The mining sector is notorious for not following proven business principles that ensure value creation for shareholders through the ups and downs of the commodity cycles, senior executive Ian Telfer told a mining conference in Vancouver this week.

In his view, the former Goldcorp and Wheaton Precious Metals executive sees acquisitions as the only reliable way to grow a company.

“We’ve been talking about exploration, but the fact is you can’t build a major mining company on exploration alone,” he told the AME Roundup on February 1. “It never will happen.”

He said mining was an exceptionally technical industry requiring many disciplines to be successful.

However, these technical people aren’t always comfortable with the acquisition process.

“It’s a process that’s outside their area of expertise. Whatever they look at looks expensive.

“The process of getting there is complicated and can be adversarial. Therefore, not everyone in the industry is as comfortable with going by acquisition, but it’s the only way you can get there.”

Telfer also cautioned management against pursuing grassroots exploration at all costs. “Exploration is absolutely essential for our industry, but you can’t grow a major mining company through exploration. There’s a role for exploration in the junior sector, and the success stories are all over the place and several large mining companies started with exploration success, but you just can’t count on it going forward,” he said.

Time and again, majors have sunk significant funds into exploration only to discover less than they had hoped for at a higher cost.

Telfer also advises against placing the “wise and worldly’ on boards of directors.

What tends to happen when people with expertise from other areas, whether it’s corporate governance or whether it’s financial markets or succession planning, become a member of the board, they’ll eventually start imposing different ideas on what the company should do next.

“Even though you may have created the company and your vision may have led to the company’s success, these people suddenly start to have strong opinions about what the company should do next. And I’ve seen a sad example in my view. Placer Dome was a company we took over 10 or 12 years ago as Barrick. They had a great board of directors and lovely people but no singular vision of where that company was going. And over time, they just lost their way and collapsed. Similar stories with Inco, Falconbridge also lost their ways,” said Telfer.

Further, Telfer cautioned miners against taking on debt.

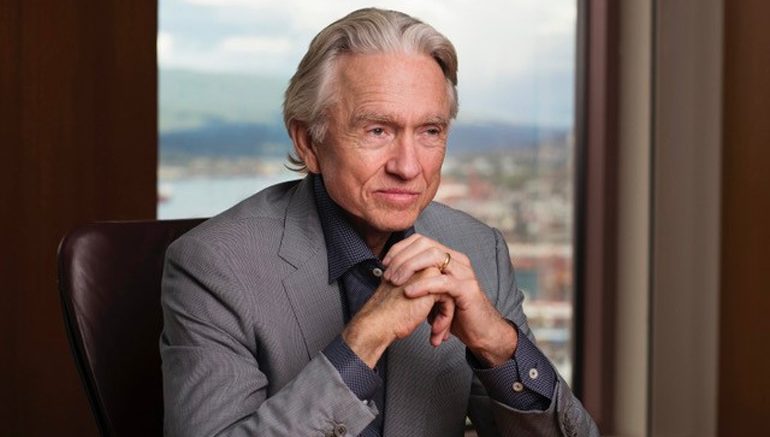

Canadian Mining Hall of Fame inductee Ian Telfer (left) receives a plaque from Anthony Vaccaro, publisher of The Northern Miner. Credit: Canadian Mining Hall of Fame.

“That may seem obvious, and with higher gold prices that we’ve had recently, not that many companies are getting themselves in trouble. But I’ve lived through a number of cycles, where companies put themselves out of business by blowing too much money.”

In the same vein, Telfer advises against companies hedging production.

“One of my favourite topics about the gold mining industry is that gold shares are only bought by people who think the price of gold is going up,” said Telfer. “And whenever they get the impression that managements are investing in things such as hedging that shows their belief the price may go down, investors abandon a company,” he said.

He pointed to Barrick going through this phenomenon about 15 years ago when management thought the price of gold had peaked. “They did a massive $10 billion hedging program, and then the price of gold kept going up. And two things happened.

“First, they had to settle and write a check to pay off three out of the money hedges they put on, and number two, the shareholders abandoned the company.”

