Vancouver — China’s potential for sediment-hosted disseminated gold deposits similar to those found in Nevada’s world-famous Carlin Trend was examined by the U.S. Geological Survey and the Tianjin Geological Academy in a joint study that involved field visits to 18 Chinese deposits from 1997 through 2000.

In an open-file report released in 2002, the authors predicted that China’s “Carlin-type” deposits could one day rival those found in Nevada, which collectively have produced more than 50 million oz. gold, with at least another 50 million ounces in reserves and resources.

The authors report that since the 1980s, Chinese geologists had outlined more than 20 million oz. of proven reserves, plus substantial additional resources, in more than 160 known sediment-hosted deposits. This does not include historic production from the oxidized upper layers of numerous deposits, mined over decades.

“This makes China second to Nevada in contained ounces of gold in Carlin-type deposits,” the authors concluded. “It is likely that many of the Carlin-type gold deposits in China, when fully developed could have resource potential comparable to the [multi-million-ounce] gold resources in northern Nevada.”

The authors also noted that while many of the Chinese deposits were small in terms of known resources, relative to Nevada deposits, “most have extensive exploration potential.”

Even before the bullish report was released, major companies with operations in Nevada rushed to acquire Carlin-type deposits in China, only to find roadblocks in the form of the central government’s complex, slow-moving, and often-ambivalent approach to foreign investment. Promotional juniors looking for “slam-bam” drill results didn’t fare much better. Many left after running out of patience, money, or both.

That was then. China’s gold industry has since been deregulated and approval and permitting processes have been streamlined. Rules on repatriation of profits have been relaxed, and a new mineral law has increased security of tenure. Even so, the pace of mine development has been slow, relative to other favourable jurisdictions. Only companies with patience, cash in the till, and credibility with Chinese authorities and agencies have managed to stay the course.

Raising funds for exploration in China hasn’t been a picnic either. There are few success stories, and the perception remains that all China had to offer was “chicken bones” — deposits with metallurgical or other problems that make development expensive and risky. There is some merit to that argument, as many deposits consist of deeper, refractory resources that sat undeveloped for years, just as they did in the early days of development in Nevada’s Carlin Trend.

There’s also debate as to whether China’s Carlin-type deposits fit the classic definition, which isn’t surprising, given the geological ambiguities of what constitutes a Carlin-type deposit. Setting that debate aside, China doesn’t yet have a mega-mine that rivals the ones that put Nevada on the gold-mining map. Then again, the Carlin Trend didn’t look like much either for its first 25 years, from 1961 through 1986. The first deposits found were shallow and small, with grades averaging 1.7 grams (0.051 oz.).

The picture changed in 1987, when drills aimed for stratigraphic units at depths greater than 250 metres and hit spectacular intersections of rich, albeit refractory, gold mineralization. It took a massive infusion of capital and the introduction of new technology to process metallurgically complex ores to make the region second only to South Africa’s Witwatersrand in terms of gold production.

Progress is being made in China, too, particularly by persevering juniors. Australian-based and listed

Sino Gold was also the first foreign company to operate a mine in the Asian nation. The company’s Jianchaling mine in Shaanxi province is a small operation with a limited mine life. It produced 5,180 oz. in the latest quarter at cash costs of about US$247 per oz.

Sino Gold is looking for growth at its newly licensed Jinfeng project in Guizhou province, described as the largest known “Carlin-type” and the largest undeveloped gold deposit in China.

The company holds an 82% equity interest in the project, which will be developed in two phases. The first phase will cost about US$70 million for a mine capable of producing 180,000 oz. gold annually, at an average cash cost of US$183 per oz., starting in mid-2006. The mine will then be expanded up to 300,000 oz. annually, starting in 2008. Capital costs for the combined open-pit/underground expansion are estimated at U$14 million.

Another pioneer is

Minco has focused its efforts on a 1,000-km-long sedimentary belt encompassing parts of Gansu, Shaanxi and Sichuan provinces. The company has 16 properties in the prospective Yangshan gold belt, including one hosting the 3-million-oz. Anba gold deposit (16.1 million tonnes at 5.64 grams gold per tonne), and is gearing up for another round of exploration on the land package. The 2005 program is expected to result in upgraded and expanded resources for the Anba deposit.

