Some issues of The Northern Miner are more fun to put together than others. Our March 2024 edition, unfortunately, offers a sobering read. It’s filled with news of shuttered mines and thousands of layoffs as lithium, nickel and platinum group metals (PGM) producers react to tanking prices.

You’ll also read about a crippling lack of financial institutional support for mining in Canada — namely from pension funds (although, to be fair, they are hardly the only investors who won’t touch the high-risk sector). Two of mining’s biggest and most well-respected names, Frank Giustra and Pierre Lassonde argue that lack of domestic investment has contributed to Canada’s loss of companies that had heft on the global stage — Inco and Falconbridge among them.

Meanwhile, one of Canada’s last diversified miners left standing, Vancouver-based First Quantum Minerals, is looking vulnerable to a takeout. Panama’s government shut the Panama Cobre mine, decimating First Quantum’s finances. It’s turned to 18.5% shareholder Jiangxi Copper of China for relief via a US$500-million copper offtake deal. And you’ll find the latest news available at press time about the Feb. 13 deadly landslide at SSR Mining’s Copler gold mine in Turkey. In late February, nine employees were still missing and presumed killed in the incident, in which a heap leach pad collapsed. The tragedy is likely to further damage mining’s already lacklustre international reputation, and sadly came just a month after a plane crash killed six people on their way to Rio Tinto’s Diavik diamond mine in the Northwest Territories.

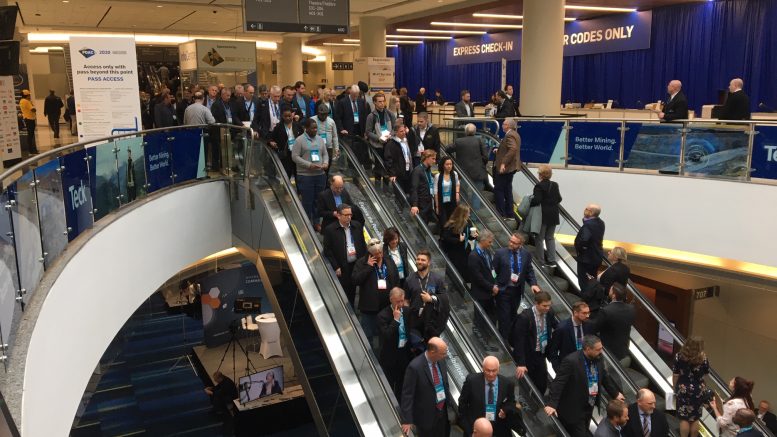

As the mining industry gathers this month at the 92nd annual Prospectors and Developers Association of Canada (PDAC) convention, we don’t mean to pile on to an already challenged sector. But it’s hard to ignore the multiple campaigns under way to “save” some portion of the mining sector or another.

There’s the junior miners (see our January issue for our feature on the junior sector’s battle with short-sellers), or PGM producers in South Africa, who are seeking to create new markets for palladium as its primary market in catalytic converters in gas-fuelled cars declines. Nickel miners in Western Australia are the latest group in need of rescue. Australia added the stainless steel and battery ingredient to its list of critical minerals in February in response to a slew of mine closures, unlocking support from a A$6-billion government fund offering low-interest loans and grants under its Critical Minerals Facility. It’s not clear how far such funding will go to help producers survive the surge in cheaper Indonesian nickel that’s caused prices to tumble by about one third over the past year.

Mixed signals

We don’t have solutions to all of mining’s various and complex challenges. Despite the market cornucopia held out by the energy transition, it looks like 2024 will be another difficult year. (Gold and uranium, which we also highlighted in our January issue as standouts for 2024, seem to be the exceptions to the rule.)

After falling an average of nearly 10% last year, base metals prices (including a basket of copper, aluminum, nickel, zinc, lead and tin) are forecast to fall another 5% this year due to a slowing global economy, according to the World Bank. The good news is prices are expected to bounce back in 2025, led by copper and aluminum, both projected to rise 9% that year.

Another glimmer of hope for our corner of the market — exploration companies who rely on cheap capital money to carry out the hard, risky, and often thankless work that could lead to a discovery — is the hope of rate cuts this year. The benchmark interest rate has been stuck at 5.5% since July — up from 0.25% in early 2022. It’s resulted in what some smaller mining company CEOs have privately characterized as a “depression” in the junior mining space. However, that doesn’t completely jibe with numbers now available for 2023.

Figures PDAC shared with The Northern Miner in February show that equity raised on Canadian exchanges last year for mining was actually up slightly from 2022 at $8 billion. That’s on par with the 10-year average for fundraising although it seems to be shifting to battery metals and uranium.

“Arguably, the availability of capital hasn’t moved or materially improved over the last 10 years,” Jeff Killeen, PDAC’s policy and program director said. “It hasn’t declined, but it does seem to be moving in different directions.”

Last year, juniors saw a record number of cancelled fundraising deals, plus more small deals scraped together just to keep companies on life support, Kai Hoffman of Vancouver-based Soar Financial, told The Northern Miner in January. But those were concentrated in the early exploration stage companies – revealing what Hoffman called a “bifurcated” market of junior haves and have nots.

We may not need to establish a “Save the Miners” fund quite yet though. With miners eyeing future supply gaps in copper, lithium and other metals, Fitch and other consultancies expect global M&A activity to grow this year after picking up in 2020 through 2023. That serves as a reminder that the opportunities companies have been chasing in energy transition minerals haven’t disappeared.

Be the first to comment on "Does mining need saving?"