Toronto-based junior Consolidated Thompson Iron Mines (CLM-V, CLMZF-O) has struck a deal to buy from steelmakers Cleveland-Cliffs (CLF-N) and Stelco (STE-T, SECNF-O) their combined 71.4% interest in the Wabush Mines iron ore joint venture in Labrador and Quebec for US$64.3 million in cash, some warrants and the assumption of certain liabilities.

Cleveland-Cliffs, the JV’s operator, would pocket US$24.1 million in cash and 1.1 million warrants for its 26.8% stake, while Stelco would get US$40.2 million in cash and 1.9 million warrants for its 44.6% interest. The warrants are exercisable into Consolidated Thompson shares at $5.10 for two years.

However, Dofasco, a subsidiary of steelmaker Arcelor Mittal (MT-N) — which owns the remaining 28.6% of the Wabush Mines joint venture — has a 90-day right-of-first refusal on both stakes, and has not yet announced its next move.

Consolidated Thompson won’t have any problems ponying up the cash: at the end of April, prior to the Wabush announcement, the company boosted the size of a previously announced private placement to $200 million. The underwriters — led by Orion Securities and including GMP Securities, Canaccord Capital and CIBC World Markets — are buying 42.1 million Consolidated Thompson shares at $4.75 apiece, but then taking a 5% commission on the gross proceeds.

Consolidated Thompson’s shares traded at 15 just a few years ago.

Investors clearly loved the Wabush deal, and drove Consolidated Thompson’s stock up another 15% to $5.85 on the day of the announcement. Shares have since settled at around the $5.55 mark.

Assuming that Dofasco lets expire or waives its purchase option and the above deal goes through, Consolidated Thompson will enter into an offtake arrangement with Cleveland-Cliffs and Stelco from closing until the end of 2009 with respect to a portion of their pro rata share of pellet production.

Beyond that, Consolidated Thompson says it’s now in discussions with other international offtake partners for similar agreements.

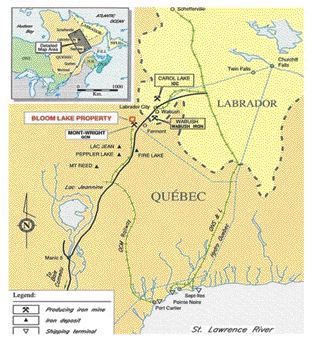

In production since 1965, the Wabush Mines joint venture comprises the Scully iron ore mine, the Point-Noire pelletizing facilities, a harbour and port facilities at Sept-les, Que., integrated railway facilities and other related assets situated near the town of Wabush, Labrador, and in Quebec. Currently, the capacity of the Wabush Mines operation is 4.8 million tonnes of pellets annually.

Elsewhere in the region, in Quebec’s Duplessis Cty., some 10 km north of Quebec Cartier Mining’s Mount-Wright iron ore mine (with QCM partly owned by Dofasco), Consolidated Thompson holds what has been its flagship Bloom Lake iron ore project.

The company plans to upgrade the Wabush mill to accept ore from the Bloom Lake deposit, so that the mill’s total capacity would be 8 million tonnes per year. The pelletizing plant would be similarly upgraded.

Production from Bloom Lake is anticipated in early 2009.

“This potential acquisition combined with an expansion at Bloom Lake would generate sustainable development in the area, benefit our regional economies and enhance shareholder value,” said Consolidated Thompson chairman Bruce Humphrey in a release.

The rest of Consolidated Thompson’s management team is rounded out by: Brian Tobin, vice-chairman and former Newfoundland and Labrador premier; Pierre Lortie, chairman of the advisory board; Richard Quesnel, president and CEO; Hubert Vallee, project manager for development; Rene Scherrer, project manager for mining; Pat Gleeson, corporate secretary; and Deborah Battiston, CFO.

The company’s board is comprised of Humphrey, Tobin, Quesnel, Bernard Wilson, Gerald McCarvill, Stan Bharti and Jean Depatie.

Cleveland-Cliffs president of North American Iron Ore, Donald J. Gallagher, commented that “Wabush has long-term issues with its pit, and adding Consolidated Thompson’s new resource to the existing mine and plant bodes well for both the long-term life of the Scully mine and the Point Noire operations, and the jobs associated with those facilities.”

Rodney Mott, Stelco’s president and CEO, concurred that the Wabush mine requires some pricey redevelopment work, and that Consolidated Thompson is “better positioned to complete this work, given operating synergies available to them with their neighbouring mining interests.”

Stelco added that Hibbing and Tilden, its two remaining iron ore interests, which are managed through its HLE Mining subsidiary, are not affected by the transaction.

Through HLE, Stelco has a 14.7% interest in the Hibbing Taconite Co., in Hibbing, Minn., where total iron taconite reserves are estimated at 158 million tonnes of product with an expected mine life of 19 years. Hibbing has a rated production capacity of about 8.1 million tonnes annually, of which Stelco takes delivery of 1.2 million tonnes of iron ore pellets.

HLE’s 15% interest in Tilden Mining Co. in Ishpeming, Mich., gives Stelco access to a complex orebody of hematite and magnetite. Total reserves there are estimated at 265 million pellet tonnes with an expected mine life of 34 years. Tilden’s annual production capacity is 7.8 million tonnes, of which Stelco can take delivery of about 1.2 million tonnes of iron ore pellets.

Be the first to comment on "Cons Thompson seeks control of Wabush Mines"