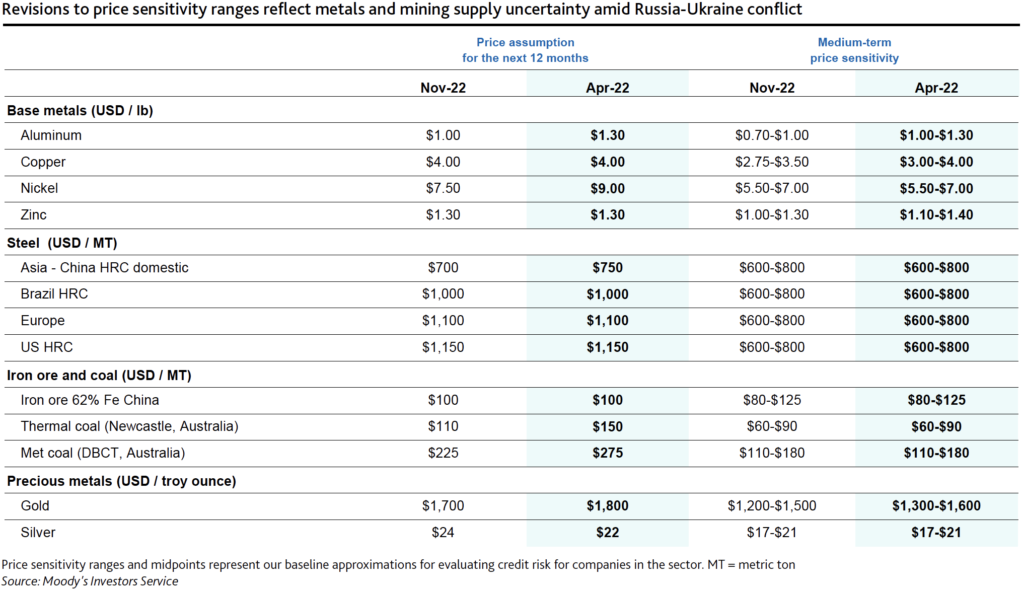

Several analysts have adjusted higher their metal price assumptions for 2022 as the February Russian invasion of Ukraine drags on, wreaking havoc on global metals and mineral supply chains.

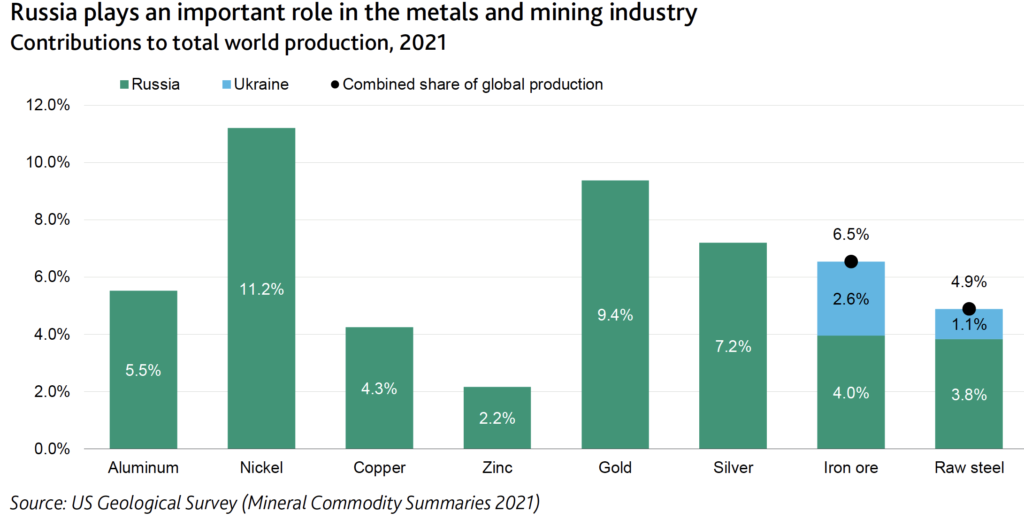

Moody’s Investors Service released a report on Apr. 6 flagging spiking prices for commodities Russia is a crucial producer of. These include aluminum, zinc, nickel, copper, gold and metallurgical and thermal coal. Moody’s said the price moves reflected fears of supply disruptions and scarcity at a time of generally low inventories, especially for base metals.

In the wake of the heightened volatility, Moody’s noted that some base metals prices, including aluminum and nickel, approached record highs in the first quarter of 2022, while copper and zinc prices have remained elevated.

Supply-demand balances for these commodities were already tight, with supply volatile amid low stocks and supply-chain disruptions. As a result, prices were high at the start of 2022, before the military conflict.

