Raymond James mining analyst Brian MacArthur has raised his target price on Newmont Mining (NYSE: NEM) from US$44 to US$46 per share after visiting the company’s Boddington and Tanami gold mines in Australia.

Boddington — Australia’s largest producing gold mine — is located in Western Australia’s Saddleback greenstone belt, about 16 km from the rural farming town of Boddington and 120 km from Perth.

Tanami is a fly-in, fly-out operation on Aboriginal freehold land in the remote Tanami Desert, located 540 km northwest of Alice Springs.

Newmont forecasts Boddington will produce 665,000 to 715,000 oz. gold this year at consolidated all-in sustaining costs (AISCs) of US$880 to US$930 per oz., and expects Tanami will produce 440,000 to 515,000 oz. gold at consolidated AISCs of US$705 to US$775 per ounce.

The company says a 450 km natural gas pipeline connecting the Tanami mine to the Amadeus gas pipeline and two on-site power stations will result in net cash savings of US$34 per oz., beginning in 2019.

Newmont has made strides at Tanami. In 2012, the mine produced 180,000 oz. gold at AISCs of more than US$2,000 per oz. gold. Since then, MacArthur notes, it has increased mine and mill throughput 80% and doubled reserves.

The analyst says “there could be more ounces discovered at the mine [recent discoveries like Federation and Liberator highlight the potential at depth] and regionally.”

In addition, Newmont is considering a second expansion at the mine that would involve building a 3.2-million-tonne-per-year shaft and increase production by 100,000 oz. gold a year.

The first expansion at Tanami, completed in third-quarter 2017, increased annual gold production 80,000 oz. gold a year to between 425,000 and 475,000 oz. gold.

The US$120-million expansion extended the mine life by three years.

If Newmont undertakes a second mine expansion, called TEP2, it would cost US$650 to US$750 million. An investment decision is expected in the first half of next year.

MacArthur says that if approved, TEP2 would “reduce operating costs by over 10%, given greater efficiencies and ultimately the benefit of even lower power costs through the gas contract.

“With the Tanami power project and TEP2 completed, we expect Tanami to have production of greater than 500,000 oz. at AISCs below US$700 per oz. through 2037,” MacArthur writes in a research note. “The shaft would also open up the mine at depth, and, longer term, we believe production could ultimately be even higher if more discoveries are made regionally or near surface that could supplement feed from the shaft.”

Newmont has fully owned and operated the Tanami mine since 2002.

As for Boddington, he says, improvements since 2012 include boosting production 12% and trimming AISCs 30%.

“Current reserve life is 2032, but continued efficiency improvements (e.g., autonomous trucks, improved equipment availability, reduced mobilization events and increased throughput) will likely lead to further laybacks, which could extend the mine life through at least 2041,” he says. “In addition, Newmont is looking at improving its copper concentrate by increasing its concentrate grade and reducing penalties.”

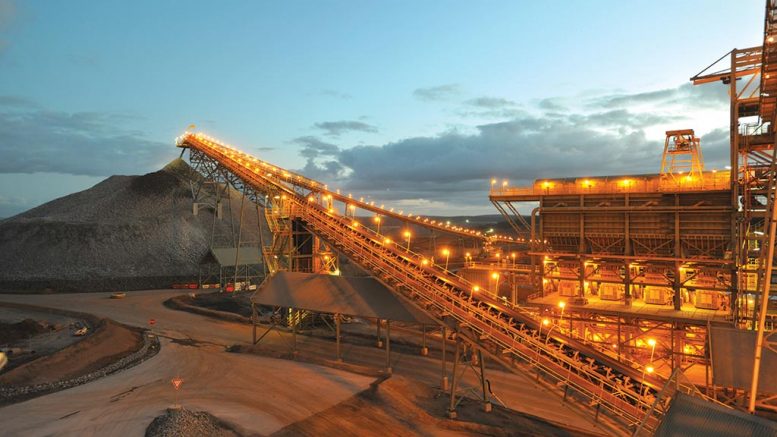

Processing facilities at Newmont Mining’s Tanami gold mine in Northern Territory, Australia. Credit: Newmont Mining.

Commercial production at Boddington began in 2009, and in March 2011, the mine produced its first 1 million oz. gold. It reached two million oz. gold production in August 2012.

Boddington was a three-way joint venture between Newmont, AngloGold Ashanti and Newcrest.

In 2009, Newmont bought AngloGold Ashanti’s shares to become Boddington’s sole owner.

Newmont is trading at US$32.42 per share.

Andrew Kaip of BMO Capital Markets has a $42-per-share target price.

“Tanami is a great success that keeps getting better, and is quickly heading to Tier 1 status,” Kaip said in a research note after visiting Newmont’s operations.

The turnaround at Tanami “has been driven by new discovery and optimization of the mine and mill,” he writes, while the mine “is able to keep costs in the second quartile, given the morphology of ore zones that are amenable to low-cost, long hole stoping.”

Moreover, reserve growth has been “just as impressive, with reserves doubling to 4.4 million ounces a 5.7 grams gold per tonne.”

“In addition, the mine hosts a further 700,000 oz. measured and indicated and 800,000 ounces of inferred at 5.4 grams per tonne,” he says. “We don’t usually mention inferred resources, but resources lie down-plunge of existing ore shoots and have a +70% conversion rate.”

Kaip expects reserves will continue to grow at Tanami because the main ore shoots are open at depth.

“Resources have yet to be established at Liberator, a new ore shoot at the mine that looks to have better than reserve grades,” he continues. “Exploration has also identified a near-surface zone called ‘Orac’ that will provide mine flexibility and could support further mine expansion.”

As for Boddington, Kaip says, the emphasis is on further cost improvements rather than mine-life extensions, and the most significant cost savings, he argues, appear to come from automated mining.

“We should find out later in 2019 whether automated mining gets the green light, but initial indications are that Boddington could realize productivity gains in the range of 20%, and mining cost reductions in the range of 25%.”

Be the first to comment on "Analysts optimistic on Newmont’s Boddington and Tanami mines"