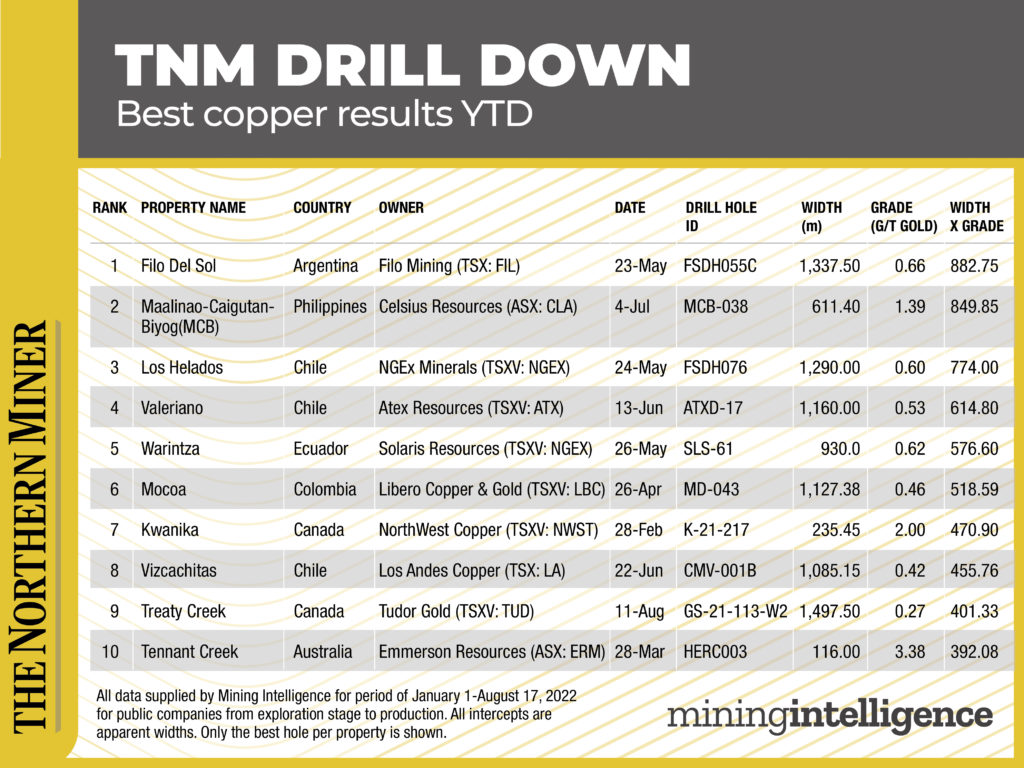

Copper is known by several monikers: The red metal for its colour; Dr. Copper because its price is a reliable economic indicator; and now, the “green metal” for its central importance in electrification. Below we highlight the top five copper drill results of the year so far (to Aug. 17), ranked by grade x width, as identified by data provider Mining Intelligence.

1 FILO DEL SOL – FILO MINING

The prize for top copper intercept for the year to date goes to Filo Mining (TSX: FIL) at its Filo Del Sol project in Argentina, about 140 km southeast of Copiapó, Chile. The Vancouver-based junior reported diamond drill hole FSDH055C in late May, cutting 1,337.5 metres of 0.66% copper (grade x width of 882.8), as well as 0.54 gram gold per tonne and 31.5 grams silver starting at 150 metres depth. The same hole also cut 8.6 metres grading 7.08% copper, 8.16 grams gold and 820.4 grams silver starting from 742 metres.

The hole was the project’s best to that date (measured by copper-equivalent grade x width), ending in strong mineralization. Drilled through the Aurora Zone, it also confirmed continuity between bonanza-grade Breccia 41 mineralization to the south and north. The company describes Filo de Sol as a high-sulphidation epithermal copper-gold-silver deposit associated with a large porphyry copper-gold system.

Filo Mining is planning 40,000 metres of drilling at the project over the next 12 months with up to 11 rigs, including deeper drilling. The company reported in August that drilling has extended the strike length of the Aurora zone to 1.6 km.

A prefeasibility study was completed on the asset in 2019 showing that an open pit mine at the project would produce 67,000 tonnes of copper, 159,000 oz. of gold and 8.7 million oz. of silver per year over 14 years.

2 MAALINAO-CAIGUTAN-BIYOG – CELSIUS RESOURCES

In second spot is Celsius Resources (ASX: CLA) and its Maalinao-Caigutan-Biyog (MCB) project in the Philippines. Diamond drill hole MCB-038, reported in July, returned 611.4 metres of 1.39% copper (width x grade of 849.9) and 0.75 gram gold from 32.5 metres depth.

