Anglo American Platinum (Amplats) has agreed to sell its 50% stake in the Kroondal and Marikana platinum group metals mines in South Africa for just 1 rand ($0.0643) to rival Sibanye-Stillwater (NYSE: SBSW; JSE: SSW), the companies said today.

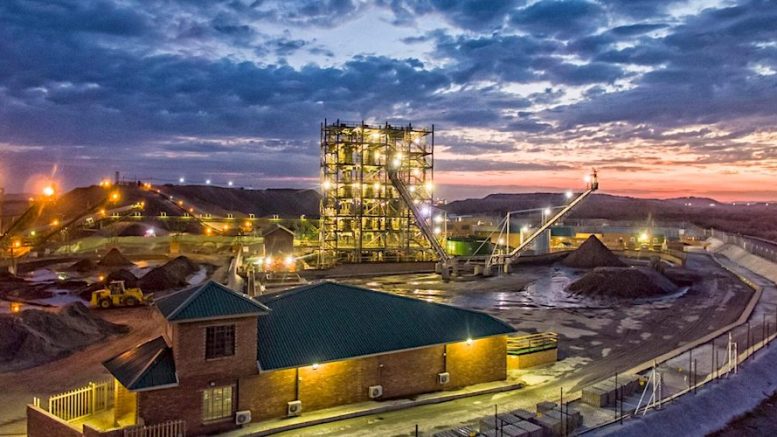

The deal gives Sibanye-Stillwater full ownership of the large Kroondal open pit mine, northwest of Johannesburg, in which both companies held a 50% interest each as part of the so-called Kroondal pool-and-share agreement dating back to 2003.

The move, which would allow Sibanye-Stillwater to extend the PGM mine-life to 2029, includes the company’s commitment to deliver 1.35 million ounces of platinum concentrate from Kroondal to Amplats’ Rustenberg smelting operations,

Without the deal, Kroondal would have closed in 2025, as certain shafts reached the boundaries of the lease area by the end of 2020. A contractor mining agreement was inked in January 2021, allowing the immediate exploitation of parts of the orebody that otherwise only would only have been mined sometime in the future, Sibanye-Stillwater said in a separate statement.

The Marikana mine, equally owned by Sibanye-Stillwater and Amplats, has been on care and maintenance since 2012, following one of the most violent and bloodiest episodes in post-apartheid South Africa. Thirty-four miners who were demanding higher wages were killed that day, only two of whom were not employed by then operator Lonmin, which Sibanye-Stillwater acquired in 2019.

Today’s deal also gives Sibanye-Stillwater full control of Marikana. In exchange, the new owner will take over all closure costs and rehabilitation liabilities, Amplats said.

The company’s parent group Anglo American (LSE: AAL) has been selling its gold and coal assets in South Africa as part of a broader streamlining of the group.

Be the first to comment on "Amplats sells stake in two mines to rival Sibanye-Stillwater"