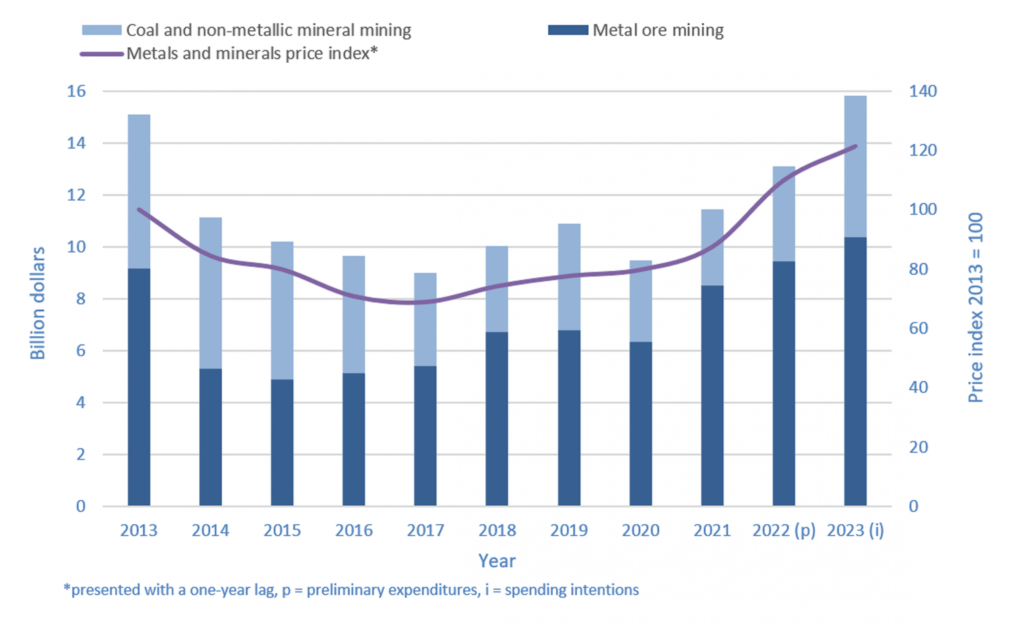

Capital spending in Canada’s mining industry increased by 14% to $13.5 billion last year, its highest in a decade, the latest figures published by Natural Resources Canada showed. The sector’s capex intentions in 2023 are also showing notable growth, rising 21% to $16.4 billion.

According to NRCan, mineral and metal prices reflect market demand and the supply balance or instability, and thus are a leading indicator of capex in the mining industry.

However, the rise in capex was also driven by inflation rates that soared to their highest levels in decades, leading to increases in the cost of materials and equipment (see figure below).

Companies tend to preserve capital when market conditions are unfavourable and financing options are limited, NRCan said. Conversely, firms tend to accelerate investment plans when the outlook for demand and prices improves, as it provides an opportunity to enhance their cash flow and profits.

After record high of $16.9 billion in 2012, capex in the mining industry declined every year for the next five years, reaching a 10-year low of $9 billion in 2017. It recovered over the next two years before declining again during the COVID-19 pandemic. Since 2021, the spending has returned to its pre-pandemic growth trend.

The 2012 peak was driven largely by the rapid growth in demand in China and other emerging economies. Supply eventually caught up with demand, causing metal prices and spending both to decrease. Commodity prices rose again after 2016, albeit much more gradually than earlier in the decade, and mining capex also rose until 2019.

In 2020, the price of many metals dropped quickly at the beginning of the pandemic, as the associated response measures constrained global consumption. Prices later recovered and surpassed pre-pandemic levels as demand initially returned in China — the world’s top consumer — while pandemic-induced supply constraints plagued parts of the global production.

Relationship between capital spending and inflation, 2006-2022. Credit: Natural Resources Canada

In early 2022, the prices of several metals reached record high levels after Russia invaded Ukraine. Russia is a major producer of precious, base and industrial metals, and it trades significant volumes of metals with Europe and Asia. Supply chain disruptions, economic sanctions and retaliatory measures contributed to price increases for several commodities, including palladium, nickel, aluminum and potash.

NRCan noted that the clean energy transition is anticipated to continue to be a key driver of increased demand for a host of critical minerals, particularly those used in electric vehicle batteries, such as cobalt, graphite, lithium and nickel.

On a broader scale, capex within the entire Canadian minerals sector, which also takes into account support activities for mining and downstream mineral-processing industries, grew 15% to $17.7 billion in 2022.

Be the first to comment on "Canadian mining capex reached decade high in 2022"