Tahera Diamond’s (TAH-T, TAHEF-O) future appears about as grim as the company’s books, which have been saturated in red ink since commercial production began at its Jericho diamond mine, in Nunavut, in July 2006.

It cost Tahera $17.9 million to produce $8.6 million worth of diamonds over the third quarter, similar to the $16 million it cost to generate $6.9 million in diamond revenue in the second quarter.

The company is blaming ongoing operational troubles, the appreciation of the Canadian dollar against the U.S. dollar and higher oil prices for its financial distress, leaving investors wary about the company’s future.

“To the layman on the streets, that sounds like lousy business,” an investor told Tahera chairman and CEO Peter Gillin during a conference call on Nov. 6.

“What I would like you to tell me, Peter, is that all is well in paradise because what I’m seeing is some pretty dark clouds,” the investor said.

Gillin pointed out that Tahera has achieved marginal success in plant improvements with more to come.

“But you are quite right, the cost structure is way out of line now,” Gillin replied.

For the first nine months of the year, Tahera’s total revenues came to $20.7 million with an operating loss of $45.5 million.

The company’s total net loss for the first three quarters was $143 million, or 71 per share, compared with a net loss of $8.2 million, or 5 per share, last year.

This year’s loss includes an asset impairment charge of $73 million, and $21-million for a writedown of deferred exploration and development after receiving poor grades from its JD-03 bulk sample.

Results from a bulk sample from Muskox, also in Nunavut, and the 2008 program will be outlined at the end of the year.

National Bank analyst Brian Christie says the impairment charge was expected based on the company’s performance.

“I think, basically, they don’t believe they are going to get the money invested back out of the operation — that’s the way I would read it,” Christie says. “Exploration has pretty much gone to zero.”

National Bank has given Tahera an “underperform” rating with a target of 20 per share. The stock plunged 29% to 20 the day the third-quarter report was released.

The financial woes don’t end there. Tahera owes jeweller Tiffany & Co. (tif-n) $12.5 million in debt repayments. Tiffany, which has a diamond purchase and marketing alliance with Tahera, has agreed to defer payments due at the end of September until the end of the year. Tahera says Tiffany has also indicated that it would convert the $12.5 million into equity, but that will be contingent on a financing plan, yet to be completed, including a successful rights offering to shareholders.

Investors asked whether Tahera had lined up a backstop for the financing, suggesting Teck Cominco (tck.b-t, tck-n), which has a 16% interest in Tahera with the option to acquire 24.9%. Gillin said nothing had been arranged.

Christie says the company will barely be able to get its money back out of the operation after it pays Tiffany back.

“It’s our belief that we are going to see a lot of equity dilution with this rights issue and the conversion of the debt,” Christie says.

Tahera’s quarterly report noted the uncertainty of the financing plan, stating that the company was exploring other corporate transactions, “including the sale of the company.”

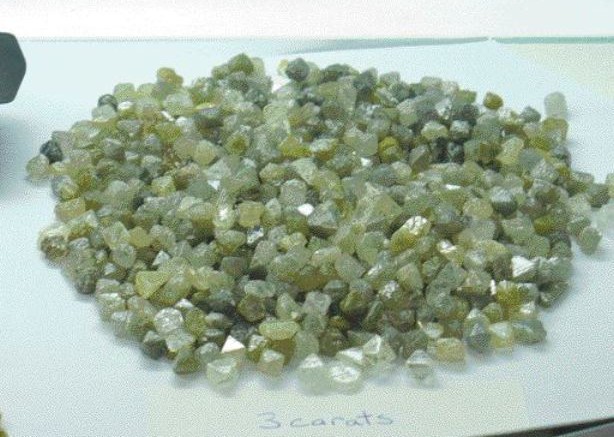

Gillin told investors that the company has been working to increase throughput at the plant, which processed 127,500 tonnes at an average grade of 0.78 carat per tonne, resulting in the production of 99,300 carats, an increase of 34% over the second quarter.

“We can’t control the value, we can’t control the dollar, so what we can control, or what we hope we can control, is tonnage throughput in the plant,” Gillin said when asked about future guidance.

Production reached its highest yet in October, with 55,000 tonnes processed at an average grade of 0.85 carat per tonne, resulting in 47,000 carats.

Another investor asked Gillin what Tahera’s output would have to be for the company to break even.

Gillin found the question difficult to answer.

“It obviously depends on the values you get and the exchange rate,” he said.

But with current monthly operating costs at $6 million and diamond output in October — the company’s best month since operations started — worth about $4 million, Gillin conceded that production would have to increase significantly.

Be the first to comment on "‘Dark clouds’ over Tahera"