Chile, the world’s top copper producer, unveiled this week an ambitious plan to become one of the three largest cobalt producing nations as it simultaneously boosts its lagging copper output.

Declining ore grades, water restrictions and pandemic-related disruptions have seen Chile’s production of the orange metal decline in recent years. That has helped offset a slowdown in demand amid inflation-fighting measures.

Despite the International Copper Study Group’s (ICSG) latest negative forecast, which calls for a 467,000-tonne surplus in 2024, most analysts expect the opposite.

Copper is a key ingredient for the manufacturing of electric vehicles and green technologies and cobalt, also called “blue gold”, is a byproduct of the processing of copper and nickel ores.

For the Chilean government, jumping onto the cobalt wagon is “the next logical step” as producing the metal would position the country as a major supplier of battery metals. Chile currently is the world’s second largest supplier of lithium.

Cobalt is used in almost every lithium-ion battery, which in turn powers mobile phones, laptops, tablets, bluetooth devices, and even electric toothbrushes.

Getting to the top won’t be an easy task. The Democratic Republic of Congo (DRC) has long been the world’s largest cobalt producer, accounting for 73% of global output in 2022.

Indonesia is in the second spot, with production up more than threefold from 2,700 tonnes in 2021 to almost 9,500 tonnes last year.

According to the Cobalt Institute, the DRC’s dominance is projected to decrease to 57% by 2030 as Indonesia ramps up its cobalt production as a byproduct from its rapidly expanding nickel industry.

The DRC’s supremacy may also be threatened by Chile, according to Pilar Parada, Director of Universidad de Andres Bello’s Center for Systems Biotechnology (CSB UNAB).

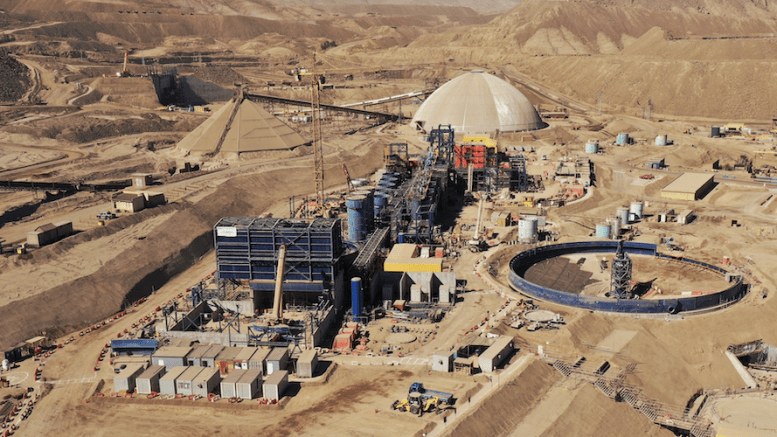

Researchers and companies have already taken steps in that direction. Canada’s Capstone Copper (TSX: CS) is one of the companies working on creating a cobalt mining district in northern Chile. The company, born in 2021 from the merger of Capstone Mining and Mantos Copper, recently integrated its Mantoverde and Santo Domingo operations in the Atacama region.

The Vancouver-based miner has said that, in addition to producing 200,000 tonnes of the industrial metal a year, it aims at generating between 4,500 tonnes and 6,000 tonnes of battery-grade cobalt annually.

Chilean Cobalt Corporation, a U.S.-based company, is also conducting exploration at its La Cobaltera cobalt project in the San Juan district of the Atacama region. The goal is to progress to the pre-feasibility stage by the second or third quarter of 2024.

The country is also looking at recovering cobalt from tailings. “Just by extracting the metal in the tailings, Chile could displace Indonesia to become the world’s second-largest producer,” Parada said in an October interview.

According to a research commissioned by Chile’s state development office Corfo and the National Geology and Mining Service (Sernageomin), the country has the potential to produce 15,000 tonnes of cobalt from its tailings annually in the medium term.

Green cobalt

With the right technology, Chile could extract the mineral in a cleaner way and at lower production costs, experts say.

One of the methods in study is the application of biotechnology to reprocess tailings to recover cobalt present in them.

This production method could also reduce the environmental risk currently posed by the mining tailings deposits, 86% of which are abandoned or inactive, according to a 2022 Sernageomin survey.

It would also mean additional funding for Chile. Given the potential production based on the current projects and production from tailings and mines, at US$33,003 per tonne in November, the country’s annual income would be about US$700 million at today’s prices.

Be the first to comment on "Chile aims to be among world’s top three cobalt producers"