Exploration drilling in Ecuador’s Corriente copper belt by partners

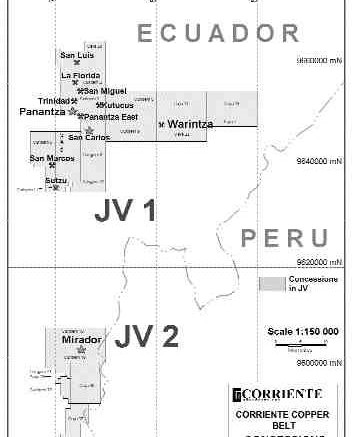

The Corriente copper-porphyry district extends at least 80 km north-south and 40 km east-west in the southeastern part of the country, near the border with Peru. Drilling by the two companies has resulted in the discovery of four separate copper-porphyry deposits in the district: Panantza; San Carlos; Warintza; and now, Mirador.

This first-ever resource estimate for Mirador, calculated by Abbotsford, B.C.-based Geospectrum Engineering, has outlined 218 million tonnes grading 0.73% copper and 0.25 gram gold per tonne, for a copper-equivalent grade of 0.85%. The calculation used a cutoff grade of 0.65% copper. Corriente says the resource figure is likely to be expanded, given that a number of holes were stopped in cutoff grade mineralization and the deposit remains open to the north and east.

Consulting engineer John Chapman has completed cash-flow projections on the Mirador resource, basing his work on a more extensive database generated by an order-of-magnitude study completed last year at Panantza and San Carlos.

The modeled resource for Mirador uses a grade of 0.85% copper-equivalent and calls for the milling and processing of 50,000 tonnes per day using conventional flotation, and then the trucking of concentrates westward to port facilities on Ecuador’s Pacific coast.

According to Chapman’s study, such an operation would produce copper concentrate at an operating cash cost of US35 per lb. copper. The study contains the following economic estimations:

– an internal rate of return (IRR) of 30% and a net present value (NPV) of US$427 million at a copper price of US90 per lb. (using a 10% discount rate);

– an IRR of 22% and a NPV of US$244 million with a copper price of 80 per lb.; and

– an IRR of 13% and a NPV of US$62 million when copper is priced at US70 per lb.

“Clearly, such a project is of economic interest and Corriente intends to make Mirador one of the priorities for the next phase of Ecuador development,” states the company in a release.

Corriente further states that its two main priorities are upgrading the resource categories from the inferred level and conducting metallurgical testing for gold recovery in the copper circuit.

The Corriente belt contains at least 10 porphyry bodies discovered during a US$12-million campaign carried out by Billiton and its precursor, Gencor, in the mid-1990s.

However, in 1999 and 2000, Billiton farmed out the exploration to Corriente, with the companies signing two joint-venture agreements that covered a northern group of tenures (containing Panantza, San Carlos and Warintza) and a southern group (Mirador).

Corriente can earn a 70% interest in both tenures by completing a feasibility study, at which time BHP Billiton can back-in for 70%, allowing Corriente to retain a 30% interest that would be carried to production. The major may also retain its 30% interest or exchange this stake for a 15% net profits royalty.

One of the key benefits for Corriente is that if a project does not meet BHP’s rather high economic threshold, ownership may revert to the junior.

The two partners are being assisted by David Lowell, one of the world’s foremost copper explorers, who is associated with the discoveries of Escondida in Chile and Pierina in Peru. For his technical direction, Lowell is provided with a 10% share of Corriente’s interest in the properties.

Panantza’s resources stand at 148 million tonnes at 0.8% copper and 0.1 gram gold per tonne.

San Carlos is estimated to contain 230 million tonnes of 0.85% copper with the best hole to date, no. SC-3, cutting 92 metres of 1.24% copper.

Warintza, on the eastern margin of the belt 10 km east of San Carlos, was discovered by Corriente-Lowell in 1999 during the drill-testing of a large copper-molybdenum soil anomaly.

