Russia has proposed introducing an export duty on aluminum as part of new measures to curb creeping inflation, sending regional premia in crucial European markets soaring, a new analysis by Bank of America (BofA) shows.

The proposed measures will affect steel, copper, nickel and aluminum from August 1 until the end of December. The measures are expected to also compensate the state budget for increasing the costs of state-run projects.

The proposed export duty on base metals was laid out as the higher of two parameters: either 15% of the metal price or a minimal rate (in effect $1,226 per tonne for copper, $2,321 per tonne for copper and $254 per tonne for aluminum).

While this measure is temporary, Russia’s finance minister, Anton Siluanov, and first deputy prime minister, Andrey Belousov, advocate long-term changes to the Russian tax system, starting next year in case global metal prices continue to stay materially above historical levels.

Click here for an interactive chart of aluminum prices

BofA notes the measures might be slightly self-defeating. Europe is an important market for state miner Rusal with a revenue share of 45%. Still, Russia is also a critical supplier to the EU, accounting for around 25% of unwrought aluminum imports.

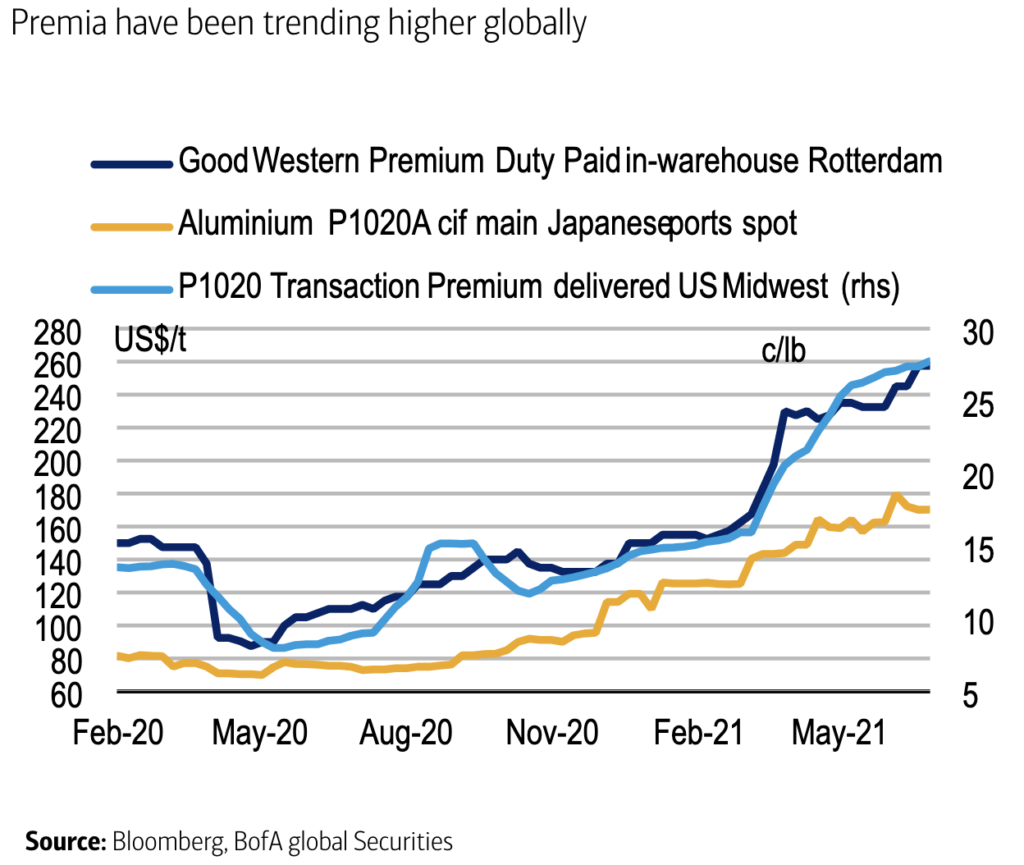

“While Russia’s measures might influence LME prices to some extent, it is likely that the impact may be felt more in regional European premia, which have already rallied materially in recent months.

