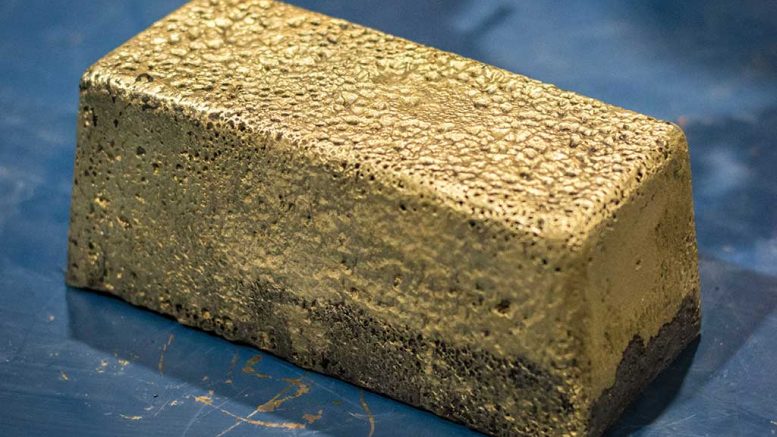

Gold futures jumped after reports of rocket attacks on a U.S. military base in Iraq, hitting fresh six year highs.

Gold for delivery in February touched US$1,613.30 per oz., up US$39 per oz. from the settlement price at the end of regular trading on Jan. 7.

History suggests that gains driven by geopolitical tensions alone may be short-lived, Macquarie Group strategists including Marcus Garvey said in a report quoted by Bloomberg earlier on Tuesday: “To illustrate this with the examples of Gulf War 1, the World Trade Center attack of 9/11 and last year’s strike on Saudi Aramco’s Abqaiq facility, gold prices initially jumped higher but were ultimately unable to sustain their newly elevated level,” they said.

Still, there are several other factors in place that are supportive for gold prices, Credit Suisse analysts including Fahad Tariq said in a note this week.

Those include a weaker dollar, dovish central bank policies and uncertainty over a more comprehensive deal between Washington and Beijing.

This item first appeared in our sister publication, MINING.com.

Be the first to comment on "Gold price scales US$1,600 after Iran attacks US military base"