While often overshadowed by larger mining countries to the north and south, Central America is an enticing destination for mineral explorers and developers interested not only in the region’s gold and silver, but also its underdeveloped base metal potential.

Here is a look at seven such juniors.

ASCENDANT RESOURCES

Ascendant Resources (TSX: ASND; US-OTC: ASDRF) is a Toronto-based junior zinc producer. It acquired the El Mochito zinc-lead-silver mine in northwestern Honduras in December 2016. The mine has been in production since 1948.

Ascendant says in 2017 it completed a “rigorous optimization program” at El Mochito that resulted in an “operational turnaround, with sustained production reaching record levels and profitability restored.”

Ascendant Resources’ El Mochito zinc-lead-silver mine in Honduras. Credit: Ascendant Resources.

This year, Ascendant says it is focused on cost reduction and further operational improvements to “drive robust free cash flow in 2018 and beyond.”

In May, Ascendant unveiled a reserve estimate for El Mochito, nearly tripling the contained zinc and extending mine life beyond seven years at a rate of 820,000 tonnes per year.

Proven and probable reserves now total 5.7 million tonnes grading 4.7% zinc, 1.7% lead and 39 grams silver per tonne, or a contained 597 million lb. zinc, 209 million lb. lead and 7.2 million oz. silver. Another 12.5 million tonnes at slightly higher zinc grades lie in the measured, indicated and inferred resource categories.

Ascendant anticipates earnings before interest, depreciation and amortization of US$32 to US$40 million in 2018, and free cash flow of US$14 to US$20 million. It ended the first quarter with US$13.3 million in cash.

BLUESTONE RESOURCES

Darren Klinck-led Bluestone Resources (TSXV: BSR; US-OTC: BBSRF) was created in 2017 with the purchase of two neighbouring assets in southeastern Guatemala: the permitted, underground Cerro Blanco high-grade gold project; and the advanced-stage Mita geothermal project, which is licensed to produce up to 50 megawatts of power.

Bluestone’s executive team and directors include many names familiar to those in the Vancouver mining scene: Peter Hemstead, David Cass, David Gunning, Jeff Reinson, Stephen Williams, John Robins, Zara Boldt, Leo Hathaway, William Lamb, Paul McRae, James Paterson, and Keith Peck.

The Lundin Family Trust is the junior’s largest shareholder at 36%, followed by CD Capital (17%), management (9%) and Goldcorp (5%).

The company notes that US$230 million has been spent to date on the project (including US$60 million on the adjacent geothermal project), highlighted by 3 km of underground development.

Bluestone looks to complete a feasibility study at Cerro Blanco in the fourth quarter, with mine financing in 2019 and leading to production in late 2020.

As of February 2017, Cerro Blanco hosted indicated resources of 3.7 million tonnes grading 10.2 grams gold per tonne and 36.5 grams silver per tonne — or 1.24 million contained oz. gold and 4.47 million contained oz. silver.

Goldcorp sold the assets — then named Marlin — to Bluestone in May 2017 for US$18 million in cash, Bluestone shares and a 1% net smelter return royalty. Bluestone also acquired equipment for US$2 million.

Goldcorp operated Marlin as an open-pit gold mine from 2005 to 2017, and the mine represented Guatemala’s first large, modern gold mine.

Extensive nickel mining is ongoing in the country’s northeast.

CALIBRE MINING

Founded by industry veterans Douglas Forster and Blayne Johnson, Calibre Mining (TSXV: CXB; US-OTC: CXBMF) describes itself as a Canadian-based exploration and mine development company “exploring for world-class, precious metals deposits in the highly prolific ‘Mining Triangle’ of northeastern Nicaragua, where historical production has been over seven million oz. gold.”

Calibre has attracted Iamgold (TSX: IMG; NYSE: IAG) and Centerra Gold (TSX: CG; US-OTC: CAGDF) into earning into specific exploration concessions and B2Gold (TSX: BTO; NYSE-AM: BTG) as a major equity shareholder at 17%.

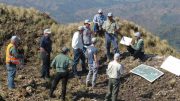

Examining gold-silver samples at the Guapinol discovery on the Eastern Borosi property. From left: Greg Smith, Calibre Mining president and CEO; Robert Page, Iamgold director of exploration; and Marc Cianci, Calibre senior project geologist. Credit: Calibre Mining.

In April at the Eastern Borosi gold project, Calibre’s JV partner Iamgold reported an inferred resource of 4.42 million tonnes grading 4.93 grams gold per tonne (700,500 contained oz. gold) and 80 grams silver per tonne. The project owned by Iamgold at 51% and Calibre, with the rest.