Telfer encouraged miners to overpay for good assets, one of the trickier pointers.

High-quality assets are scarce, they’re hard to find, and they’re hard to buy. And whenever they possibly become available, they seem overpriced.

“My experience has been you can’t overpay for good assets. Again, if you believe the price of a commodity will go up, that will bring you from what might look like an expensive asset today and make it look more reasonably priced in the future,” he said.

“I just can’t overemphasize overpaying for good assets. Stretch yourself to get them because they are rare. They aren’t like streetcars. They don’t just keep coming down the road. If you believe the price of gold is going up, as you should be, that asset will become more reasonable in the future.”

Telfer also encouraged miners to conduct their acquisitions via shares. “When you’re about to issue shares with cash or issue shares to buy an asset, people obsess over their share price every day. You don’t need to. If you think you’re on the right path and doing the right things, the market will rise to reflect that going forward.”

Emphasizing his point of believing in the gold price, he thinks management should always bet on a rising gold price.

“This is what your shareholders want. This is what hopefully you believe. And so, when you are making acquisition or development or expansion decisions, you have to assume the price of gold is going to stay where it is or go higher to make your decision. Because if there’s some flat gold price, you’ll never do anything,” said Telfer.

Another pointer is to pay close attention to political risk.

“There are several companies now that are being punished by the politicians and the countries that they are operating in. They are having the tax rates jacked up, or assets are taken away or having the government demanding shares.”

Telfer said companies had to pursue many acquisitions to grow, circling back to his initial advice.

“While researching potential acquisitions, models are usually built on any number of assumptions to arrive at a suitable price. However, sometimes that asset is better than you expected. Many times too, the asset is not as good as you expected.

“And so, my advice to anyone is don’t bet on making a silver bullet-type acquisition to build your company and stop there. Keep going because the best way to diversify is to acquire more assets,” said Telfer.

Lastly, Telfer urged miners not to pay dividends.

“My observation of our industry is that we do not generate enough cash to operate our mines and demobilize them when they are finally finished, acquire new assets to replace ore reserves that we’re depleting every day, and then pay dividends on top of that. It doesn’t make sense,” said Telfer.

“We even have companies that have borrowed money to pay dividends, which is insane. And we have companies whose reserves and the quality of their reserves are going down every day. And then they’re using the cash they have to pay dividends. It’s an unbelievable situation.”

He pointed out several mid-tier miners were not paying dividends, yet investors were piling into the stocks. “It’s because of the underlying value of the reserves and future potential of the cash flows. That’s why people buy the stocks,” said Telfer.

“Yes, big institutions love the dividend because if you’re a gold fund, you must buy gold shares, so you want to buy ones that will pay something. But most people that buy gold shares are not buying them for the dividends. So, I think that’s a waste of money,” said Telfer.

Very hard to finance a new discovery of source gold for the klondike size placer that President Herbert Hoover mined and wrote a report on. Over 1200 square miles of heavy mineral and gold is found in this area. The area has history of gold production. Finess of gold 945-965. W.R Grace stated that this rare earth deposit is one of the largest in the world.

Ian Telfer gives textbook advice on how not to build a gold miner – this article is everything that’s wrong with our industry.

Ian Telfer’s advice is great for those looking to end up on top of a mining operation conglomerate. The shareholders will end up a lot sadder. Simply overpay for everything using your comparatively less overpriced shares and you’ll end up as the biggest dog. How did that work for his shareholders at Goldcorp?

Ian Telfer also discourages miners from returning cash to shareholders from finite-life, wasting assets. After all, in his view, the underlying businesses can never afford to do so. Telfer thus implies that all gold miners are overpriced. If you deliver investors’ cash return on their money, it’s harder to build an empire. Besides, it’s much easier to trick them with future promises anyway.

Silver Wheaton didn’t seem to agree with his philosophy either, as he got the boot after less than a year.

And we wonder why capital has fled the gold mining industry, and we lag every other sector. We have thought leaders like Telfer lighting the way. This is an industry whose collective remaining companies only ever make money by accident. Where are the shareholders’ yachts?