Newcrest Mining (ASX: NCM) says there is potential to transform Imperial Metals’ (TSX: III) Red Chris copper-gold mine in northwestern British Columbia into a tier-one operation, and is spending US$806.5 million to acquire a 70% joint-venture stake in the mine and surrounding 230 sq. km land package.

“We do not do mergers and acquisitions purely to get bigger or for the sake of adding ounces,” Newcrest CEO Sandeep Biswas told analysts and investors on a conference call announcing the transaction. “We look for opportunities where we can unlock real value through the application of our strong technical capabilities and transformative way of thinking. We prefer this approach rather than financial engineering or nebulous synergy savings, which rarely deliver to their planned value.”

Biswas outlined a two-stage transformation plan for the open-pit mine that he says will deliver value and capitalize on Newcrest’s technical expertise in block caving, operations optimization and selective processing.

In the first stage, Newcrest will focus on process plant optimization, including debottlenecking, recovery uplifts, process control and improving the quality of the concentrate; mine optimization by improving knowledge of the orebody, grade control, fleet management systems and mine planning; and trim costs in the supply chain. It will also start an extensional drill program.

The Australian miner also said it will optimize Imperial Metals’ open-pit mine plan and improve production and mill recoveries. The current open-pit mine has a processing plant and associated infrastructure that gives Newcrest brownfield expansion options, Biswas said.

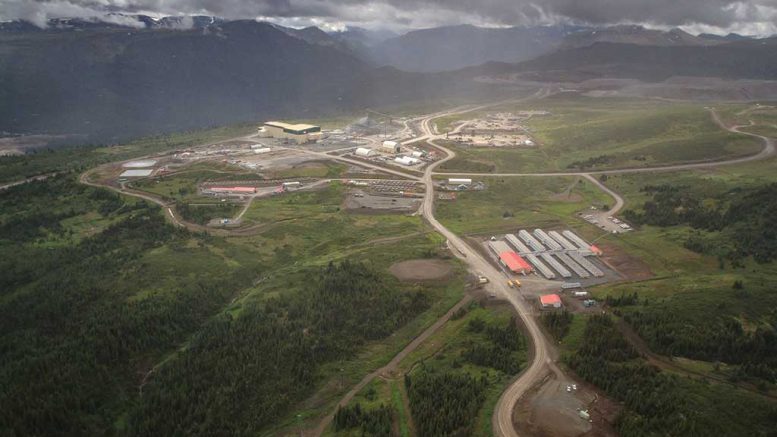

Imperial Metals’ Red Chris copper-gold mine in British Columbia. Credit: Imperial Metals.

During the second stage of the transformation, Newcrest will apply its expertise in block caving, coarse ore flotation, mass sensing and sorting, as well as continue exploration at the mine and on the surrounding tenements, Biswas noted, starting with a study on accelerating the development of a larger block cave at Red Chris.

“We’re going to bring value to the existing operation, but the big prize is the underground block cave — that’s the reason we’re there — and the exploration tenements,” Biswas said.

“The big prize is the underground block cave — that’s the reason we’re there — and the exploration tenements.”

Sandeep Biswas

CEO, Newcrest Mining

Block caving is the most effective bulk-underground mining method, he explained, and Newcrest has had over 12 years of experience in developing and operating block caves at its Cadia operation in New South Wales, 250 km west of Sydney. Cadia is one of the lowest-cost and largest gold-producing mines in the world, and is proof that Newcrest can create significant value from deep underground porphyry orebodies, he said.

“By accelerating the block cave development [at Red Chris], we not only bring forward access to higher-value ore, but it also enables us to reduce the depth and footprint of the open pit that was previously planned for Red Chris,” Biswas added. “We expect the [block cave] plan to significantly reduce open-pit costs by reducing waste movement and improving the strip ratio. A smaller open pit will also reduce the level of environmental disturbance.”

Biswas noted that Newcrest sees the investment in Red Chris “as a meaningful, but measured, addition to our portfolio,” and pointed to the mine’s “significant” mineral resources of 20 million oz. gold and 13 billion lb. copper, as well as the potential for more discoveries on the property’s substantial land package.

“This large resource base points to an asset that has a multi-decade mine life,” he said. “This is a great fit for our existing long-life portfolio, which is … a hallmark for Newcrest and a key competitive advantage.”

The transaction also delivers highly prospective exploration tenements, he added.

“Red Chris is located in Canada’s Golden Triangle — which is already home to a number of large mines and undeveloped gold and copper-gold resources discovered over the last 10 years,” he said. “This is one of the premier gold districts in the world. Existing drilling indicates there is potential for further deep discoveries to be made on the tenement package and Red Chris will be targeting regions beyond the current mine also in search of additional porphyry centres.”

During the question-and-answer part of the call, Biswas offered more insight into Newcrest’s views on resource expansion potential and the property’s prospectivity.

“This thing gets higher in grade the deeper you go, and there are still some areas of extensional exploration, which could open up to enlarging the resource beyond what we think it currently is.”

As of September 2015, Red Chris has measured and indicated resources of 1 billion tonnes grading 0.35 gram gold per tonne and 0.35% copper for 12 million contained oz. gold and 8 billion lb. copper. Inferred resources add 0.7 billion tonnes of 0.32 gram gold and 0.29% copper, for 8.1 million contained oz. gold and 5 billion lb. copper.

Newcrest spent the last couple of months on due diligence, but Biswas noted that the company’s management team “had our eye on the Red Chris orebody for several years now, when we did our initial scanning of what are the sort or type of orebodies we would want to be part of. Red Chris was definitely on that list, but the opportunity to access it didn’t open up until the last few months.”

When asked why the percentage ownership stake was fixed at 70%, Biswas said it was simple. “That’s what was on offer. They didn’t really want to go anywhere below 30%, so that was what was on the table.”

The mill at Imperial Metals’ Red Chris copper-gold mine. Credit: Imperial Metals.

As for the US$806.5-million sticker price, Biswas said there were two factors behind the sum.

“That’s a balance between what we see existing today in terms of the existing facilities and the mine, but more importantly the value we see in the underground deposit, which is where the majority of the value lies, and also taking a view of the exploration potential of those leases nearby the orebody, but also wider than that, based on some of the initial drilling that has already been done by the Red Chris team.”

When asked by one analyst about Imperial Metals’ “unflattering” financials, Biswas responded that “the thing to remember is this is an asset transaction, so we’re not exposed to anything in relation to Imperial Metals.”

In response to a question about whether Newcrest views Red Chris as a gold or copper mine, Biswas emphasized that taking a majority stake in Red Chris was not a “conscious move into copper.”

“The Americas have been a target for us for the last couple of years: we’ve made target investments in things like SolGold and Fruta del Norte in Ecuador, so we’re not necessarily focused on Canada, or anything especially. It’s about the opportunity, and this is an opportunity that came our way. You’ll find orebodies get deeper and porphyries form part of everyone’s portfolio going forward to a greater or lesser degree. You’ll find sometimes there’s more copper than gold and sometimes more gold than copper. And you’ll see a lot more copper appearing in everyone’s portfolio, I believe. But this is principally and wholly around the opportunity that presents itself. The fact that it’s in B.C., which is a tier-one district, in a low political-risk country, is a great bonus.”

News of the transaction sent shares of Imperial Metals surging 56.57%, or $1.12, to finish at $3.10. At press time, the shares were up another 7.4% to $3.33.

Over the last year shares of Imperial Metals have traded in a range of 93¢ to $3.48. The company has 127 million shares outstanding for a $423.3-million market capitalization.

Be the first to comment on "Newcrest to buy 70% of Red Chris for US$807M"