Bear Creek Mining (TSXV: BCM) is acquiring the Mercedes gold-silver mine in Mexico from Equinox Gold (TSX: EQX; NYSE-AM: EQX).

Payment to Equinox consists of a cash payment of $75 million and the issuance of 24.73 million Bear Creek common shares upon closing. A deferred cash payment of $25 million is also due within six months of the closing date. In addition, Equinox will receive a 2% net smelter return (NSR) royalty payable on metal production from the Mercedes mining concessions.

The $75 million cash payment will be funded by $15 million from Bear Creek’s treasury and $60 million from Sandstorm Gold, which has entered into a gold purchase agreement with the company on the Mercedes mine ($37.5 million) as well as a debt financing agreement ($22.5 million).

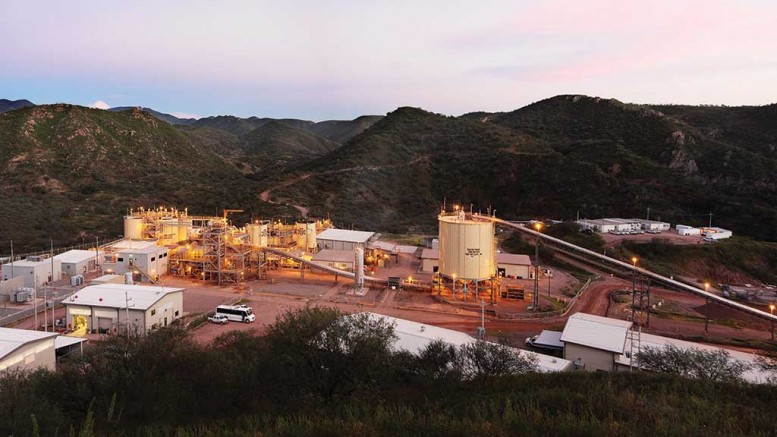

The Mercedes mine is located in the state of Sonora, about 300 km northeast of the city of Hermosillo. It has been in continuous operation since commencing production in 2011.

Throughout Mercedes’ production history, gold-silver ore has been produced from five deposit areas, of which two (Diluvio and Lupita) are currently being mined.

Up until the end of 2020, about 5.84 million tonnes grading 4.42 grams gold per tonne and 49.5 grams silver per tonne have been processed at Mercedes, with total production of about 781,800 ounces of gold and 3,356,200 ounces of silver.

The underground mine was previously acquired by Equinox as part of its takeover of Premier Gold Mines last December.

“Moving from a development stage company into a precious metals producer is an important step in Bear Creek’s evolution,” Anthony Hawkshaw, Bear Creek’s president and CEO, stated in a news release.

“The acquisition of Mercedes provides our shareholders a cash flowing asset with expansion potential and participation in a land package with an exciting exploration outlook.”

The company also says the Mercedes acquisition will provide a source of funding for future construction of its Corani silver mine, considered to be one of the largest fully permitted silver-polymetallic deposits in the world.

In a research note to clients, Ryan Thompson of BMO Capital Markets noted he wasn’t “entirely surprised” to see Mercedes sold “as management has suggested in the past it would look to monetize non-core assets.”

“Although the proceeds are a bit below our previous carrying value, we are pleased to see a non-dilutive cash infusion ($100M total cash) as the company [Equinox] embarks on construction of Greenstone,” he wrote in a research note. “Mercedes represented less than 5% of our overall NAV [net asset value]. Equinox will retain exposure to Mercedes and gain exposure to Corani through its ownership in Bear Creek Mining.”

Thompson lowered his target price on Equinox from $16.50 per share to $14.50 per share.

Be the first to comment on "Update: Bear Creek Mining acquires Mercedes mine from Equinox"