Denison Mines (TSX: DML; NYSE: DNN) has completed the final phase of field testing that shows its commercial in-situ recovery (ISR) method could be viable at the Phoenix deposit in Saskatchewan, the company said on Thursday.

Phoenix and Gryphon are the high-grade deposits that form Denison’s Wheeler River project, the largest undeveloped uranium project in the eastern region of the Athabasca Basin.

During the feasibility field test (FFT), the company recovered 14,400 lb. of uranium oxide (U3O8) in solution in the leaching and neutralization phases. The third and final phase, also known as the solution management phase recovered over 99.99% of the contained uranium, validating Denison’s process design for a future commercial plant at Phoenix.

“The completion of the recovered solution management phase of the FFT has allowed Denison to demonstrate our operational capabilities from start to finish of the ISR mining process,” said Kevin Himbeault, Denison’s Vice President Operations & Regulatory Affairs. “We are proud of our team of operators and technical personnel for the safe execution of the entire FFT program.”

The news about the field test comes just over one year after Denison said initial ISR testing that recovered uranium-bearing solution at targeted rates and grades was “history in the making.” The ISR leaching method separates uranium from ore underground and pumps the solution to the surface for extraction. It’s generally less expensive than traditional hard rock mining, doesn’t require the digging of large pits and leaves fewer tailings.

BMO Capital Markets uranium analyst Alexander Pearce said in a note on Thursday that the completion of the last phase of the field test brings Phoenix another step towards being the first to use ISR in the Athabasca Basin. He added that though a final investment decision on the project is expected in two or three years, it could come earlier if Denison successfully delivers its permitting milestones.

Denison also said on Thursday that in the test phase it collected treated water suitable for release, which was tested and then injected into a designated underground area. Additional monitoring revealed no migration of the effluent above, below or outside the injection area.

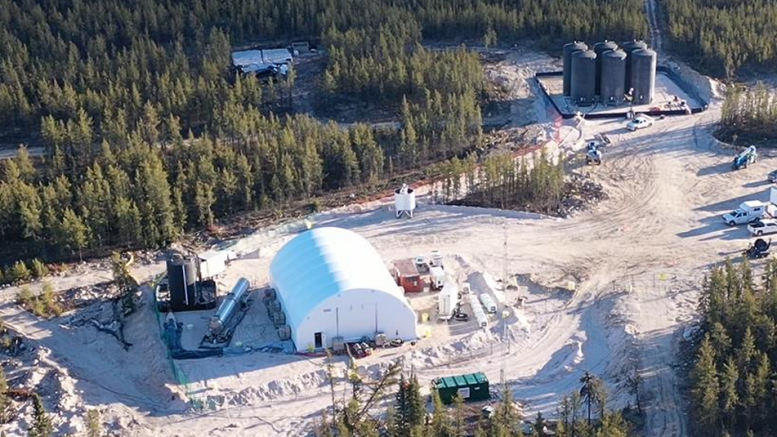

The FFT was installed at Phoenix in 2021 to assess various properties of the deposit. It had three phases: leaching, neutralization, and solution recovery. Denison has begun decommissioning the facility, but the work will not be completed until next year.

A feasibility study for Phoenix estimates the deposit hosts measured and indicated resources of 280,200 tonnes of ore grading 11.4% U3O8 and containing 70.5 million lb. of uranium oxide. There is also an inferred resource of 5,600 tonnes at 2.6% U3O8 containing 300,000 lb. uranium oxide.

A preliminary economic assessment for the Gryphon deposit was completed in 2018, and the 2023 update remains basically unchanged.

The news from Phoenix comes just weeks after Denison announced an agreement with Cantor Fitzgerald Canada for the sale of 37 million Denison shares on a bought deal basis to raise about $75 million for the project and advance it towards a final production decision.

Denison shares traded at $2.26 apiece on Thursday afternoon in Toronto, valuing the company at about $2 billion. Its shares traded in a 52-week range of $1.28 and $2.41.

Congratulations to Denison. Nice work!