This is my final editorial for The Northern Miner, as I will soon depart to join gold miner Agnico Eagle Mines as a senior geologist in their Toronto head office, working on technical writing.

After almost 23 years at the Miner, including the past 14 years as editor-in-chief, I’ve been overwhelmed by the hundreds of well-wishes coming in from around the world after my departure was announced, representing all stages of my time at the paper.

I extend my thanks to all my work colleagues as well as my mining and media industry contacts over the years for their help that allowed for our editorial team to produce top-quality stories that will stand the test of time.

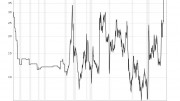

I was hired by the Miner fresh out of geology grad school in December 1996 during a peak in the mining industry, when Bre-X Minerals was the toast of the town, and its Busang fraud had yet to be exposed. The peak was, of course, soon followed by a slow decline in the commodities markets that didn’t turn a corner until the 9/11 attacks in 2001, which started gold and other metals on their supercycles that lasted many years.

Back in the late 1990s, it was instructive to see how people in mining and mineral exploration reacted to a commodity downturn, as they usually had wholly inadequate, one-year plans to cope.

After the first year I would see a CEO downsize his company to eliminate all fieldworkers. The next year he would have laid off all his staff. The next year he would tell me he’s working alone from a home office. By the next year he would be working for free in return for shares, and possibly show signs of a failed marriage and heavy drinking.

Speaking some French, I had been hired at the Miner in part to boost coverage of the juniors active in Quebec, which I did by making numerous trips to “La belle province,” particularly that golden strip in the Abitibi between Rouyn-Noranda and Val-d’Or.

One memory has stuck with me throughout my time at the Miner: During a visit to Val-d’Or in the depths of the gold bear market — when the yellow metal traded below US$250 an ounce, and majors like Barrick Gold and Placer Dome had pulled out of the region, leaving little remaining activity — I was at a sparsely attended meeting of barely surviving junior explorers.

As I was about to leave the group to head to the airport for Toronto, one of the middle-aged CEOs turned to me, his face in anguish, and said, “Don’t forget about us, John!” And then he slumped over and started crying. (To that CEO: I never forgot about you guys, and tried my best to give good coverage of the area.)

To me in my 20s, it was a first glimpse of the personal toll that failed businesses exact on ordinary people. But more than that, it underscored how unprepared most people in the mining industry are for extended downturns, even as they will quickly say that one of the defining characteristics of the mining industry is its cyclicality.

That group of CEOs didn’t know they were only a few years away from a spectacular gold-mining renaissance in the region, led by a new era of miners like Agnico and Osisko.

One of the defining features of the most successful mining entrepreneurs I’ve met over the years is not only do they realize that downturns last longer than most people expect, but they retain the capacity to take swift and decisive action during the worst of that downturn, picking up company-building assets for cents on the dollar, while their competitors are broke and curled up in a fetal position.

A crucial aspect of this is an ability to keep your personality separate from the prospects of the commodities you’re involved in. I’ve seen too many people in mining become personally glum when their commodity is down, or hubris-filled when their commodity peaks.

A positive attitude during the worst of business times becomes integral to being able to see and take advantage of once-in-a-lifetime business opportunities.

Mining entrepreneur Ross Beaty, with his infectious enthusiasm and brilliant long-term vision and business decisions, perhaps exemplifies this trait better than anyone in the junior mining game.

And finally: Thanks to you for being a reader of The Northern Miner, and please keep supporting independent news coverage in all its forms with your subscriptions and advertising.

I am sorry you are leaving the Northern Miner, I enjoyed reading your editorials and meeting you in Turkey. I wish you well in your future endeavours.

Thank you, Otto. That was a great trip and it was a pleasure meeting you and hearing tales from London’s iconic film sound stages!

John – have enjoyed our get togethers over the years and your top notch editorials. Wish you all the best as you enter the gold mining business.

Kind regards, Ted Yates

Thanks for all your great coverage these many years. I wish you well at Agnico.

John:

The Northern Miner has been my “go to” publication for all the up to date information in our industry. I have appreciated all your editorials and Podcasts over the years. We will miss you as the editor and wish you the best as you travel “over the tracks” to the other side of our business. Best wishes in the gold business. I think that gold is on for a strong rebound back to $1800!