In February, Calibre reported that step-out drilling at Eastern Borosi in the fourth quarter of 2017 extended high-grade discoveries at the Cadillac and Veta Loca gold-silver vein systems.

CONDOR GOLD

London-based Condor Gold (TSX: COG; US-OTC: CNDGF; LON: CNR) is another junior exploring for precious metals in Nicaragua. It’s aiming to prove up a large reserve on its wholly owned La India project.

As of September 2014, La India held an indicated resource of 9.6 million tonnes at 3.5 grams gold per tonne for 1.08 million contained oz. gold, plus an inferred resource of 8.5 million tonnes at 4.5 grams gold for 1.23 million oz. gold. This includes total probable reserves of 6.9 million tonnes at 3 grams gold and 5.5 grams silver.

Another 700,000 tonnes at 3.5 grams gold lie in the inferred category.

Condor shares have traded on London’s AIM market since 2006, and the firm gained a secondary listing in Toronto in January 2018.

Condor’s goal is to complete a bankable feasibility study at La India, and prove up a gold district totalling 4 to 5 million oz. gold.

From 2011 to August 2017, Condor drilled 397 holes totalling 59,000 metres and carried out 18 km of trenching.

It seeks to permit and build, as a base case, a 2,800-tonne-per-day processing plant that produces 100,000 oz. gold per year.

Condor says it has “serious backing” from the World Bank, Jim Mellon and Ross Beaty.

FIRESTONE VENTURES

Firestone Ventures (TSXV: FV; US-OTC: FSVEF) is another Canadian junior active in Guatemala, with a focus on being what it calls a “first mover … and dominant landholder in a historical zinc-lead-silver mineral belt extending for 250 km across Guatemala.”

Firestone says very little modern exploration has taken place in the carbonate belt, despite the historical mining of many oxide and sulphide zinc occurrences on surface.

Firestone Ventures’ Torlon Hill zinc-lead-silver project in west-central Guatemala. Credit: Firestone Ventures .

Firestone’s Torlon Hill zinc-lead-silver project in western Guatemala has a preliminary, National Instrument 43-101 compliant resource — defined from 105 drill holes totalling 8,600 metres of drilling to date — that total 330 million lb. zinc, 114 million lb. lead and 978,000 oz. silver in all categories, and in oxide and sulphide zones. Firestone describes the deposit as on- or near-surface, and open for expansion.

The company has a second zinc target called the Quetzal property in central Guatemala, which returned several high-grade intercepts in 2010 drilling.

The company had no press releases for 2018 on its website at press time. Its most recent release, dated October 2017, related to a debt settlement for shares that in part resulted in gold explorer Keith Barron owning 19.6% of Firestone shares.

GLEN EAGLE RESOURCES

Montreal-based Glen Eagle Resources (TSXV: GER; US-OTC: GERFF) has a gold project in southern Honduras comprising the acquisition, construction and expansion of a gold processing plant that the company wholly owns through its subsidiary Cobra Oro de Honduras.

The plant’s crushing and milling capacity stands at 225 tonnes per day, with leaching limited to 120 tonnes per day. Commercial production started in April 2017.

The company says it has ordered more equipment to increase leaching capacity by mid-year, so that it can match crushing and milling throughput capacity.

Glen Eagle comments that “no mining concessions have ever been confiscated in the country’s entire history. The new mining law, effective in 2016, was another step taken by the government of Honduras to further protect mining investments in the country.”

Glen Eagle also has a phosphate project named “Moose Lake” near Chicoutimi, Quebec.

TAHOE RESOURCES

Tahoe Resources (TSX: THO; NYSE: TAHO) has precious metals mines in three countries: the Escobal silver mine in Guatemala; the La Arena and Shahuindo gold mines in Peru; and the Timmins West and Bell Creek gold mines in Canada.

Despite becoming a technical success as one of the world’s largest primary silver mines, Escobal has been a headache for Tahoe in recent years, and drove the company to lower its political risk profile by acquiring newer assets in Peru and Ontario.

Workers in the mill at Tahoe Resources’ flagship Escobal silver mine in Guatemala. Credit: Tahoe Resources.

The Escobal mine has been on care and maintenance since July 2017, as Tahoe awaits a Guatemala court ruling to get its various permits fully restored, as well as resolve chronic local roadblocks.

The mine still hosts reserves of 24.7 million tonnes grading 334 grams gold per tonne, or 264 million oz. silver.

During the first quarter, Tahoe lost US$6.9 million (2¢ per share) company-wide, due to care and maintenance costs at Escobal of US$10.4 million. With production lost from Escobal, total first-quarter revenue tumbled to US$140 million from US$251 million in the year-ago quarter.

Be the first to comment on "Central America Snapshot: Seven juniors advance gold, silver and zinc assets"