Battery material explorer and developer Lomiko Metals (TSXV: LMR; US-OTC: LMRMF) has posted a major increase in resources at its La Loutre natural flake graphite property in southern Quebec. The mid-April mineral resource estimate (MRE) shows that Lomiko’s 2022 drill program boosted indicated mineral resources of graphitic carbon (Cg) at the site by 45 million tonnes — a 195% gain compared to 2021 estimates.

La Loutre now contains an indicated resource of 68.3 million tonnes grading 4.08% Cg containing in situ 3.1 million tonnes and an inferred resource of 12.7 million tonnes grading 4.11% Cg containing 800,000 tonnes of in situ graphite. The company said that it was able to upgrade previously inferred resources to the category through an additional 13,000 metres of infill drilling in 79 holes combined with refined modelling.

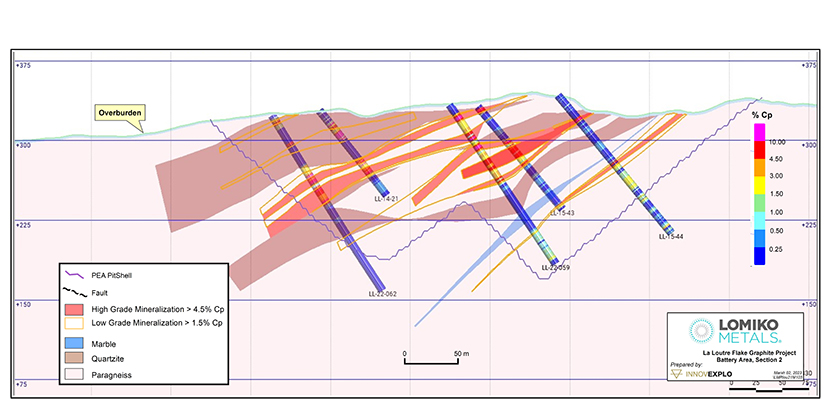

A cross-section view of Lomiko’s 2022 shoulder drilling program at La Loutre. Credit: Lomiko Metals

“The quality of the assets has surpassed our expectations, it’s extraordinary,” says Lomiko COO Gordana Slepcev. “Part of that is because we discovered that graphite is not only in the paragneiss, but also in the marble zone.”

Since joining Lomiko in 2021, Slepcev and her team have been working to advance La Loutre to the prefeasibility study stage, with infill and step-out drilling to define the extent of graphite mineralization in the project’s EV and Battery zones being a main priority. Both deposits remain open along strike and at depth and are accessible for further drilling.

“It took the shoulder sampling to realize what we had here,” Slepcev notes. “But we have more work going forward to determine the full depth of the mineralization and understand how deep these deposits go.”

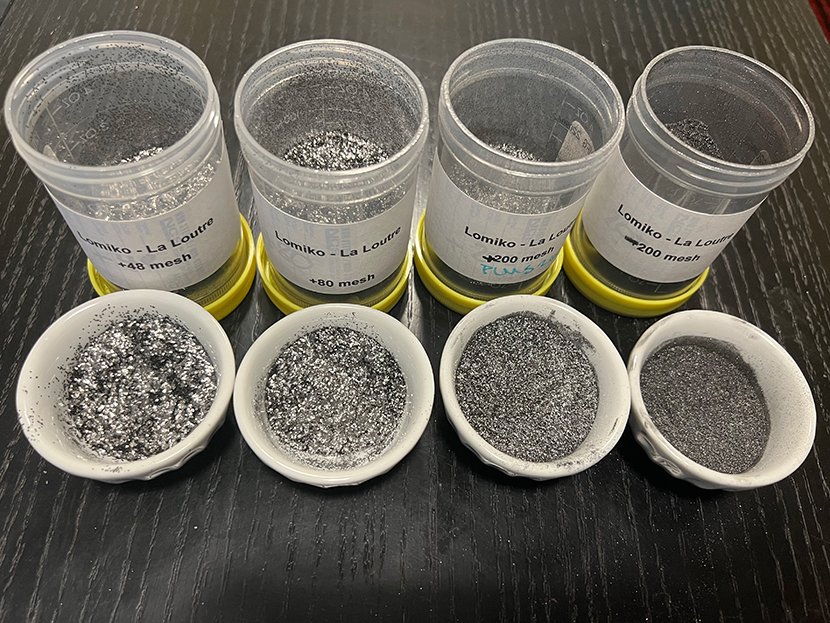

The positive news from Lomiko comes after the firm announced in February that high-grade concentrates with up to 99.7% total carbon content and 94.7% recovery could be produced at La Loutre using results from prefeasibility level flotation optimization studies.

