In an interview at Ernst & Young’s virtual Americas Mining & Metals Forum, Barrick Gold (TSX: ABX; NYSE: GOLD) chief executive Mark Bristow spoke about the importance of building a strong licence to operate, creating lasting relationships with governments and all stakeholders, and attracting generalist investors.

Jeff Swinoga, co-leader of EY’s Canada Mining & Metals division, began the discussion by congratulating Bristow on Warren Buffett’s recent investment in Barrick Gold.

Bristow responded that building a sustainably profitable business is key, and something he started at Randgold Resources in 1995, prior to that company’s merger with Barrick Gold, completed early last year.

“We set out to build a sustainably profitable business, it happens to be gold … and to do that you need to focus on employing the best people, manage the best assets and … [focus] on the longer term. … This is a long-term game,” he told EY’s Swinoga. “The mining industry often gets caught up with exploiting the moment … and we at Randgold attracted a very broad-based generalist following … talking to some of our big funds, it wasn’t uncommon to have 10 to 12 portfolio managers in those discussions from the generalist side led by specialist fund managers, and so we aspire to do that, and when we put Randgold and Barrick together we wanted to create a long-term ten-year plan that can roll [and] build a very sold data platform.”

Bristow noted that since the business combination, Barrick’s balance sheet has improved and it has broadened its register of investors.

“If you look at Barrick’s P&L today it looks very different than it was 18 months ago … and looks like any other public company. We’ve seen that general investor base in our register broaden out, and it’s a great privilege to have an investor like Berkshire Hathaway in our register, but we need more of those, so that’s a good step forward, but that’s our focus.”

“The way investments are managed, public money is managed, is really moving away from the specialist focus, that’s why you have to be relevant and attractive to the generalist investor portfolio managers,” he added.

Turning to the importance of Environmental, Social and Corporate Governance (ESG), Bristow noted it is “absolutely core to our business.”

“For many years it’s been like a feel-good index, but I can tell you whether you’re in Nevada or the Democratic Republic of Congo, you need a licence to operate today.”

Bristow pointed to the main drivers behind having a strong licence to operate. The first is that mining companies are “stewards of national assets” – whether they be state or national assets – and given that political leaders change all the time, companies need to build a “social licence to operate that is not just about being compliant,” but means being a good “corporate citizen.”

Transparency is another driver of licence to operate, he says, because companies need to put themselves out there and clearly state their objectives, and principles and values. Relationships are extremely important, he says. “It’s about meeting, having a conversation … and allowing people to criticize.”

Bristow noted that he does a mass meeting at least once a year and Barrick welcomes feedback from the community and the local press. “We allow the local press to challenge us, because that’s where we get an opportunity to educate the population, not shying away.”

In addition, he emphasized that mining companies have to be held accountable publicly on their own, not through third parties or the media. “It needs to stand up and share with its stakeholders. Mining is an industry we all need and the majority of people don’t like, and we have to take that one on. Our objective is to work toward being acceptable to next generations … which drives you to: How do you listen? How do you engage?”

Bristow pointed out that Barrick has also changed in the last 19 months – with the average age of its employees now under 30 – with greater numbers of female employees.

The long-time mining executive also noted that the 36 partners at the core of Barrick “need to be chosen” and “need to be a rising star” and are required to be heavily invested as shareholders. That means they must own stock five times their gross salary before they can realize any stock incentives. “So we are all shareholders and that makes it very focused, and we perform in line with our shareholders.”

Bristow also said that while Barrick’s corporate office is in Toronto, the company doesn’t have a head office and executives spend a lot of time at their mines. “The ownership and direction of the organization falls under three regions led by executive teams, and those three teams are amazing people, and it’s been an absolute pleasure to work with them,” Bristow said. “They are nimble and agile. Even in Covid we’ve been able to be engaged with our teams, and then the operation of the ore body and planning we’ve pushed down to the mines.”

Bristow emphasized the importance of relationships in Barrick’s operating structure, noting that “partnership is about relationships and relationships are about values – respect, high-quality performance, not allowing anyone to be a free-loader – and the smarter and sharper you get, the better and better the teamwork.”

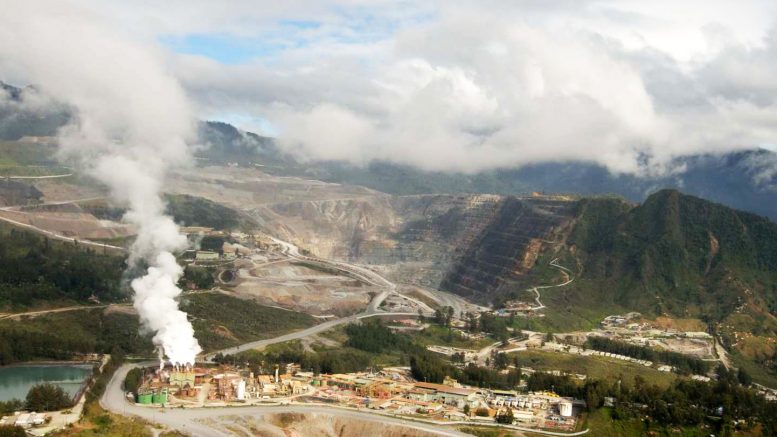

When asked about digital initiatives, Bristow noted they are “absolutely important in driving efficiencies” and pointed to the highly automated Kibali mine in the DRC, where, “after blasting and once it’s loaded, we don’t touch it again until it’s a bar of gold.”

He also pointed to Barrick’s automated trucks in its open pits in Nevada, where the company is working to allow them to operate in the same pit where manned trucks operate. Bristow added that across the organization the team is working on proof-of-concept projects, and noted that having a shared platform is essential.

“Everyone talks about IT, digital and automation, but Randgold had a set platform where we could see the whole organization at any moment of the day, and it allowed us to make decisions … inside the shift,” he says. He noted that when Randgold merged with Barrick, decision making was around a 45-day cycle, which has since been trimmed to a seven-day cycle. In addition, Barrick can plug-in predictive maintenance, consolidate its P&L, which it can then “flex with different gold prices and costs.” The next step is to take away budgeting, he says, hopefully done by next year.

When asked about what excites him the most about Barrick’s future, Bristow responded: “Everything.”

While the coronavirus has been a challenge, he added, it has also been something of a “facilitator”, “to bed the organization down” and empower employees to make decisions. He also referred to Barrick’s rolling ten-year-plan, announced earlier this year, which sees the company sustainably producing around 5 million oz. gold per year and delivering significant free cash flow. He also pointed to the US$1.5 billion it has realized through the disposal of non-core assets.

Swinoga concluded the interview by asking Bristow what advice he would give to other mining executives.

“The important thing is to have your own strategy, or what I call ‘strategic imperatives,’ and to realize those imperatives, and to realize that we are stewards of our business,” he replied. Bristow also said that while many CEOs are challenged by shareholders and even elected politicians “who want short-term returns,” they must remain focused on the long-term “and ensure you can be sustainably profitable through the cycles.”

Be the first to comment on "Barrick’s Mark Bristow on building a licence to operate"