Albemarle (NYSE: ALB), the world’s top lithium producer, says it will buy China-based Guangxi Tianyuan New Energy Materials for about US$200 million, as part of its plans to boost lithium conversion capacity.

Tianyuan, a lithium converter founded in 2017, owns a recently constructed lithium processing plant close to the port of Qinzhou in Guangxi.

The facility has a designed annual capacity of up to 25,000 tonnes of lithium carbonate equivalent (LCE) and can produce battery-grade lithium carbonate and lithium hydroxide. It’s currently in the commissioning stage and is expected to begin commercial production in the first half of 2022, Albemarle said.

Lithium prices jumped to their highest in more than three years earlier this month thanks to an upsurge in electric vehicle sales, depleting stocks of the battery material in top consumer China.

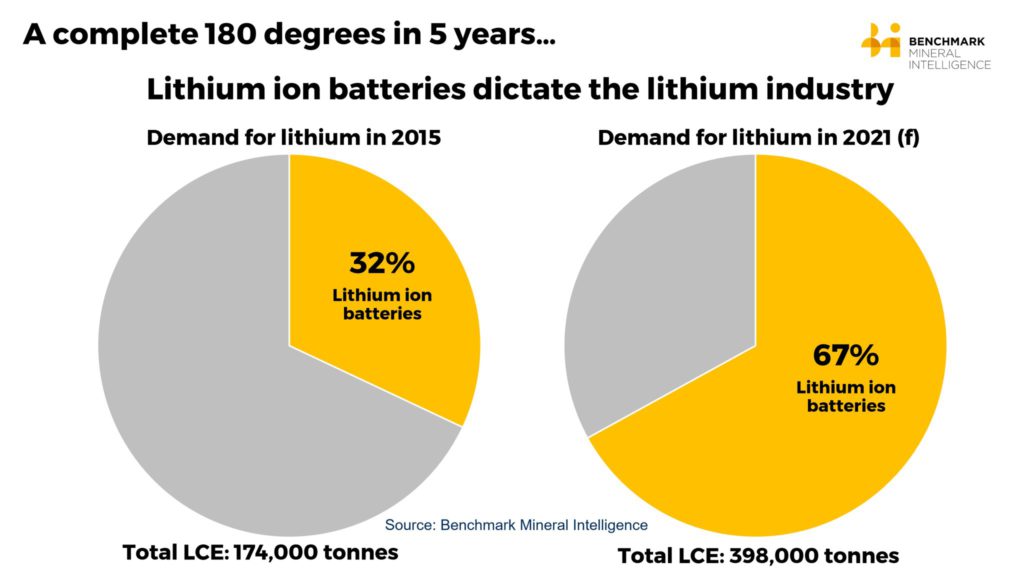

Benchmark Mineral Intelligence (BMI) expects demand for the battery metal to jump 26.1% or about 100,000 tonnes of LCE to a total of 450,000 tonnes, flipping the market into a deficit of 10,000 tonnes.

Albemarle produces lithium from its salt brine deposits in Chile and the United States and its hard rock joint venture mines in Australia. Albemarle is also a global leader in the production of bromine, used in flame retardants.

Be the first to comment on "Albemarle to buy Chinese lithium firm for US$200 million"