Analysts at Raymond James are lowering their forecasts for zinc and copper prices.

For the fourth quarter, the analysts have changed their zinc price forecast to US$1.20 per lb. from US$1.40 per lb., and for 2019 they have trimmed their target price from US$1.30 per lb. to US$1.20 per lb. In 2020 they forecast a zinc price of US$1.10 per lb., down from their previous estimate of US$1.20 per lb.

For copper, the analysts have decreased their price target in the fourth quarter from US$3.20 per lb. to US$3.00 per lb., and for 2019 from US$3.25 per lb. to US$3.10 per lb. In 2020 they forecast a copper price of US$3.20 per lb., up from their previous estimate of US$3.00 per lb.

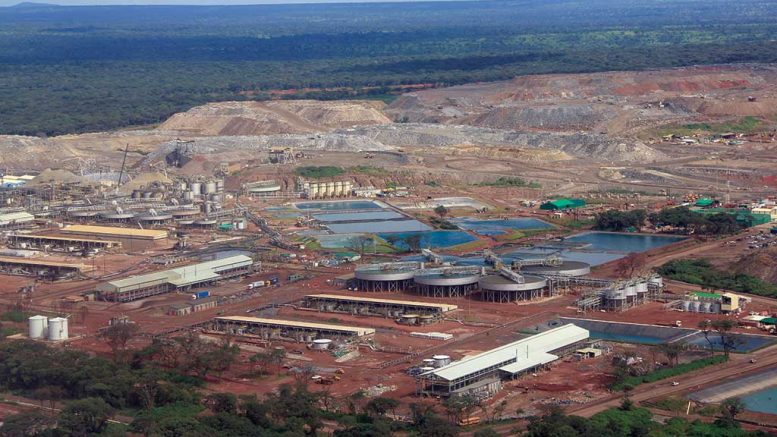

As a result of their lower price forecasts for the two base metals, the analysts have trimmed their target prices on First Quantum Minerals (TSX: FM) from $25 per share to $24 per share; for Freeport-McMoRan (NYSE: FCX) from US$18 per share to US$17 per share, for Hudbay Minerals (TSX: HBM; NYSE: HBM) from $10 per share to $9 per share, for Teck Resources (TSX: TCKB; NYSE: TECK) from $46 per share to $44 per share, and for Trevali Mining (TSX: TV) from $1.50 per share to $1.25 per share.

Raymond James’ top picks among the senior caps are First Quantum Minerals and Teck, and among the intermediates, Ero Copper Corp. (TSX: ERO).

The analysts also point out that during the third quarter of 2018, uranium performed better than zinc, lead, and copper.

“Metals prices were under significant pressure in the third quarter of 2018, with zinc, lead and copper all posting double-digit, quarter-on-quarter declines of 18.5%, 12.0% and 11.0% respectively,” the Raymond James’ analysts write in a research note. “In contrast, we note uranium’s out-performance, increasing 16.5% in the quarter, with spot prices continuing to increase post quarter end.”

Be the first to comment on "Raymond James adjusts forecasts as uranium outperforms zinc, copper in Q3"