A softening platinum market is taking a bite out of miners as companies face shrinking margins and production challenges, especially in South Africa’s prolific Bushveld complex, which accounts for 72% of global platinum output.

The challenges started in mid-May for Vancouver-based producer Eastern Platinum (ELR-T) after the company released underwhelming first-quarter results triggered by lower realized platinum prices, falling production and declining recoveries. Eastplats recorded a loss of US$8.9 million, or 1¢ per share, and a 36% year-on-year fall from the US$5.6-million loss recorded in the first quarter of 2011.

Platinum group metals (PGM) sales fell 4% to 24,500 oz. over the same period, but bounced back from lows of 19,850 oz. in fourth-quarter 2011 when Eastplats was beset by labour unrest and safety issues. Operating cash costs jumped 13% to US$990 per oz. PGM over the first quarter, compared to US$880 per oz. in early 2011.

The most concerning trend for platinum producers has been a sharp decline in averaged realized prices. Eastplats saw delivered prices per PGM oz. fall 15% to US$969 during the first quarter, down from US$1,136 per oz. in early 2011. Platinum prices averaged US$1,670 per oz. through the 2011–2012 fiscal year according to Platts Metals Week, peaking at highs around US$1,700 in March before falling to lows of US$1,400 per oz. on June 8. Platinum futures were not looking much brighter with orders for July delivery falling around US$1,450 per oz. at presstime.

Socio-economic instability in the European Union has impacted South African producers especially hard, as half of the region’s platinum production typically fuels automotive and industrial production in the eurozone.

Eastplats was forced to suspend development at its Mareesburg and Kennedy’s Vale projects — in the Steelport Valley along the Eastern Bushveld complex — at the end of May. Mareesburg is an 87%-owned PGM asset under a joint-venture agreement with Lion’s Head Platinum, which holds measured and indicated reserves totalling 16 million tonnes grading 4.92 grams PGM and gold per tonne for 2 million oz. contained PGM equivalent.

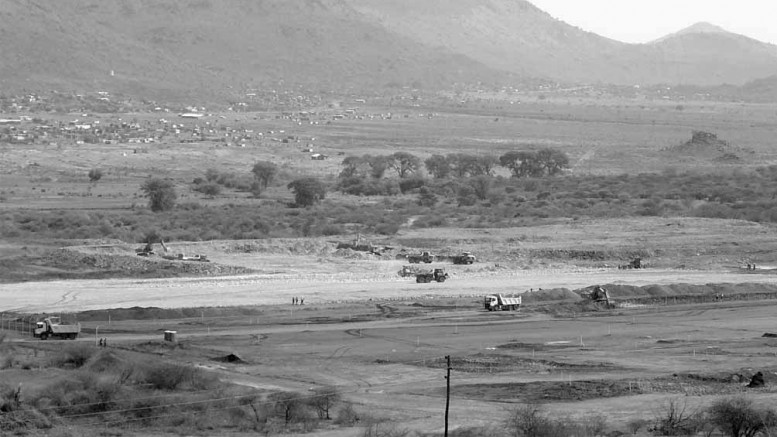

Initial development focused on Mareesburg’s open-pit in tandem with the nearby Kennedy Vale site, where Eastplats was constructing a 90,000-tonne-per-day milling facility. Construction on Mareesburg’s pit infrastructure and the Kennedy Vale concentrator plant was put on hold in an attempt to juggle costs and slow-burn rates.

“These factors, and particularly the continued cost pressures that we are experiencing in South Africa, make the platinum sector an extremely difficult space in which to operate,” president and CEO Ian Rozier comments. “We do not envisage significant large-scale production cuts from the larger producers and consequently expect that the industry will have to contend with much lower metal prices than previously projected in the medium term.”

Civil works at Mareesburg-Kennedy were “largely complete” according to company reports, with much of the concrete work well advanced. Eastplats had signed deals and received delivery on “almost all the necessary processing equipment.” Estimates had the project at 30% completion, on pace to meet a commissioning date in 2013.

Eastplats followed up with a report in mid-June on a financial review its South African mining operations. Management at the company’s producing Crocodile River mine — on the western limb of the Bushveld complex — submitted an updated redevelopment strategy aimed at controlling costs and ramping up efficiency.

The mine plan involves suspending activities at the mine’s Zandfontein zone in order to proceed with more extensive underground development designed to reduce stoping production, and increase near-term “on-reef” development in hopes of boosting reserves, production and long-term operating flexibility.

The redesign would reportedly take 18 months, and provide stope availability to sustain higher production while reducing average costs. On-reef mining operations will continue at the Maroelabult zone, with an objective of hitting a 30,000-tonne-per-month throughput. Crocodile River has a 2012 production guidance of 125,000 oz. PGM.

Eastplats did not release capital costs for the plan, according to its official statement, but maintained it could fund development through cash flows from mining operations, cash-on-hand and the sale of mining equipment and land assets. The company maintains US$213 million in cash, though its heavily diluted, 928-million-share equity position could cause financing challenges with liquidity challenged by development costs and falling platinum prices. The company said it would most likely put off any additional capital expenditures through 2013.

“We are committed to the ongoing operation and accelerated development at Crocodile River in the near-term in order to maintain its potential as a safe, sustainable and profitable mine in the medium and long-term, and at the same time, safeguard our cash resources and overall business interests,” Rozier states. “This development plan would achieve these objectives and would provide us with enormous operational flexibility going forward.”

Eastplats shares have been on a crash course since platinum prices first struggled in early March, registering a 59%, or 33¢ loss, over the past three weeks en route to a 23.5¢ presstime close. The company’s market capitalization has been shredded, falling to US$218 million — meaning Eastplats shares are trading at cash-backed value.

South African Resource Minister Susan Shabangu pledged to create a committee aimed at investigating the country’s struggling platinum industry during an address at the Gordon Institute of Business Science in Johannesburg on June 12, following an announcement by partners Aquarius Platinum and Anglo American regarding the Marikana mine closure near Rustenburg on June 11.

Be the first to comment on "Eastplats stung by platinum price drop"