You might have seen the news: BHP (NYSE: BHP; LSE: BHP; ASX: BHP) has just made its next major copper grab.

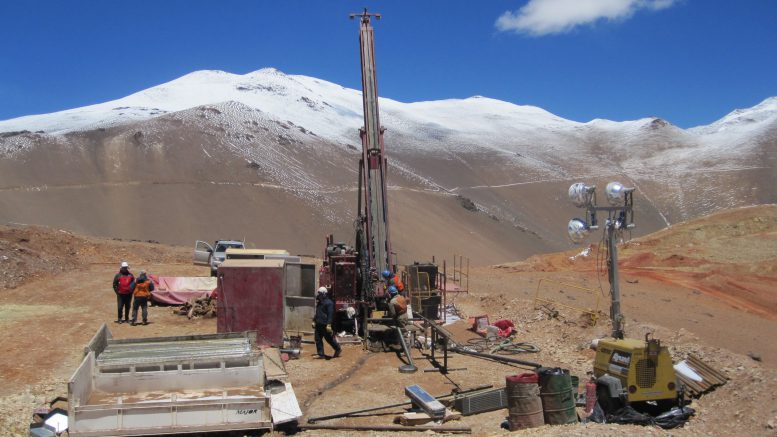

This time, it’s for the prized Filo del Sol project, owned by Filo Corp. (TSX: FIL), in Argentina.

In partnership with Lundin Mining (TSX: LUN), BHP has agreed to a 50/50 joint venture to develop this world-class deposit. They plan to develop Filo del Sol together with Lundin’s Josemaria gold-silver-copper project in Argentina.

Under the terms of the deal, Filo shareholders will receive a total consideration of approximately $4.1 billion, representing $33.00 per Filo share.

On paper, that looks impressive. After all, this is just an exploration project.

Yet, past the fanfare and excitement, the cream being offered to Filo shareholders appears rather mundane — Just a 32.2% premium above Filo’s 30-day ‘unaffected’ average stock price.

BHP/Lundin rejoice

It’s telling when you read comments from the main powerbroker behind the deal, Lundin’s Mining president and CEO, Jack Lundin (emphasis added):

“This strategic transaction is the key to unlocking the enormous value that the Vicuña District represents.

As we partner to acquire Filo del Sol, one of the world’s largest undeveloped copper-gold-silver deposits, with its true size yet to be defined, we are very excited about the future of the company and our role in developing this region.

Combined with the Josemaria project, we are now positioned to create a multi-generational mining district with significant synergies and cost savings on a scale that has the potential to become one of the largest of its kind.

Importantly, we gain a valued partner in BHP and together we aim to generate long-term value through combining complementary skills and experiences, foundational to our near-term goal of becoming a top-tier copper producer.”

To be clear, Lundin and BHP have purchased a world-class asset in a “multi-generational mining district.” And the “largest of its kind.”

So does a 32.2% premium adequately compensate Filo shareholders?

Well, according to Filo’s CEO, Jamie Beck, it does (emphasis added):

“I’m very happy to announce this transaction today, which delivers compelling value to Filo’s shareholders.

The Transaction delivers a 17.4% premium to the unaffected all-time high for Filo’s shareholders while offering exposure to the future development of Filo del Sol in addition to Lundin Mining’s high-quality operating portfolio.

The total consideration represents approximately C$924 million in value above Filo’s unaffected market capitalization on July 11, 2024.”

Jamie Beck believes a “17.4% premium to the unaffected all-time high for Filo’s shareholders” is “compelling value.” But Filo investors would be justified in asking: compelling for who?

Is Beck following the script relayed by his former employer… Lundin Mining?

Past all the smiles, handshakes and back-slapping, there’s a clear lack of tactical deal-making happening here.

That’s a disservice to the quality of the Filo del Sol deposit and shareholders who have backed Filo from its roots.

Giving up a ‘multi-generational’ copper asset

Filo del Sol has a resource of 644.2 million tonnes of ore, which includes 4.5 billion lb. of contained copper, 6.7 million oz. of gold, and 210.7 million oz. of silver.

Even without its primary copper base, this would be a significant standalone gold or silver project.

The deposit made headlines in 2022 after geologists struck a 1,252-metre interval grading 0.91% copper equivalent.

Since then, the company has returned numerous 1,000-metre plus mineralized hits, mainly around the Aurora Zone target. And as Jack Lundin aptly puts it: “Its true size is yet to be defined.”

Considering all that, the latest deal suggests Filo’s board has lost sight of its strong negotiation platform.

Mining conglomerates like BHP have been pressing hard to build their copper portfolio. Over the last decade, these organizations’ lack of organic growth, from exploration to mine development, has made their need to acquire new projects more urgent.

Grades across key minerals such as copper, nickel, lithium, and steelmaking are “falling at existing operations,” BHP’s CEO Mike Henry warned at the IEA Critical Minerals and Clean Energy Summit in Paris last year.

“This means more ore needs to be mined just to stand still,” he said. “Newly discovered and developed deposits are, on average, incrementally lower grade as well.”

They’re also harder to find, often deeper, and smaller, he added.

In other words, BHP and other multinational miners desperately need large-scale undeveloped projects to replace or supplement aging deposits.

Filo’s board seems to be blissfully unaware of its strong negotiation platform, which its highly successful exploration team has built over the last two years.

BHP following its Oz Minerals playbook

Similar to today, in 2022, BHP capitalized on a pullback in copper prices and acquired the South Australian copper miner OZ Minerals.

After initially rejecting the bid, the Oz board unanimously recommended a takeover after BHP offered a revised and slightly higher offer.

At the time, Oz Minerals operated one of the world’s highest-profit-margin copper businesses. Its mines were in a spectacularly desirable location, safe with virtually no geopolitical risk – rare features in today’s copper market.

The acquisition instantly boosted BHP’s South Australian copper division, substantially improving operating margins at its ageing Olympic Dam facility.

So, what was the reward for Oz shareholders? Ultimately, they received an A$28.25 per share offer from BHP, below Oz’s high of around A$28.88 earlier that year.

Given the quality of the company’s assets (and location), I believe Oz would be trading substantially higher today, even with copper prices pulling back over the last few weeks.

The deal from 2022 offers a timely reminder for Filo and other junior copper developers. These takeover deals can have an enormous opportunity cost, especially if negotiations are watered down to appease potential buyers.

Right now, the majors are scrambling for new copper opportunities.

A 32.2% premium fails to adequately compensate Filo shareholders in a future that Mike Henry, Jack Lundin, Robert Friedland and other mining elites state will be immensely bullish for copper.

And just like Oz shareholders, I suspect Filo investors are destined to be short-changed if these mining powerbrokers and their prophecies prove correct.

— James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

Be the first to comment on "As majors thirst for copper, Filo bid premium seems awfully low"