For graphite, flotation processes are critical to separating flakes from the surrounding rock. Carried out on 640 kg of samples by Peterborough-based testing firm SGS Lakefield, Lomiko’s optimization studies involved simulating continuous plant operations and testing conditions such as grind sizes and flotation composites.

The metallurgical testing showed that Lomiko can achieve a purity of 98.6% Cg (reconciled 99.1% Cg) while recovering 94.7% of the graphite from a master composite mixture of several concentrate batches that represents the average quality and quantity of processed ore during La Loutre’s initial years of operations. High flotation concentrate grades were achieved from head grades ranging from 1.39% Cg to 9.86% Cg.

Graphite concentrate produced during Lomiko’s prefeasibility testing has the purity and quality needed for demanding battery applications. Credit: Lomiko Metals

“What’s great is with these studies, we achieved that graphite content with only three stages of cleaning,” Slepcev says. “It’s looking like our base concentrates could be sold as +97% total carbon content — the standard is 94% grade, so there can be a big premium.”

Another factor impacting the price of graphite is flake size. Lomiko’s metallurgical testing revealed that about one-third of the recovered flakes fell into the extra-large to medium category (100 to 32 mesh, or about 150 to 450 microns). Flakes in this size range are easier to process and have a higher value for industrial applications while smaller flakes are used in lithium-ion battery applications due to their superior conductivity and durability.

In early May, Lomiko announced that they had successfully transformed their floatation concentrate into spherical graphite particles with a grading of 99.99% carbon total (C(t)), thanks to testing performed by German firm ProGraphite.

Spherical graphite is a critical component in lithium-ion battery anodes, which power electric vehicles and energy storage systems among others. A grading of 99.99% C(t) signifies that Lomiko’s graphite has the purity and quality needed for demanding applications.

“The physical characterization tests produced very good results, such as narrow particle size distribution range and purity, that meet target values for lithium-ion based battery applications,” Slepcev notes.

Graphite is extremely heavy and costly to ship. With hundreds of new battery mega-factories in the pipeline worldwide, Benchmark Mineral Intelligence estimates over 1 million tonnes of new annual graphite demand could emerge by 2025.

“Our preliminary economic assessment was done on a US$916 [per tonne] selling price for graphite, and today it’s closer to US$1,100,” Slepcev says. “Many producers are selling now for over US$1,500 a tonne, that could increase the net present value of La Loutre project to a half-billion dollars.”

Lomiko’s 2021 preliminary economic assessment proposed an open pit mine with a 15-year life and a total production of 1.4 million tonnes of graphite concentrate.

“Moving forward we’ll update our costing numbers, but it’s obvious there’s going to be a huge graphite deficit in the years to come,” Slepcev states. “Unlike other battery metals, graphite is hard to recycle, and producing synthetic graphite has a carbon intensity up to five times more than mining.”

While currently halfway through the La Loutre prefeasibility study, Lomiko continues to add to its holdings in Quebec’s prospective Grenville graphite belt. In March, the company announced the acquisition of the 6.8-sq.-km Carmin natural flake graphite property, which sits adjacent to the 45.3-sq.-km La Loutre site. Carmin has been subject to extensive drilling, trenching and surface sampling in the past, including a historic prefeasibility study that estimated the site holds 1 million tonnes at 8.8% Cg.

“Carmin provides a lot of potential for site planning and additional resources and in addition last year we acquired six new properties to bring our total to over 15,000 hectares,” Slepcev says. “The goal is to build a southern center of excellence for graphite, because when you talk with industry suppliers, the number one issue is energy security — everybody wants a reliable source for the next 30 years.”

Also on the agenda for Lomiko this year is completing the first stage of 49% ownership toward the Bourier lithium property that Lomiko optioned from Critical Elements Lithium (TSXV: CRE; US-OTC: CRECF).

“It’s an early-stage project, but we’ve identified a two-and-a-half-kilometre-long zone with lithium, cesium and tantalum at increased values,” Slepcev says. “We’re hoping that this year’s work not only gets us to that 49% level but also generates the targets for future drilling.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Lomiko Metals and produced in cooperation with Northern Miner Staff. Visit www.lomiko.com for more information.

Be the first to comment on "JV Article: Graphite tonnage gains spur Lomiko Metals along prefeasibility pathway"