BHP Billiton (NYSE: BHP) is spending US$22 million to boost its stake in SolGold (TSX: SOLG; LON: SOLG) to 14.7% from 11.1%, making it one of the two largest shareholders in the Ecuador-focused junior exploration company. Newcrest Mining (ASX: NCM) owns 14.8%.

BHP is acquiring 77 million shares at 22.15 pence per share — a 13% premium to SolGold’s closing share price on Nov. 22.

Under the deal, BHP agreed not to acquire more shares in the company over the next two years without SolGold’s consent. But the investment does give it options for 19.25 million shares at a price of 37 pence through Nov. 25, 2024.

The transaction underscores the attractiveness of copper assets, as mines age and appetite for the metal grows with rising demand for renewable energy and the electrification of the transportation sector.

SolGold’s Apala deposit in northern Ecuador contains 8.4 million tonnes copper and 19.4 million oz. gold in the indicated category (2.1 billion tonnes grading 0.41% copper and 0.29 gram gold per tonne), and another 2.5 million tonnes copper and 3.8 million oz. gold in the inferred category (900 million tonnes grading 0.27% copper and 0.13 gram gold).

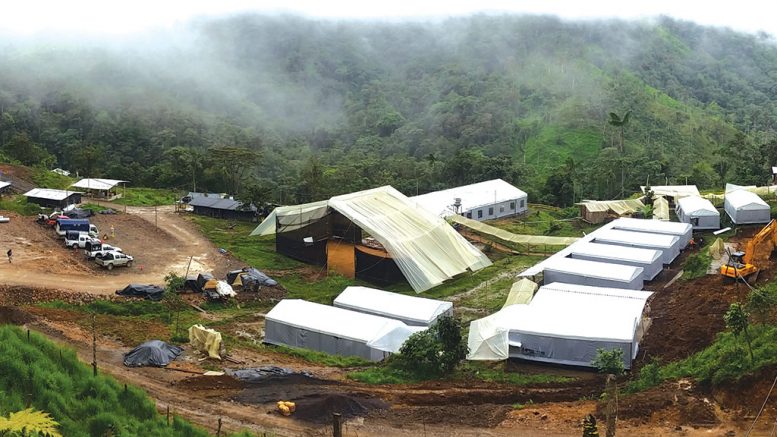

The company has drilled more than 228,000 metres on the project and expects to complete a prefeasibility study in the first quarter of 2020.

A preliminary economic assessment in May 2019 outlined preproduction capex of between US$2.4 billion and US$2.8 billion, and total capex — including life-of-mine sustaining capex — of US$10.1 billion to US$10.5 billion, depending on the production rate scenario.

The study envisioned a 50-million-tonne-per-year operation producing 456 million lb. copper and 438,000 oz. gold per year over 25 years.

The study favoured block-cave, underground mass mining over several caves designed on two vertically extensive lifts.

According to SolGold, Alpala has produced some of the best drill hole intercepts in porphyry copper-gold exploration history, including one intersection of more than 1,000 metres grading 0.74% copper and 0.54 gram gold per tonne.

The deposit is the main target on SolGold’s Cascabel concession, which sits on the northern section of the Andean copper belt.

Matthew O’Keefe of Cantor Fitzgerald says the investment puts BHP “on par with SolGold’s other major shareholder, Newcrest Mining, supporting competitive tension.”

He also points to SolGold’s enormous land position in the country.

“With a first-mover advantage in Ecuador, SolGold has amassed 3,200 sq. km of concessions, and is well-positioned for additional large-scale discoveries,” he writes in a research note.

“SolGold has significantly greater leverage to copper than gold and with copper at multi-year lows, we see this as a good time to buy SolGold, particularly for the investment horizons over the medium-term,” he adds. “As copper prices improve, and as the project advances through permitting and feasibility, we expect the stock to move up towards our target price.”

The analyst has a one-year target price on the stock of $1, or 60 pence, per share. T

Be the first to comment on "BHP boosts investment in SolGold"