Another entrepreneurial pioneer is

The company has focused most of its efforts on the 83%-held Dachang gold project near the headwaters of the Yellow River, in Qinghai province. The Carlin-style project has an inferred, highly refractory resource of 5.7 million tonnes grading 7 grams gold, or about 1.3 million oz., plus exploration targets that are yet to be drill-tested.

Inter-Citic opened an exploration camp at Dachang earlier this summer. The first-stage of the company’s 2005 program will include trenching of gold-in-soil anomalies discovered during last year’s program, plus additional mapping and geochemical sampling of untested areas.

Inter-Citic defined 22 gold anomalies last year, and has plenty of targets to test in the coming season. Some of the better results to date have come from three large gold-in-soil anomalies found in the North River district late in last year’s program.

Results from previous drilling at North River include 6.4 grams gold over 8.5 metres, including a 7.1-metre interval of 7.6 grams, and 3.7 grams gold over 4.5 metres. Trenching results include 12.43 grams over 3 metres, including 18.37 grams over 2 metres. Another trench returned 5.6 grams over 6 metres, plus a second interval of 1.56 grams over 1.5 metres. A broader sample-interval from the same trench returned an average grade of 1.03 grams gold over 26 metres.

A more recent entrant,

The Toronto-based junior recently drilled the Laguhe prospect, one of several targets outlined during a reconnaissance program over the Xiahe property. Results were mixed, with several intersections below 1 gram. The best intercept was 3 metres of 2.94 grams, which includes 1 metre of 7.4 grams. The company is now testing several nearby targets, with results expected shortly.

<

p>Calgary-based

The land package covers 90.76 sq. km along strike of a small, producing mine where a stratabound, replacement, Carlin-style exploration target has been identified. The company is negotiating with the operator of the producing mine to gain control of the mine and the drill-ready target, and says “steady progress is being made.” If the negotiations are successful, the parties would form a jointly owned company to further explore their combined land package.

TVI also reports that it is in discussions with “several major gold-mining companies on a strategic alliance” in the Golden Triangle. The aforementioned property would be included in any possible future agreement.

The Carlin-type target of interest lies within a 30-metre-thick stratabound lens of altered and mineralized calcareous sandstone and breccia, in contact with an unaltered, barren, limestone unit.

TVI has also carried out sampling programs at the 50-tonne-per-day mine, with encouraging results. Values ranging from 0.01 gram to 13.6 grams gold per tonne were obtained from 61 channel samples, for an average of 1.95 grams.

Results from 53 composite channel samples taken along the target horizon averaged 2.25 grams, and include 8 metres of 7.4 grams inside the main adit, 9 metres of 2.85 grams above the main adit, and 8 metres of 3.47 grams across a 5-metre-wide, sub-vertical structure.

Vancouver-based

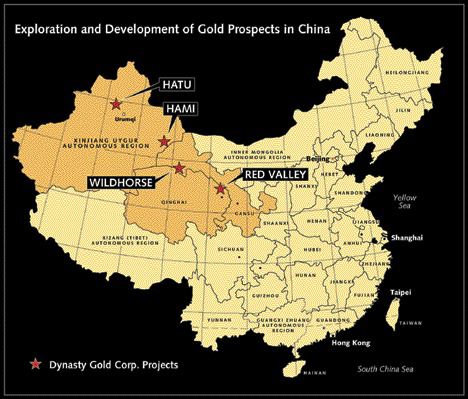

Dynasty is exploring the Red Valley property in Qinghai province, the Wild Horse project in Gansu province, and the Hatu project in Xinjiang province.

A drill program began this summer at the Hatu property to test the Qi-2 deposit, which hosts an inferred resource of almost 1 million contained ounces. About US$840,000 will be spent on the project this year.

The Red Valley and Wild Horse projects are early-stage exploration projects, albeit ones with known gold occurrences and/or anomalies. Red Valley also covers a small, known gold producer.

There are numerous other foreign companies actively exploring for gold in China, including other deposit types, with Australian companies being among the more aggressive players.

A force to watch in the coming years is

Afcan holds an 85% interest in the Tanjianshan gold project in Qinghai province in western China. The mine under construction is scheduled for completion in 2006, to produce 140,000 oz. gold in the first year.

Major gold companies are more visible in China, too.

Rival

China may not have a gold camp that rivals Nevada’s Carlin Trend yet, but time could tell a different story, given the gap in production rates and exploration spending between these endowed districts.

Be the first to comment on "‘Carlin-type’ gold deposits lure foreign explorers to China"