Alrosa, the world’s top diamond miner by output, says the industry has “fully recovered” from the Covid-19 pandemic as a structural production decline paired with growing end-user demand are pushing prices past levels reached in 2019.

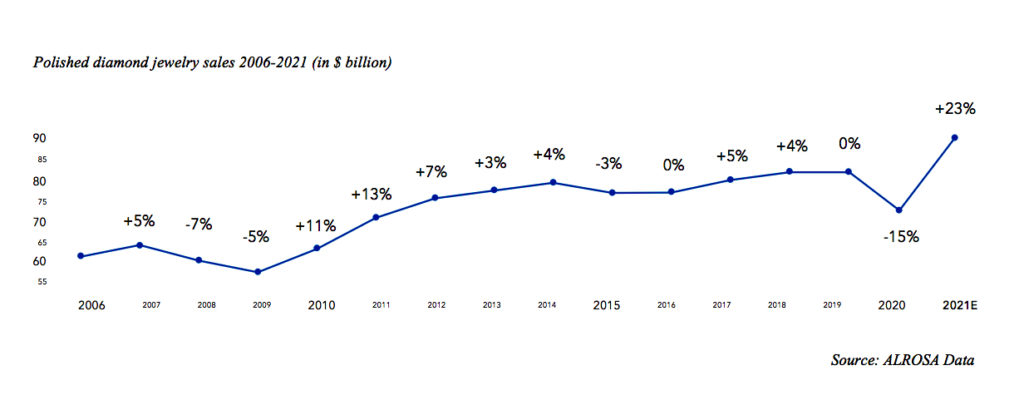

In its yearly diamond investment market report, the Russian producer said that jewellery sales have risen sharply in the past few months and are expected to exceed US$90 billion in 2021. That’s a 23% increase when compared to 2020 levels.

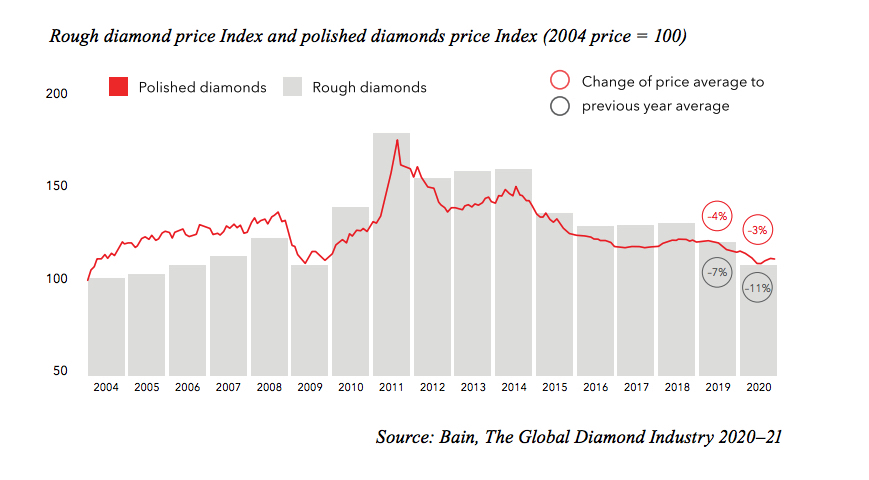

The diamond market came to a standstill at the height of the pandemic, increasing worries that oversupply could hurt the sector for years. But surging purchases by intermediaries that cut, polish and trade stones has all but wiped-out miners’ stockpiles, even as Alrosa and its closest competitor, Anglo American’s (LSE: AAL; US-OTC: NGLOY) De Beers, have hiked prices.

Alrosa said that jewellery demand from the United States, which accounts for 45% of global sales of diamonds, and China, which drives 20% of global sales, has jumped by 50% and 10%, respectively, compared with pre-pandemic levels in 2019.

There is also a growing interest in buying diamonds as an investment and financial hedging tool, the company said, noting that investment-grade diamonds have higher price growth expectations than general stones.

Investors are drawn to colourless polished diamonds over four carats ad well as and fancy coloured ones, which are declining in production at a faster rate following the closure of Rio Tinto’s Argyle mine in Australia.

The report follows Alrosa’s warning last week that diamonds stocks were at “minimal levels” as demand increased without a meaningful supply response from miners.

Be the first to comment on "Alrosa says global diamond sector “fully recovered” from pandemic hit"