The hole was the fifth of six holes Celsius is drilling as part of a 4,000-metre six-hole program at the project, which is located on the country’s main island of Luzon, 320 km north of Manila.

The project, which was previously owned by Freeport-McMoRan (NYSE: FCX), hosts a JORC-compliant resource of 290.3 million indicated tonnes grading 0.48% copper, and 23.5 million inferred tonnes of 0.48% copper.

In 2021 Celsius released a scoping study on the project, focused on a higher-grade portion of the porphyry deposit containing 93.7 million tonnes @ 0.8% copper and 0.28 g/t gold. The study forecast the project could have a mine life of 25 years, and be developed at a cost of US$253 million, projecting a post-tax net present value of US$464 million and an internal rate of return of 31%.

3 LOS HELADOS – NGEX MINERALS

NGEx Minerals (TSXV: NGEX) takes third spot for a hole drilled at its Los Helados project in Chile’s Region III. Hole FSDH076, released in late May, cut 1,290 metres of 0.6% copper (grade x width of 774), 0.21 gram gold per tonne, and 2.3 grams silver from 110 metres depth.

The company noted that the hole, which ended in strong mineralization at 1,400 metres depth, confirms its new geological interpretation that Los Helados contains at least two high-grade centres. The hole extended both the Condor and Fenix zones, both open at depth.

NGEx completed a 10-hole, 10,300-metre drill program in June, with the next campaign expected to start in September after a short winter break. Drilling is focused on adding high-grade material at the copper-gold porphyry project, which has a 2019 indicated resource of 2.1 billion tonnes of 0.38% copper, 0.15 gram gold per tonne, and 1.37 grams silver (0.48% copper equivalent).

Los Helados is only 16 km northeast of Filo Mining’s Filo del Sol deposit, along the same major northeast-trending structure. Both are part of the Lundin Group of companies.

NGEx is the majority partner (67%) and operator of Los Helados, with Nippon Caserones Resources holding a minority stake.

4 VALERIANO – ATEX RESOURCES

In fourth spot, Atex Resources (TSXV: ATX) reported a long intercept from its Valeriano porphyry copper-gold project in Chile’s northern Atacama Region.

In June, diamond drill hole ATXD-17 returned 1,160 metres of 0.53% copper (grade x width of 614.8), 0.28 gram gold per tonne, and 70 parts per million molybdenum from 802 metres depth. The hole ended in mineralization at 2,057 metres.

Atex noted that the hole extended mineralization by 200 metres southwest of historical drill hole VALDD-14 (which returned 1,194 metres of 0.73% copper equivalent), and confirmed the presence and continuity of a high-grade core to the porphyry. It also extended the high-grade core (initially intersected in VALDD-14 with 272 metres of 1% copper equivalent) 200 metres to the southwest.

Mineralization associated with the large multi-phase granodioritic porphyry system, which has intruded into and altered a sequence of rhyolitic tuffs, flows and breccias at Valeriano, strengthens at depth.

The project hosts an inferred resource of 297.3 million tonnes grading 0.59% copper, 0.193 gram per tonne gold and 0.9 gram silver at a cut-off grade of 0.5% copper for 1.8 million tonnes copper, 1.8 million oz. gold and 8.6 million oz. silver.

5 WARINTZA – SOLARIS RESOURCES

Staying in South America, Solaris Resources (TSXV: NGEX) had the next best interval, drilled at its Warintza project in southeastern Ecuador. Infill drill hole SLS-61, reported in May, cut 930 metres of 0.62% copper (grade x width of 576.6), 0.03% molybdenum, and 0.07 gram silver per tonne from surface at Warintza Central.

In a July update, the company said it had seven drill rigs at work at the project. The company is also drilling to expand its Northeast Extension zone to the north and northeast. Solaris has defined a higher-grade, near surface zone there, releasing an indicated resource for a potential start pit of 180 million tonnes grading 0.82% copper equivalent and an inferred resource of 107 million tonnes grading 0.73% copper equivalent.

The project, which hosts a cluster of outcropping copper porphyry deposits, has an overall resource (updated in April) of 579 million tonnes grading 0.47% copper, 0.03% molybdenum and 0.05 gram gold per tonne for 2.7 million tonnes of copper, 150,000 tonnes of molybdenum and 930,000 oz. of gold. Inferred resources add 887 million tonnes grading 0.39% copper, 0.01% moly, and 0.04 gram gold for 3.5 million tonnes of copper, 130,000 tonnes of moly and 1.1 million oz. gold. TNM

Be the first to comment on "TNM Drill Down: Top Ten copper drill results year to date"