VANCOUVER — It sat idle for five years but now Atna Resources (ATN-T, ATNAF-O) is firing up the Briggs gold mine in Inyo Cty., Calif., and expects to produce its first gold dor soon.

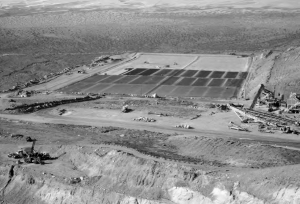

Canyon Resources, now part of Atna, built the Briggs mine and operated it from 1996 to 2004. The mine was an open-pit operation with recovery through heap leaching. The mine ceased production in 2004, but Canyon continued to recover gold from the heaps until 2006. All told, Briggs produced 554,000 oz. gold from 23.5 million tons of material grading 0.031 oz. gold per ton (21.3 million tonnes of 1.06 grams gold per tonne).

In March 2008, Atna and Canyon merged. Atna immediately commissioned a technical report and reserve estimate for the mine, which concluded that Briggs could be reopened for just US$13 million in capital investment.

Atna quickly decided to reopen the mine, this time around as a combined open-pit and underground operation. And at the end of January, Atna achieved that goal, announcing that mining was again under way at Briggs with gold-bearing ore being stockpiled in preparation for crushing.

Atna has just completed a study that boosts reserves by 70% and outlines a new six-year mine plan. It pegs open-pit reserves at 12.5 million tons grading 0.021 oz. gold per ton (11.3 million tonnes at 0.72 gram gold per tonne), for 267,000 contained ounces gold. Measured and indicated resources add another 20.7 million tons at 0.027 oz. gold (18.8 million tonnes of 0.93 gram gold) for 550,000 contained ounces gold.

The new, slightly expanded mine plan projects total output of about 213,000 oz. gold with annual production of 40,000-50,000 oz. between 2010 and 2013, with residual gold recovery in 2014.

Atna reports that open-pit mining is under way and the leach pad expansion has been completed. The company will begin crushing stockpiled ore in early March and expects to pour gold in April.

During 2009, Atna expects to produce more than 20,000 oz. gold at Briggs. Life-of-mine cash costs and total production costs are projected to be US$468 and US$587 per oz. gold, respectively.

Life-of-mine pretax cash flow at a gold price of US$750 is projected to be US$36 million, net of capital recapture, including sustaining capital and project closure costs. The company calculates that cash flow will increase by more than US$20 million for every US$100 increase in the gold price.

Meanwhile, Atna is working to add tonnage in the form of openpittable deposits within trucking distance of the mine; two such deposits already exist but the tonnage is not yet proven up according to National Instrument 43-101 standards. The more advanced satellite zone is Cecil-R, which sits 6 km north of the mine. Drilling is now under way at Cecil-R to inform a resource estimate.

In the underground deposit at Briggs, which is also called the Goldtooth structure, measured and indicated resources stand at 313,000 tonnes grading 7.65 grams gold. Inferred resources add 2.7 million tonnes grading 2.53 grams gold.

Atna, following the recommen- dations of the Briggs technical report, plans to crush 1.45 million tonnes each year. At present, plans call for three years of crushing, with leaching continuing for a fourth year, but if the satellite deposits turn out as hoped, mine life would be extended.

Atna is also hoping to expand the underground resources at Goldtooth and the open-pit resources at Briggs main. To that end, the company drilled 17 expansion holes and the results indicate that significant gold grades continue beyond current mine-plan limits. For example, hole 11 was drilled into the main pit area and returned numerous intercepts, including several at depth: 9 metres of 0.76 gram gold, 9 metres at 1.37 grams gold, and 10.7 metres of 0.41 gram gold. And hole 6, an underground expansion hole, cut 59 metres grading 0.75 gram gold.

Briggs sits 50 miles east of the town of Ridgecrest in central California, on the side of the Panamint Mountains. Mineralization is contained in Precambrian gneiss, and in the amphibolite in particular. As explained in the 2008 technical report, structure is “critically important to ore formation” at Briggs — both mineralization and alteration are controlled by macro-and micro-scale structures, as the structures make an otherwise generally unsuitable host rock amenable to gold deposition.

The most obvious structure is the Goldtooth fault, which was a major conduit for ore-bearing fluids. The Briggs orebodies are disseminated replacement-style deposits, with a simple assemblage of gold, disseminated pyrite, carbonate, and silica.

Atna has already spent US$6.4 million at Briggs since rehabilitation work began and has committed an additional US$7.3 million. But Briggs is not Atna’s only project.

In clover

Over at the Clover project in Nevada’s Elko Cty., Anta’s joint-venture partner Yamana Gold (YRI-T, AUY-N) recently completed a 10-hole drill program. In 2007, one of Yamana’s drills hit 9.5 metres grading 9.4 grams gold; the 2008 program probed the continuation of that mineralization to the north.

The effort was successful: the Clover Hill zone now stretches another 200 metres north. Hole 9 returned some interesting intercepts: 15 metres of 0.58 gram gold and 16.5 grams silver per tonne from 231 metres depth, followed by 9 metres of 2.87 grams gold and 4.8 grams silver from 250 metres. Hole 12 hit a short, high-grade segment — 4.6 metres carrying 13.8 grams gold and 16.5 grams gold — and hole 14 returned 10.7 metres of 0.89 gram gold and 61 grams silver.

Yamana is working to earn a 51% interest in Clover by spending US$3.3 million on exploration and paying Atna US$635,000 before mid-2010. By completing a pre-feasibility study on the project, Yamana can increase its interest to 30%. The major recently told Atna that it plans to drill at Clover again in 2009; it is currently up to date with its earn-in payments.

And at its major joint-venture project, Atna’s partner Pinson Mining recently earned its 70% interest in the Pinson project by spending US$30 million on exploration. Last year, Pinson drilled more than 50 holes into the Carlin-type gold system at the property, which is in north-central Nevada. According to a 2007 estimate, Pinson hosts 2.5 million measured and indicated tons grading 0.34 oz. gold per ton (2.3 million tonnes of 11.66 grams gold per tonne) as well as 3.4 million inferred tons grading 0.34 oz. gold (3.1 million tonnes of 11.66 grams gold).

Finally, at its Reward gold project near Beatty, Nev., Atna recently completed an economic feasibility study that concluded a conventional open-pit mine and heap-leach operation would be profitable. Atna is now focused on permitting work at Reward, which hosts 5.2 million tons averaging 0.027 oz. gold (4.7 million tonnes of 0.93 gram gold) as proven and probable reserves.

Atna refilled its coffers in September when it closed the US$20- million sale of a royalty portfolio, including a royalty on the development- stage, privately owned Wolverine project in the Yukon and royalty interests on properties in the Dominican Republic and Argentina.

And in the final chapter of a long saga, Atna lost its petition to have its court case against a cyanide ban in the state of Montana heard in the Supreme Court. In 1998, the passage of the I-137 anti-cyanide ballot outlawed the use of cyanide to recover gold from ores mined by open-pit methods. When the initiative passed, the Seven-Up Pete joint-venture (in which Atna was a partner) had already spent more than US$70 million on drilling, permitting, and engineering at the McDonald gold project in Montana.

News that operations at Briggs had gotten under way lifted Atna’s share price to 80¢ from near 60¢. The company has a 52-week trading range of 30¢-$1.59 and has 82 million shares outstanding.

Be the first to comment on "Atna Primed To Pour Gold Again At Briggs"