Zacatecas, Mexico — With plenty of cash on hand and dewatering and drilling under way,

Plans call for underground mining to begin in the first half of 2006 at a capital cost of US$15-20 million.

The property is one of five that were optioned to the junior for a 90% interest from Mexican mining conglomerate Grupo Bacis late in 2003. Capstone is now moving to secure a source of revenue from Cozamin at a time when copper, silver and zinc prices are on the rise. Bacis retains a 1.5% net smelter royalty and a 10% interest in the properties.

Capstone is fairly new to the junior mining scene, but it did not take long for the Vancouver-based company to get its Venture Exchange listing upgraded to the Toronto Stock Exchange.

The company’s president and CEO, Darren Pylot, learned much about junior mining during his time at PricewaterhouseCoopers. He is assisted by geologist Hugh Wilson as vice-president of exploration; Wilson was instrumental in discovering

The other Bacis projects include Claudia, Copala, Montoros and Promontorio, all of which have historical gold and silver resources. “Capstone can drop projects individually if they don’t meet its criteria,” said Pylot, who recently escorted The Northern Miner and a group of mining analysts on a tour of the property.

The company is currently dewatering the former Roberto underground mine workings at Cozamin. At the same time, a second phase of drilling is trying to define at least three years’ worth of minable material to justify restarting the Cozamin mill.

Capstone will next carry out metallurgical studies and underground definition drilling as part of a scoping study, which is due by June. Proceeds from a recent, $8.5-million private placement, plus $5 million in cash on hand, will be used to finance further exploration and development.

Cozamin comprises 10 sq. km on the outskirts of Zacatecas City, where silver mining dates back to the Spanish colonial era of the 1500s. The property sits at an elevation of 2,400 metres on the Mexican Plateau between the Sierra Madre Oriental and Sierra Madre Occidental.

The Zacatecas mining district covers a belt of epithermal and mesothermal vein deposits, which contain silver, gold and base metals. Tertiary-age structures concentrate the mineralization and are believed to be related to the development of a volcanic centre and to northerly trending basin and range structures.

The Zacatecas area is underlain by Triassic metamorphic rocks, which are overlain by Upper Jurassic mafic volcanics or Lower Cretaceous Chilitos Formation. The Tertiary comprises a red conglomerate unit overlain by rhyolitic tuff and flows. Rhyolite bodies cut the Mesozoic and Tertiary units and have, in some places, resulted in dome structures. The mineralization in the veins that cut the volcanics of the Sierra Madre Occidental are moderate-sulphidation epithermal to mesothermal.

Other North American companies active in the area include

The most prominent vein on the Cozamin property is the Mala Noche, which has been traced over 5.5 km and ranges in width from 5 to 18 metres. Mine workings extend from the San Roberto mine in the west to the San Bernabe mine in the east.

The San Roberto sector, near the mill, is where underground production occurred. Underground sampling and diamond drilling by

In March 2004, Capstone began drilling the main vein system, which is still open in all directions. The objective has been to define historical resources on the San Roberto sector and expand the resource by way of stepout holes.

Results from more recent drilling, beneath the old San Roberto mine workings, suggest that grade increases with depth, especially in the case of copper.

Says Exploration Vice-President Hugh Wilson: “The increasing copper grades, combined with decreasing zinc grades, at depth are significant, not only because copper prices are relatively higher but because the zinc was hard to recover in the past and had a high iron content, making it less amenable to smelting. The higher grades, as well as wider vein intervals, appear to be associated with the top of a carbonaceous siltstone, whereas the andesite tends to produce a narrow vein with more moderate grades.”

Capstone intends to outline 6 million tonnes, or three years’ worth of feed, to justify restarting the Cozamin plant.

To date, all of Capstone’s drilling has been from surface, since the former workings were flooded. The first phase of 19 holes (7,500 metres) indicated an average width of 6.6 metres and grades of 2.61% copper, 91.2 grams silver and 1.38% zinc. Three of the four most recent holes on the Mala Noche vein in the San Roberto sector yielded significant results; these were drilled between depths of 190 and 355 metres.

Hole 18 returned 14.1 metres grading 3.9% copper, 0.4% zinc and 82.2 grams silver per tonne, including a 6.4-metre section of 7% copper and 145.6 grams silver. The hole confirmed the vein’s width and grade in the eastern part of the zone, where hole 03 had returned 4.35% copper and 99.6 grams silver over 14.9 metres (true width) and where hole 10 had returned 2.5% copper and 107 grams silver over 9 metres.

Two more recent holes on this vein returned 3.9 metres grading 1.5% copper, 62.2 grams silver and 0.5% zinc, and 6 metres of 1.6% copper, 58.2 grams silver and 2.2% zinc (including 1.7 metres of 4.4% copper, 106 grams silver and 0.5% zinc).

The first hole of the second-phase program tested the strike projection of the Mala Noche vein beneath the previous San Roberto mine workings. Results suggest the vein extends to a depth of at least 450 metres and is open in all directions.

The Mala Noche system also showed comparable grades 500 metres away from the workings. Old workings are evident along the 5.5-km stretch of the vein on surface.

Hole 20 returned 6.8 metres grading 1.4% copper, 4.8% zinc and 100.3 grams silver, including 2.6 metres of 1.9% copper, 2.7% zinc and 138.7 grams silver. One drill rig is testing the Mala Noche vein down to the 2150 level and east of hole 20. Two holes were designed to test a large geophysical anomaly at a depth of 1,000 metres, and further targets along the vein have been outlined from geophysics.

Results from the second phase of drilling are pending.

Mincanmex has been commissioned to rehabilitate the San Roberto underground mine.

“The dewatering is going well,” says Gillian Kearvell, Capstone’s regional geologist. “We were a week late because of a broken down pump, but it looks like we will be done before the end of December. We’ll have to go down and do preliminary reconnaissance to see what conditions are like.”

Cozamin, which last saw production in 1997, has a 750-tonne-per-day flotation plant on site. The mill appears to be well-maintained and easily expandable.

It was upgraded to 750 tonnes per day in 1996 and, in the following year, processed at a rate of 250,000 tonnes a year.

Expanding the mill to 1,200 tonnes-per-day would cost US$1.4 million and expanding to 2,000 would cost US$2.7 million, according to an in-house review.

Capstone contracted Lakefield Research to look at restarting the existing Cozamin mill. The plant has processed 250,000 tonnes of ore grading 1.2% copper, 1.8% zinc and 0.6% lead, plus 90 grams silver 0.5 gram gold per tonne, mainly from sulphide ore.

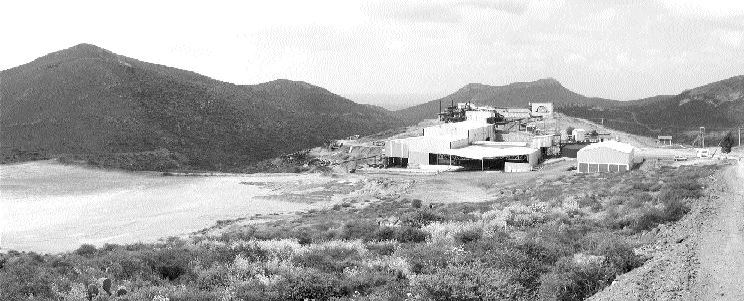

A view of the idled plant on Capstone Gold’s Cozamin copper-silv

er-zinc property on the outskirts of Zacatecas, Mexico. The area is in need of some remediation work around the former tailings pond on the left.

Be the first to comment on "Capstone revives past-producer Cozamin in central Mexico"