Noront Resources (TSXV: NOT) says it welcomes the investment in the company by Australian explorer and developer Wyloo Metals Pty Ltd.

“We are delighted that Wyloo Metals has chosen to acquire a cornerstone interest in Noront,” said Noront president and CEO Alan Coutts.

In a deal with Resource Capital Fund V and Resource Capital Annex Fund V, Wyloo will pick up 22.5% of Noront’s outstanding shares, issue a US$15-million debenture, and take up a 1.0% net smelter royalty interest in the Eagle’s Nest deposit in Northern Ontario’s Ring of Fire. Wyloo will also earn the right to nominate two directors, one of which must be independent, to the board of Noront.

The arrangement is subject to regulatory approval.

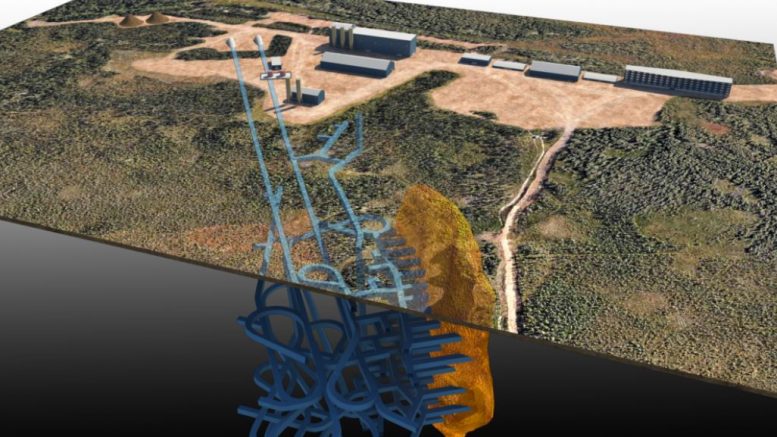

Eagle’s Nest is one of the world’s largest undeveloped, high grade nickel-copper-platinum group sulphide deposits. According to a 2012 feasibility study, the project has proven and probable resources of 11.13 million tonnes at 1.68% nickel, 0.8978% nickel, 0.89 grams platinum per tonne, and 3.09 grams palladium per tonne.

Once developed, the Eagle’s Nest project has the potential to reach annual production rates of 15,500 tonnes nickel, 8,700 tonnes copper, 23,470 oz. platinum, and 90,022 oz. palladium. However, significant infrastructure, most importantly a transportation corridor, has yet to be established in the Ring of Fire.

Wyloo Metals is a subsidiary of Tattarang, one of Australia’s largest private companies. This is Wyloo’s second investment in Canada mineral potential. It earlier took a stake in Queen’s Road Capital of Hong Kong, a company that has interests in Canadian uranium explorers NexGen and IsoEnergy.

Noront shares advanced on the investment news, rising 18.2% or $0.03 to 19.5 cents on volume of almost 2.98 million. The shares are trading in a 52-week range of 22.5 cents and 11.5 cents.

Be the first to comment on "Australian developer Wyloo to take up 22.5% of Noront shares"