High-profile investments by Agnico Eagle Mines (TSX: AEM; NYSE: AEM) in two new Nunavut gold operations will drastically alter the company’s production profile with the onset of commercial production later this year. However, perhaps lost in the excitement is that its core operations in Quebec — La Ronde, Canadian Malartic and Goldex — are also expected to expand. Help on the regulatory front from Quebec Premier François Legault, whose Coalition Avenir Quebec government took office last October, could speed up the process.

Currently, “start-ups take longer and are more complicated because we have to get approvals at the federal and provincial levels,” said Christian Provencher, Agnico Eagle’s vice-president for Canada, in an interview. The Coalition Avenir Quebec government, whose electoral base is concentrated in the province’s regions, has committed to reviewing the situation.

According to Claude Potvin, a spokesperson for Quebec’s Ministry of Natural Resources and Energy, mining is a government priority. “Quebec was recently named [by the Fraser Institute] as the world’s fourth best mining jurisdiction,” Potvin said in a phone interview. “We want to make it number one.”

Potvin would not commit to a specific date, but said that new measures could be announced later this year.

Quebec’s largest gold producer

According to Provencher, the province’s Minister of Natural Resources and Energy Jonatan Julien provided a signal of the government’s commitment to reform during a recent tour of Agnico Eagle’s facilities in Quebec.

“He was impressed with our progress,” Provencher said, noting that Julien’s knowledge of mining gives the industry a sympathetic ear in the provincial capital.

Agnico Eagle’s presence in Quebec is concentrated at the LaRonde, Canadian Malartic and Goldex mines, which, according to Provencher, at a combined attributable output of more than 800,000 oz. gold per year, have made the company Quebec’s largest gold producer. The three sites are relatively close by in the Abitibi region, which in turn helps Agnico generate a range of synergies.

Agnico Eagle’s management places a high value on human capital, despite — with the exception of a few specialized trades — labour remaining relatively available in the province. For example, when the company closed its Lapa site in the Abitibi, officials took great pains to relocate its 250 employees, many of whom were able to remain in Quebec.

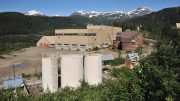

LaRonde opportunity

Provencher cites the possibility of extending the life of Agnico Eagle’s flagship LaRonde mine as the company’s biggest opportunity in Quebec. LaRonde — which yielded its five-millionth ounce in 2016, and cranked out another 350,000 oz. last year — is a “gold mine” in every sense.

True, gold production at LaRonde stumbled slightly during the first quarter of 2019 to 77,433 oz. — compared to 89,785 oz. during the same quarter last year — due to the lower grades inherent in the current mining sequence. (In addition, Agnico’s newly producing LaRonde Zone 5, located adjacent to and west of the main LaRonde operation, yielded 12,988 oz. gold in the first quarter.)

However, grades at LaRonde could increase during the second half of 2019 to reach 5.22 grams gold per tonne for the entire year. Cash costs per ounce of gold produced for their part increased to US$488 from US$427 during the corresponding quarter last year.

Longer term, the future is brighter. Last year’s upgrading of 800,000 oz. gold from the resource category into reserves brought totals at LaRonde — which, at more than 3 km in depth, is the deepest mine in the Americas — to 3.8 million oz. gold in reserves (LaRonde and LaRonde Zone 5 combined). Copper, zinc and silver by-products, which comprise 10% of mine revenues, provide icing on the cake. Those totals could increase, said Provencher, as drilling, which could hit 3.5 km in depth, continues in the coming three to four years.

Canadian Malartic extension

Visitors on the pit floor at Agnico Eagle Mines and Yamana Gold’s Canadian Malartic gold mine in Malartic, Quebec. Photo by John Cumming.

The big news at the Canadian Malartic mining complex, which Agnico Eagle and Yamana Gold (TSX: YRI; NYSE: AUY) operate in a fifty-fifty joint venture, was the March 2019 acquisition of the adjacent 2 sq. km Rand Malartic property. Exploration work at the site begins mid-year to determine whether the geological profile of the existing Malartic asset can be extended. Permitting to develop an underground ramp was approved late last year, and Agnico Eagle is in discussions to get local First Nations groups on board — which could include a “financial component.”

“It’s a very interesting piece of land,” said Provencher of Rand Malartic. “The site is less than 10 km away from current operations. So we could share milling and surface infrastructure.” Production and cash costs at the Canadian Malartic mine, which the company bills as Canada’s largest gold mine, rose slightly during the first quarter of this year to an attributable 83,670 oz. gold and US$572 per ounce.

Goldex depth potential

Workers at a section of the Rail-Veyor system at Agnico Eagle Mines’ Goldex underground gold mine near Val-d’Or, Quebec.

Photo by Jon Cumming.

Agnico Eagle’s Goldex facility generated strong production and cost numbers in the first quarter. Furthermore, according to Provencher, the mine has “interesting” potential at depth, which could increase from 1.2 km to the 1.5 km range in coming years.

The nearby Akasaba West gold property, which company officials say could feed Goldex’s extra milling capacity, provides an example of how regulatory reform could spark development in Quebec’s mining sector, Provencher said, as the project has been in the permitting phase since 2014.

Gold demand, positive outlook

The benefits of Agnico Eagle’s strong capital expense program (which is forecast to hit $660 million this year) are set to bear fruit, as production ramps up at the Meliadine and Amaruk sites in Nunavut.

Agnico Eagle Mines chairman James Nasso (left) and CEO Sean Boyd at Rankin Inlet airport, 25 km from the Meliadine gold project in Nunavut. Photo by Trish Saywell.

Agnico aims for a record 1.75 million oz. gold output during 2019 at total cash costs and all-in sustaining costs in the US$620 to US$670 and US$875 to US$925 ranges.

Agnico Eagle officials eschew broader industry pessimism about gold prices, partly due to the company’s output being sold in U.S. dollars, and costs incurred at its Canadian operations mostly paid for in local currency.

Agnico CEO Sean Boyd recently pointed out that strong central bank gold buying during 2018 — which was at its largest in over 50 years — and 61% year-over-year purchase increases in January and February of 2019 put more upside pressure on gold prices.

— Based in Montreal, Peter Diekmeyer is a freelance writer and translator specializing in the resource industries. For more information, visit www.peterdiekmeyer.com.

Be the first to comment on "Agnico Eagle sees continued promise in Quebec"