Wesdome Gold Mines (TSX: WDO) reported high-grade results from its drill program at the Kiena mine complex in Val d’Or, Que., as the company continues to move forward with its goal of boosting the project’s resources.

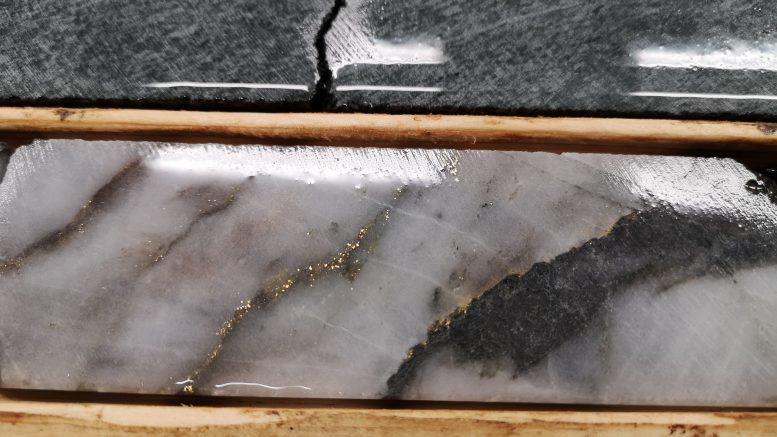

Highlights from the drill results included 50.7 metres, with an estimated true width of 5.5 metres, grading 92.11 grams gold per tonne, starting from 94 metres in hole 6796W6; and 83.2 metres (true width unknown) grading 13.94 grams gold starting from 748.9 metres in hole 6752W10.

The latter hole intercepted new mineralization at the Kiena Deep A zones area, located about 100 metres below the known limit of the A zone resource, the company said. It also made a discovery in the south limb of the A zone, a lateral expansion of mineralization identified by multiple intercepts.

“We are continuing to spend aggressively on exploration at Kiena with $17.7 million to be spent in 2022 that includes approximately 50,000 metres of underground drilling and 30,000 metres of surface drilling,” the company’s CEO Duncan Middlemiss said in a press release.

“It is evident that as we continue to explore and collect new information, we are able to discover traps for gold mineralization outside of the known zones, thereby demonstrating the prospectivity of this area and the entire property,” he added.

The Kiena Mine complex restarted production in May 2021 after operations were suspended in 2013 due to declining gold prices and lack of developed reserves. The integrated mining and milling infrastructure produced close to 1.8 million oz. gold between 1981 and 2013. The company expects the mine to produce about 64,000 to 73,000 oz. gold this year.

In 2016, while exploring the deposit, Wesdome discovered the Kiena Deep A Zone, which continues to be drilled. Underground drilling refocused on expansion drilling since 2021 and a new high-grade zone was discovered in the footwall of the Kiena Deep A zone.

The Footwall Zone is defined by gold mineralization located within a 50 –metre-wide corridor adjacent to the footwall of A2 Zone. It is interpreted that the Footwall Zone runs parallel to the A Zone and extends at least 300 metres down plunge.

The project has proven and probable reserves of 1.8 million tonnes grading 11.1 grams gold per tonne for a 651,000 oz. of contained gold. Based on a prefeasibility study completed in 2021, the project is expected to produce an average of 84,000 oz. gold annually over a mine life of seven years at an all-in sustaining cost of $894 per ounce.

BMO Capital Markets mining analyst Andrew Mikitchook described the discovery of new mineralization at the mine as positive, adding it is “testament to the prospectivity of Kiena and emphasizes Wesdome’s potential to add high-grade ounces near planned mine infrastructure.”

In a note to clients on June 2, Mikitchook wrote of the new discoveries: “The results highlight the exploration leverage at Kiena, where finding additional mineralization has the potential to add gold ounces that could be extracted at a low incremental cost.”

Aside from Kiena, Wesdome also operates the Eagle River underground mine in Wawa, Ont., which is currently producing gold at a rate of 95,000 to 105,000 oz. per year.

At noon, shares of Wesdome were trading at 13.08, up about $1 or 8.5%, within a 52-week trading range of $9.76 and $16.77.

Be the first to comment on "Wesdome cuts new high-grade mineralization at Kiena gold mine in Quebec "