Egypt-focused gold miner Centamin (TSX: CEE; LSE: CEY) said today it is looking at expansion opportunities as soaring bullion prices and the country’s decision to open up its riches to foreign capital unlock opportunities.

Gold prices have hit nine-year-highs of about US$1,800 per oz. in recent weeks, boosting treasuries and spurring merger and acquisition activity.

Chief executive Martin Horgan said current gold prices have made “things interesting” in the company’s ability to do transactions. He acknowledged, however, that striking a deal could prove challenging, given that all gold miners are benefiting from the metal’s price strength.

Hogan also highlighted Egypt’s new drive to attract foreign miners. Until February this year, Centamin was the only international company with a mining license in the country. But on Feb. 13, Aton Resources (TSXV: AAN) secured a mining permit — the first one in 15 years.

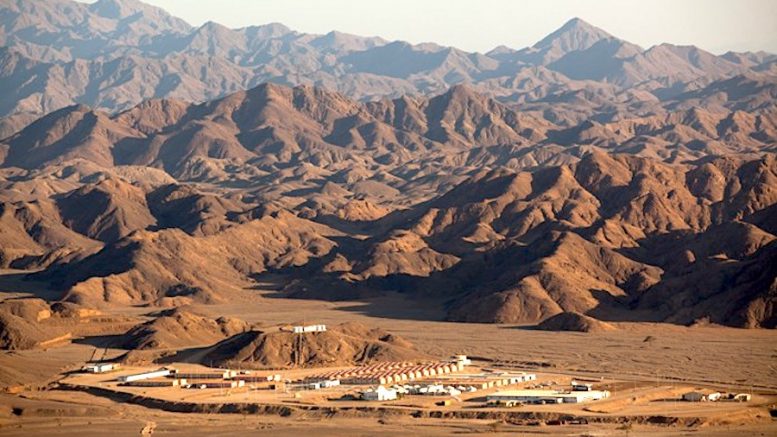

A month later, Cairo began auctioning 56,000 sq. km of exploration concessions in the Eastern Desert.

It recently extended the auction’s original July deadline to Sept. 15, due to delays caused by the coronavirus pandemic and to extend the opportunity to more potential bidders.

Centamin’s boss said the company would participate in the ongoing auction.

“We have significant infrastructure in Egypt and leveraging off that would be a good thing,” Horgan said, adding that the company was waiting for details on the process before preparing any bid.

Unlike Egypt’s natural gas sector, its mineral wealth remains underexplored and largely undeveloped.

The lack of activity was due, in part, to the nation’s past system of royalties and profit-sharing agreements. They made it difficult and unprofitable for miners to explore for and exploit minerals.

Centamin reported that its flagship Sukari asset, the only operating gold mine in Egypt, produced 130,994 oz. gold in the March-June period, above the 115,000 oz. anticipated in April.

The company attributed the better-than-expected output figures to higher mill feed grades. Deferring plant maintenance shutdowns to the third quarter, a coronavirus-related precautionary measure, also helped, Centamin said.

Net cash generated in the period totalled US$144 million, a 151% improvement year-on-year. As of June 30, cash and liquid assets were sitting at US$367 million, after the first interim dividend distribution of $69 million, paid on May 15.

While the gold miner said the pandemic has not significantly affected its business, it decided to lower guidance for the year to reflect minor delays in the supply chain.

Centamin now expects to mine between 510,000 and 525,000 oz. gold this year, slightly down from a previous range of 510,000 to 540,000 ounces.

Egypt’s Ministry of Petroleum and Mineral Resources revealed last month the discovery of a gold deposit with estimated resources of 1 million ounces.

While the government did not provide details on the methodology used to determine the deposit’s size, it noted it expected at least $1 billion in investments related to the development of the deposit over the next 10 years.

Be the first to comment on "Centamin reviews expansion options as results exceed forecast"