Two joint ventures in two weeks with the two giants of the uranium world have lifted Purepoint Uranium Group (PTU-V, PUMGF-O) above the host of other junior exploration companies vying for market attention.

It’s not often that uranium giants like Cameco (CCO-T, CCJ-N) and Areva (ARVCF-O) initiate joint ventures on their projects and then hand over the keys to an incoming junior.

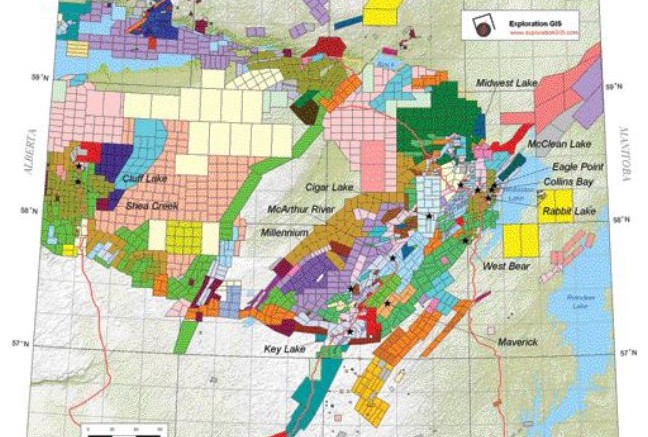

But Purepoint has managed to win the confidence of both Cameco and UEM — a company that is held equally by Cameco and Areva — to wind up as the operator of two additional and separate exploration projects in the Athabasca basin.

“This validates what we’re doing,” says Purepoint president and CEO Chris Frostad. “It validates that we’re serious about being there and serious about developing new resources in this area rolling forward.”

At Hood Lake — UEM’s formerly 100%-owned property — Purepoint can take a 35% stake by spending $7.5 million over six years with an option to earn up to 50% by matching UEM’s spending up until feasibility.

UEM has already isolated a basement alteration trend where previous drilling hit uranium mineralization. UEM retains the right to mill and market any uranium mined from the project.

But it was the first deal made with Cameco on its Smart Lake project at the southwestern edge of the Athabasca basin that had the biggest impact on Purepoint’s shares.

When the news was released in late January, its shares shot through their 52-week high of $1.35, climbing as much as 57% in the following two days to $1.84 on roughly 3.3 million shares traded.

At presstime, Purepoint shares were trading at $1.70.

Purepoint can acquire an initial 35% interest in Smart Lake by spending $4 million over six years. It can earn another 15% by sharing costs equally with Cameco up to feasibility.

For Frostad, a highlight of the deal is that Purepoint isn’t starting from scratch, as Cameco had already done extensive early stage exploration since 2004.

“It’s been advanced to the point where we have specific drill targets,” Frostad says.

He expects drilling to begin by the end of February.

Smart Lake is composed of two claims that cover 97 sq. km and is described as a shallow sandstone project where depth to the unconformity ranges up to 350 metres. Aeromagnetic and electromagnetic patterns are said to be similar to those underlying UEX’s (UEX-T, UEXCF-O) Shea Creek deposits, which are situated 55 km north of Smart Lake.

As with the UEM deal, Cameco retains the right to mill and market any uranium mined from the project.

Funds for drilling will come from a healthy kitty that is still growing with the recent announcement of a private placement for $20 million. Details of how many shares will be issued had not been released at presstime. Currently, the company has just over 62 million shares outstanding after completing a private placement in October for roughly $4.6 million.

Smart Lake JV

Purepoint’s growing position as one of the leading exploration juniors in the basin gathered momentum in November, when Cameco approached a host of juniors with an eye towards rapidly advancing some of its exploration projects in the Athabasca.

The move came as activity in the region heated up to the point where it was difficult for any one company to find the resources needed for any one project.

“Last year you saw a shortage of property in (the basin). This year, it’s a shortage on the operation side. The easy money has been spent,” Frostad says, referring to the less labour-intensive surveying and early stage exploration that went on in the region last year.

Purepoint, which had already established itself with a strong exploration portfolio in the region, was chosen after what Frostad says was a lengthy review of possible candidates. Ultimately, he says, Cameco believed Purepoint would operate the project best on its behalf.

The signing of the two deals culminates what has been a steady maturation process for the Toronto-based company — a process highlighted by the recent hiring of Dale Huffman as its vice-president of field operations.

Huffman is a 15-year veteran of the uranium industry, having held a variety of senior positions at Areva. He will direct fieldwork at all of Purepoint’s four camps, so that “our technical people can focus on what they have to do,” Frostad says.

Be the first to comment on "Basin bulk up"