Corriente has described Warintza as having a modest resource (under 100 million tonnes) grading 0.9% copper equivalent. Drilling has indicated a potential for a supergene zone of high-grade copper, with intersections such as 82 metres of 1.37% copper, 95 metres of 1.2% copper and 30 metres of 1.07% copper.

An earlier scoping study prepared by Geospectrum shows that, with a copper price of US$1 per lb. and no byproduct credits, the open-pit mining of the Panantza and San Carlos deposits would generate a 20.5% IRR on a US$500-million investment. The NPV would be more than US$228 million at a 10% discount rate.

Below the threshold

Corriente has already given BHP Billiton notice that the Panantza project is below the major’s 200-million-tonne threshold of 1% copper-equivalent, meaning that Panantza will likely become a Corriente-Lowell project separate from the existing two joint ventures in Ecuador. Thus, depending on BHP Billiton’s decision, the interest of Corriente-Lowell in the Panantza project will be either 70% or 100%.

Corriente intends to make the Panantza project available for joint venture or sale to other parties interested in medium-sized copper and copper-gold projects.

Meanwhile, Corriente plans to start a prefeasibility study and continue drilling new copper targets, in particular San Luis, San Marcos, Sutzu and Warintza.

The company also intends to work with government agencies regarding access to a multi-billion-dollar bilateral fund created for trans-border infrastructure development — a bi-national commitment that was part of the 1998 peace agreement between Ecuador and Peru.

The new infrastructure will likely include improved roads, expanded hydroelectric power capacity, and a new road connecting southeastern Ecuador to the Amazon River, which would allow mine production to be shipped eastward.

The partnership in Ecuador between Corriente and BHP has gone so well that, in mid-December 2001, the two signed a “global exploration alliance” agreement, whereby Corriente will focus on grassroots exploration and BHP will provide the junior with a mix of projects, technical advice and financing.

The first new project to fall under the alliance is the Mumbwa project in central Zambia, where Corriente has already begun exploring a series of regional Olympic Dam-type copper-gold targets identified by BHP Billiton affiliates over the past five years. In particular, Corriente wants to assess the area’s potential for applying BHP’s proprietary Falcon airborne gravity/magnetic survey.

The major regards the Mumbwa district as the most prospective iron-oxide copper-gold project in Zambia and has already spent more than $4 million identifying several granite-related, iron-oxide breccia systems. The most-advanced of these is the Kitumba prospect, which consists of a complex magnetic anomaly overlain by an extensive iron-oxide breccia system as big as the original Olympic Dam deposit in Australia.

BHP has already discovered a 12-by-4-km copper-gold geochemical and geophysical anomaly overlying the Kitumba breccia system, and past drilling, which was carried out without the benefit of a modern Olympic Dam exploration model, has intersected significant copper mineralization, including 100 metres of 1% copper and 20 metres of 3.9% copper.

Large breccia systems with geophysical and geochemical anomalies have been identified elsewhere in the district at Mutoya, Kantonga, Nalusanga, Lubungu, Kasalansonkwe and Kachindu.

Similar to the Ecuadorian arrangement, Corriente can earn a 70% interest in Mumbwa by performing a feasibility study on any prospect, though the company says it would undertake such a study only if the size and grade are of interest to BHP Billiton.

‘Small resource option’

The two partners have further agreed that all joint ventures between the two will provide a mechanism (dubbed the “small-resource option”) that allows Corriente, upon completion of a scoping study, to earn a 70-100% interest in any smaller discoveries — specifically, less than 200 million tonnes of 1% copper-equivalent for a milling deposit, or less that 10

0 million tonnes at 1% copper-equivalent for a heap-leach deposit.

Early in 2002, Corriente hired Vancouver-based Haywood Securities to assist with the private placement of 2.2-2.8 million units priced at 90 per unit, for gross proceeds of about $2 million. Each unit consists of a share plus a warrant entitling the holder to buy another share for $1 within two years.

The resulting funds are to be earmarked for general corporate purposes.

Be the first to comment on "Corriente, BHP Billiton, Lowell make progress in Ecuador"