America’s economy could see a US$3.4-billion hit if China imposes a total ban on gallium and germanium, according to a new report released by the United States Geological Survey (USGS).

China imposed export licensing controls on mineral commodities containing gallium and germanium last year. All exports require state approval, which established a pathway to progressive export restrictions.

Gallium prices could increase by more than 150% and germanium prices by 26% if there’s a total ban, the agency predicts.

“Losing access to critical minerals that constitute a small fraction of the value of products like semiconductors and LEDs (light-emitting diodes) can result in billions of dollars in economic losses,” said Nedal Nassar, lead author of the report.

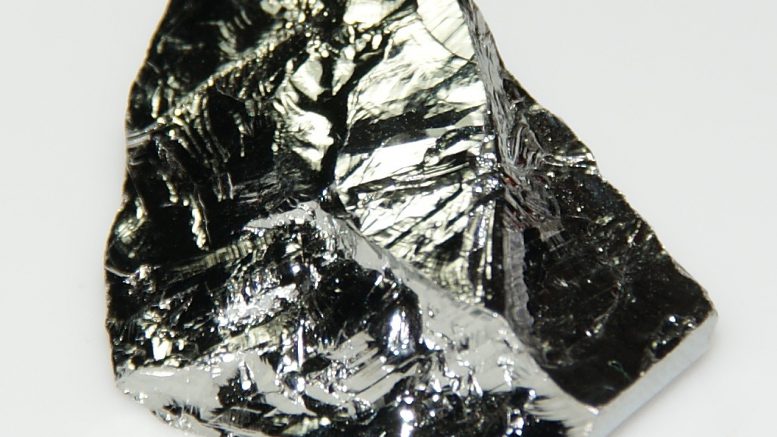

China supplies 60% of the world’s germanium. It’s used in applications such as fibre optic cables, solar cells and infrared technology. Prices for the metal hit record highs earlier this year in China due to speculation about potential state buying.

Semiconductors, defence

According to the USGS, economic losses in the U.S. would primarily impact the semiconductor device manufacturing industry, accounting for over 40% of the total loss. Additional hits would affect downstream producers reliant on semiconductors.

The Asian giant stepped up its scrutiny of critical minerals over the weekend with plans to limit exports of graphite, tungsten and magnesium from Dec. 1. It’s part of a wider push to tighten controls on dual-use technologies that are used for civilian and military purposes, BMO Capital Markets said on Wednesday.

“Tungsten is one of the critical minerals which China has relative dominance of the value chain, and has been one we expected to be subject to restrictions at some point,” BMO research director Colin Hamilton said in a note.

“Magnesium is potentially the bigger issue however given its importance to a number of aluminium alloys, both for the beverage can and automotive industry. Previously, when China’s power shortage restricted magnesium exports, the value of magnesium-containing scrap jumped to a premium to London Metal Exchange aluminium.”

Be the first to comment on "China germanium, gallium ban could cost US$3.4B"