Calibre Mining (TSX: CXB; US-OTC: CXBMF) and Marathon Gold (TSX: MOZ) are combining to create an Americas-focused mid-tier gold producer with an estimated average annual gold production of about 500,000 oz. in 2025-2026.

In an all-stock deal made public on Monday, Calibre will issue 0.6164 of a common share for each Marathon share acquired. This gives Marathon an implied value of 84¢ per share, or $345 million on a fully diluted in-the-money basis.

For Calibre, the merger will nearly double production, as well as diversifying its near-term production away from Nicaragua, where the bulk of its producing assets are located. Of the 250,000 to 275,000 oz. gold guidance for 2023, its Pan heap-leach mine in Nevada will only contribute up to 45,000 oz. gold.

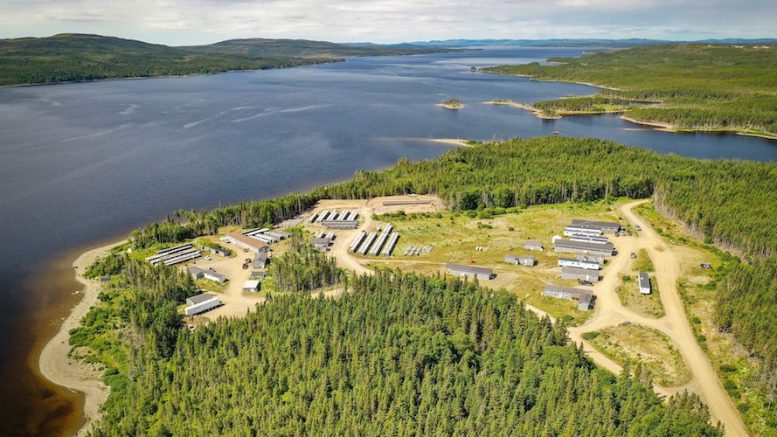

For Marathon, which is building its Valentine gold mine in Newfoundland, with first production expected in 2025 the deal will provide strong financial backing.

In a note to clients, BMO Capital Markets mining analyst Brian Quast noted the benefits to both companies.

“On a valuation basis, we view the transaction as relatively neutral, however, we believe that Calibre will greatly benefit from the added diversification in a top tier jurisdiction,” he wrote. “Calibre is also purchasing C$40M in Marathon shares by way of private placement, in order to immediately add liquidity to Marathon’s Valentine gold project.”

This consideration represents a premium of 32% based on spot price of the companies’ shares, and a 61% premium over their 20-day volume-weighted average price.

Shares of Marathon Gold surged nearly 11% on Monday afternoon following the news, giving the company a market capitalization of $285.6 million. Calibre Mining’s shares, meanwhile, were down 12% with a market capitalization of $552.6 million.

Half-million-ounce producer

A December 2022 feasibility study for Valentine outlined an open pit mining and conventional milling operation with an average gold production profile of 195,000 oz. of per year for the first 12 years of a 14.3-year mine life. Production is scheduled to begin production in early 2025.

The combined company would have over 4 million oz. of mineral reserves, 8.6 million oz. of measured and indicated resources (inclusive of reserves) and 4 million oz. of inferred mineral resources

During 2024-2026, the company will also boast a peer-leading production growth of 80%, Calibre noted in Monday’s press release.

“This transformative merger creates a projected 500,000 oz. gold producer and offers our shareholders diversification and exposure to high-quality, long-life production in a tier-1 jurisdiction,” Calibre chairman Blayne Johnson stated.

“This transaction builds on that commitment, adding a high-quality gold asset in the final stages of construction with strong exploration upside in one of the top mining jurisdictions in the world,” CEO Darren Hall added.

According to Calibre, the combined company will have a strong balance sheet with a combined cash balance of US$148 million and significant free cash flow generated from Calibre’s existing mines, ensuring the seamless completion of Valentine during the final 50% of construction.

“Through this transaction, Valentine will be fully funded to production without additional debt, royalties, or shareholder equity,” Marathon CEO Matt Manson confirmed.

In connection with the merger, Calibre will invest $40 million in Marathon via a private placement of common shares priced at 60¢ each, giving it a 14.2% stake in Marathon.

Proceeds will go toward development of Valentine, which is estimated to cost $403 million.

Be the first to comment on "Calibre Mining, Marathon Gold combine to create Americas-focused gold mid-tier"