The equity of exploration and development company American Pacific Mining (CSE: USGD; US-OTC: USGDF) surged as much as 18.4% this morning after the company announced late yesterday that it had effectively doubled the size of its Tuscarora land package, in Nevada.

The Vancouver-based company has agreed to acquire the assets from project generator Ubica Gold, gaining 77 claims (76 unpatented and one patented) at Tuscarora, totalling 417 hectares.

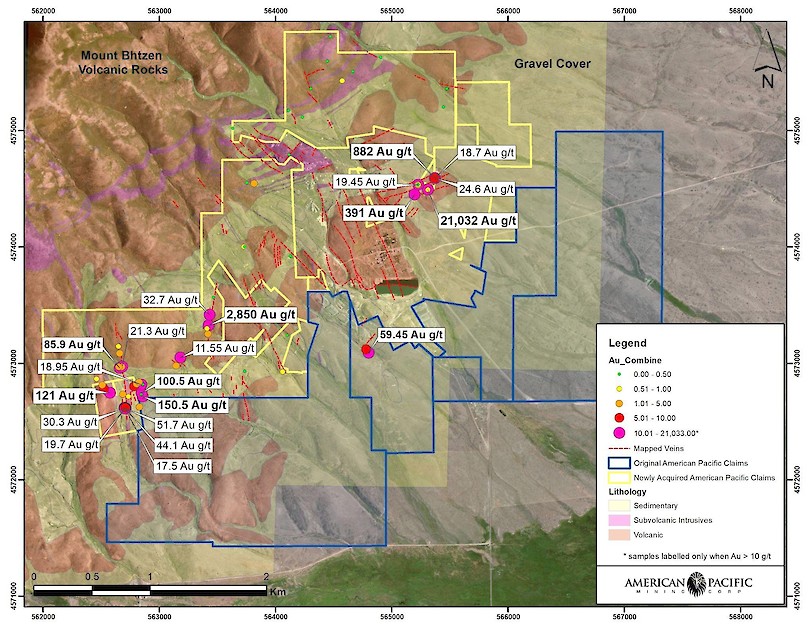

American Pacific also reported assay results for high-grade rock chip and grab samples collected from the newly expanded land package at Tuscarora, with some returning bonanza-grade gold.

The company has collected 135 samples from several targets, ten of which returned grades of more than 34 grams gold per tone, including a sample of 21,032 grams gold per tonne and 38,820 grams silver per tonne, or 5.9% precious metals content, from surface at the Grand Prize target.

Other sampling highlights include 882 grams gold per tonne and more than 10,000 grams silver per tonne at the Argenta target and 2,820 grams gold per tonne and 1,460 grams silver per tonne at the Modoc target.

“This very important acquisition adds significant value to our Tuscarora project,” Eric Saderholm, American Pacific’s president, stated in a media release.

“These samples show the bonanza grades that these veins can host, and importantly, these high-grade values are broadcast throughout the property and not along one single vein,” said Saderholm. “This suggests the potential to greatly expand upon mineralization we have discovered in the past and map the full vein extent across this large property package in advance of drill campaigns later this year, or early in 2022. Using this data we will update our 3D model and begin the permitting process to commence a fourth quarter 2021 drill programme.”

Tuscarora is one of two early-stage assets the company owns in Nevada, the other being the Gooseberry gold-silver prospect. The company’s flagship Madison copper-gold project, in Montana, is under option to Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) which is currently finding a drilling campaign.

As of September 16, at its new 12-month high of $1.03 per share, American Pacific’s shares are up 168% over the past 12 months. The company has a market capitalization of $86.13 million.

Be the first to comment on "American Pacific shares surge on ‘bonanza’ grabs from an expanded Tuscarora"