“It is also worth noting that the premia Rusal receives for value-added products (VAPs) are usually higher than for standard-grade, LME-traded aluminum. This might give Rusal an incentive to focus on VAP exports, which in turn might well give further support to standard-grade ingot premia.”

BofA’s analysis found other countries had implemented a series of measures tackling domestic raw material markets in recent years.

This has perhaps been most visible in the import duties of the Section 232 order implemented by US authorities in aluminum. However, the export taxes proposed by Russia work slightly differently.

Indeed, the fiscal levies are a mixture of an ad valorem tax, a tax as a percentage of the metal price, and a specific tax such as the minimum levy per tonne of aluminum sold.

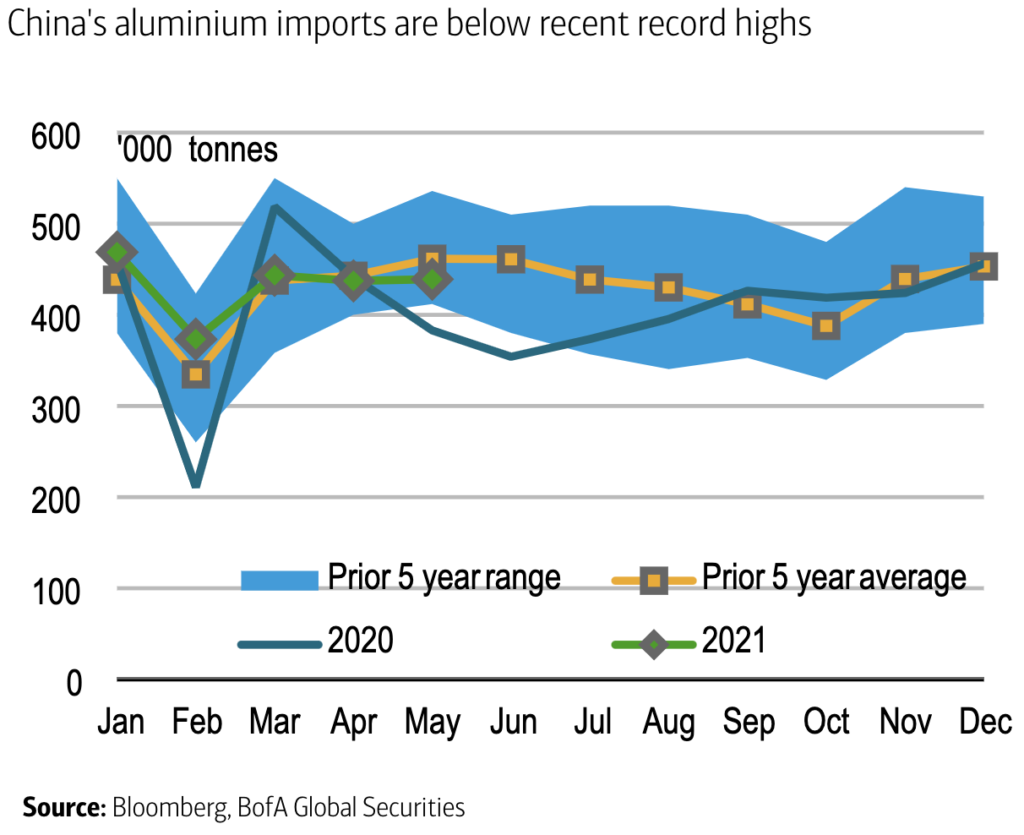

“The impact of an export tax on the global market ultimately depends on whether the country proposing the duty has pricing power. Digging a bit deeper, Rusal accounts for around 6% of global supplies.

“This may not sound significant, but we believe it is worth noting that the global aluminum market has been tightening as producers have been reluctant to invest in new capacity. As such, every tonne counts.”

Be the first to comment on "Aluminium premia spike on planned Russian export tax"