from Cambridge University — discusses China’s ascendancy as an economic superpower and unseating the West and creating a whole new world.

“My view is that this book is correct, and we are going to see it, as China is grabbing all the gold they can get and the U.S. is making every mistake they can make, in every effort that they try,” Goodman declared.

Deriding the U.S. for printing money at will since 2008, Goodman noted that China is buying gold every day. “It almost doesn’t matter what the price is, they’re collecting gold,” he said, adding that their intention is not, as some would argue, to make the Chinese yuan the reserve currency, but rather to get enough gold to “eliminate the U.S. dollar from being the reserve currency.”

He pointed to statistics from the World Gold Council showing that China overtook India as the world’s largest gold buyer last year. China’s demand for gold bars, coins and jewellery soared 32% to a record high, he said, and the government has encouraged its citizens to own gold.

Should China get enough gold to eliminate the U.S. dollar as a world currency, he continued, the impact would “enormous . . . it’s going to be enormous in the sense that it just means that the U.S. is possibly in bankruptcy,” Goodman concluded. “The U.S. has an unsustainable debt load owed to China most of all. They owe nearly four trillion dollars of reserves, 60% of that is in U.S. treasury. But they simply can’t dump the treasuries because there is no one to sell them to. That’s why they’re vacuuming up the world’s gold.”

Goodman argued that the Chinese have “some kind of plan” behind their actions and that they are “preparing to do something with all of their gold,” and that it is “China’s secret weapon.”

As a company builder, merchant banker and investment advisor, Goodman also pointed to other trends in the mining industry, such as giant companies selling assets to shore up their cash positions, such as Glencore, Barrick Gold, BHP Billiton and Anglo American, and the growing importance of private equity funds in the mining space.

“It’s not a question that there is no money out there,” he said, adding that he is also teaming up with a Hong Kong company — that is to say, businessman Simon Murray — to run a private equity fund dedicated to resources.

Goodman also compared today’s discounted and undervalued prices for materials and commodity/resource stocks to the “overvalued” sectors of specialty chemicals, financials, health care, industrials, auto parts and equipment, railroads, pharmaceuticals and packaged goods.

“Material is the stuff we deal in, guys. It’s undervalued and it’s ready to be bought . . . this is copper, zinc, fertilizers — anything that the market is telling us that they’re trading for a lot less than they’re worth,” Goodman said, invoking Warren Buffett’s ratio of market values and his theories on picking undervalued companies in which to invest.

Goodman also argued that the demographics are “unbelievably in favour of our industry,” and cited a recent McKinsey Research study that reasons that the resource industry has a long way to go before it finds enough of the products that are needed to service the world.

“As we enter 2014, I’m bearish about the state of all stock markets,” he said. “But the bearishness doesn’t necessarily mean I’m bearish on the price performance of the stock market for the coming year, because I think we’ll end up having a buying opportunity that will result from this bearishness.”

Goodman recounted that he had had the luxury of sitting beside Buffett at a dinner not long ago. When he asked the billionaire why people never hear him being optimistic or pessimistic, Buffett replied it was because he was neither, he was just “realistic.”

When Goodman pressed him about what he meant by “realistic” Buffett replied that if he can buy a company that he is absolutely confident will give him a 15% annual return forever, he’ll buy it.

“That’s what we’re going to see in the market — that kind of stuff — and I hope I’m going to be able to follow Mr. Buffett’s rules and take it back into the investment-management business at a point in time, which is the right time,” he said. “The basics of having a good time are here.”

As for raising money, he noted that “when we put the TSX Venture division out of business, it will be an awful lot easier to raise money.”

Be the first to comment on "PDAC: Ned Goodman on China, gold and Warren Buffett"