Special to the Northern Miner

Vancouver — There is a major economic change developing that has the potential to affect the world in a huge way. The industrialization of Asia is starting to challenge the viability of many established industries in the rest of the world, and we have only just seen the beginning of a massive industrial buildup in the region.

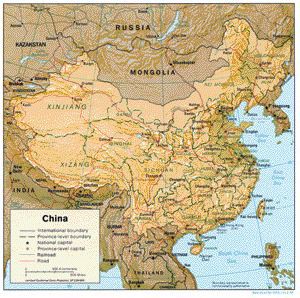

China has been leading the way over the past decade or so, but it has only been in the past three or four years that its influence has been felt across the entire globe. The nation’s demand for basic materials seems to be insatiable as the country moves from the relatively slow-paced, low-demand, agricultural-based economy to an industrial one. This process started off slowly because of political resistance to change — the government fearing a loss of control after decades of strict communist rule.

Once the Chinese government started moving towards adopting a more capitalist economic model, an entrepreneurial spirit quickly took hold. The pace of change has accelerated dramatically as millions of people capitalized on the new opportunities presented by the expansion of global trade. The government still has total control over many segments of the economy, but has been slowly loosening its grip as the economy continues to grow and evolve.

The country is going through an infrastructure upgrade and expansion that will take decades to complete. The construction of roads, electrical and water systems capable of meeting the requirements of the newly established industrial base will have to remain a priority for years. The building of a modern infrastructure will create a sustained demand for materials, which will support prices at the current levels or even higher over the longer term.

The biggest change that has taken place is the opportunity for individuals to accumulate wealth, thus allowing the development of a middle class in a previously classless society. The development of a middle class — and thus consumers — has created demand for an incredibly wide array of products. As the middle class grows — and it is growing at an astounding rate of about 40 million people a year — these new consumers are buying homes, furniture, appliances and cars, creating an internal demand that will continue to grow rapidly.

The new homes and products require copper, stainless steel and other building materials, keeping global supply of these commodities tight for years. The demand from China has only just started; the increase in the middle class has only started to build momentum. To add a little perspective on the situation regarding commodities and the power of growth in the middle class, consider the boom that developed after the Second World War, when North America and Europe were building the modern middle class. That boom lasted until the late 1960s and was fuelled by the demands of 40-50 million new middle class families over that timeframe. The potential in China will dwarf the North American and European experience by tenfold and occur over a shorter timeframe.

Measured by gross domestic product (GDP), China’s economy has been growing at 10% plus for years now. The Chinese central bank is trying to slow this rapid, likely unsustainable pace, but has so far seen limited success. A major slowdown in U.S. economic activity will have some impact and may reduce the pace of GDP growth in China to a more reasonable level of 5-6% — still high compared with growth of 3-4% in the past few years in North America and 1-2% in Europe. This slower pace of growth in China is much more likely to be sustained over the longer term and would still be sufficient to maintain a strong commodity market going forward.

Investors in North America have tended to look at the world with a biased view concentrating on the economic activity in North America as paramount to the potential globally. Over the past 60 years, that has been true as the continent dominated world economic growth, but that is changing. At 1.3 billion people, China’s population is three times that of Canada and the U.S. combined, and as the average income of this enormous population grows, each increase will affect the global economy as those consumers demand more variety and convenience.

The variety will not be restricted to just consumer goods. There will be a demand for new foods beyond the traditional diet as well, especially for foods more often associated with a Western diet, such as beef and pork. The added demand for these meats will put upward pressure on prices in North America, increasing the potential for inflation. There will also be a surge in demand for fertilizers and weed control chemicals in an effort to increase crop yields to meet demand.

The pressure we are seeing on industrial commodities such as base metals and energy products will eventually spread to agricultural commodities as the Chinese middle class grows. The transition from an agricultural economy to an industrial economy will not happen overnight, nor will it be a smooth process. There will be hurdles to overcome. With China’s huge population, the magnitude of the transition is of historic proportions and will permanently change the world economy. And I have not even touched on the economic changes taking place in India, a country with another billion people.

— The author, based in Vancouver, publishes the website thecambellreport.com and has 20 years of experience in the financial services industry.

Be the first to comment on "Bulging Middle"