“Our price assumptions incorporate our expectations that G-20 economies will expand by 3.6% in 2022 and 3% in 2023,” said Moody’s. “China’s GDP will grow 5.2% in 2022 and 5.1% in 2023, reflecting policy support with higher infrastructure spending, tax cuts and measures targeted to specific segments; these factors support commodity prices because China is a significant commodity consumer.

“Risks to the outlook are high as the escalating Russia-Ukraine crisis has the potential to tip the global economy into a recession,” said Moody’s analysts.

The rating agency further elaborates that metals and mining companies will probably benefit from the high commodity prices and sustain profitability above historical levels in 2022.

Moody’s expects commodity prices to continue reflecting the risk of supply and trade-flow disruptions in the short term because of the military conflict. Rising energy and freight costs will also support higher prices because they will lead to additional production curtailments in Europe, where high energy prices are already straining industrial production and further tightening base metals supply.

“Moreover, surging energy and steelmaking input costs and fears of potential raw material and steel product shortages caused steel prices to rise during March, after steep declines during the second half of 2021. These factors are expected to keep steel prices at elevated levels in 2022 and possibly longer,” said Moody’s.

“The military conflict has put Russian coal exports at risk, further disrupting supply and increasing coal prices.”

Moody’s expects, at least for the medium term, that some countries will look to reduce their dependence on Russian oil and gas, which could also support an acceleration in the energy transition, particularly in Europe. This reduction, in turn, will foster demand growth for certain metals used in electric batteries, such as copper, nickel and cobalt.

Moody’s expects this shift to support these base metals prices at high levels, while steel, coal and iron ore prices would probably moderate toward the medium-term price sensitivity ranges.

“At the same time, an extended military conflict would weaken economic growth over time. An extended conflict would, in turn, directly reduce industrial activity and demand for metal and steel, constraining further growth in commodity prices,” said Moody’s.

Persisting price volatility

Meanwhile, Fitch Solutions Country Risk & Industry Research released three recent reports arguing the potential for the conflict to keep nickel and zinc prices high while flagging the potential for copper prices to moderate in the second half of 2022, despite maintaining a bullish longer-term outlook for the red metal.

In late March, Fitch revised its 2022 zinc price forecast higher by more than 20% to US$3,500 per tonne.

In a market commentary, Fitch argues that metal prices are being bolstered by the energy crisis stemming from the ongoing Russian invasion of Ukraine that has led to many smelters halting or reducing zinc metal production.

Zinc prices have rallied since 2020 over a long-standing mismatch between supply and demand, and despite global refined zinc output ramping up over recent months compared to 2020, it has been outpaced by demand.

Prices have averaged US$3,688 per tonne in the year to date and are currently hovering around US$4,069 per tonne. According to Fitch, at these levels, zinc is close to reaching its all-time high of US$4,442 per tonne achieved in 2006.

“Our 2022 price forecasts imply that we expect prices to stabilize and weaken from here on in the coming months, despite remaining elevated compared to historical standards,” Fitch analysts said.

Similarly, Fitch said it expected the nickel price to consolidate in the US$30,000 to US$40,000 per tonne range over the current quarter before moving below US$30,000 per tonne by the end of the year.

“We have revised our nickel price forecasts significantly higher due to Russia’s invasion of Ukraine. We expect prices to average US$27,500 per tonne in 2022, compared with US$18,466 per tonne in 2021 and our previous forecast of US$17,000 per tonne,” said Fitch.

The Fitch Solutions price forecast for 2022 is markedly higher than the Bloomberg consensus at US$23,150 per tonne.

“Ultimately, Western sanctions on Russia mean that the supply outlook for nickel over the coming years has deteriorated.

It added: “Nickel importers in the West are increasingly shunning Russia-origin metals, primarily due to risks of further sanctions, concerns over the extent of sanctions recently announced, and reputational risks associated with deals with Russian entities while the crisis continues.

“More broadly, we note that shipping traffic near Russian ports has fallen by over 30% since the country invaded Ukraine and that the number of Russian-owned vessels looking for work has increased sharply,” said Fitch.

Meanwhile, Fitch revised upwards by more than 8% to US$10,000 per tonne its copper price outlook for 2022. It flagged persisting supply issues in Latin America, combined with positive investor sentiment towards metals due to the Russian invasion of Ukraine to have pushed prices to new historical highs.

“Our forecast still indicates that prices will ease slightly from current levels later in 2022 as supply improves and sentiment stabilizes,” said Fitch analysts in a commentary.

“Nevertheless, positive long-term investor sentiment towards the green metal will continue to place a floor under prices and prevent them from returning to levels seen before 2021. Over the long term to 2031, we forecast the copper market will remain in deficit as consumption continues to outpace supply, driving prices higher amid the green transition,” said Fitch.

Be the first to comment on "Analysts adjust higher metal price assumptions on Russia-Ukraine conflict"