Eldorado Gold (TSX: ELD; NYSE: EGO) has inked an amended investment agreement with the Greek government covering the miner’s operations in the north of the country.

The new contract between Eldorado’s subsidiary Hellas Gold and Greece replaces a 2004 transfer agreement between the parties, securing continued operation and further development.

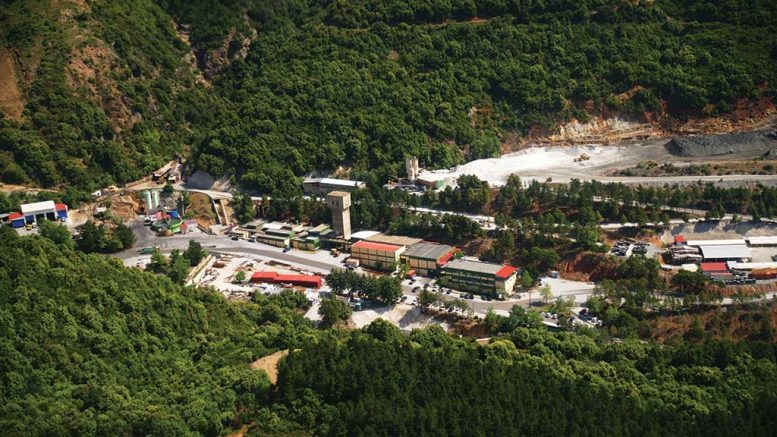

The agreement covers the Vancouver-based company’s Skouries, Olympias and Stratoni/Mavres Petres mines and facilities in the country, collectively known as the “Kassandra Mines.”

President and CEO George Burns said the agreement was mutually beneficial. “For Eldorado, it provides investor protection mechanisms including a permitting framework similar to other large-scale foreign investment agreements in Greece,” he said in a press release. “For the Hellenic Republic, it provides enhanced fiscal revenues, environmental benefits, and community development opportunities.”

The deal will allow the company to finish construction at Skouries and transition the project into production.

It would also help it expand production at the Olympias gold-silver-lead-zinc mine to 650,000 tonnes a year.

The revised plan covers upgrades to the port facilities at Stratoni to allow for bulk shipment of concentrates and boost of exploration work at Mavres Petres deposit, part of the company’s Stratoni project.

Eldorado has also committed to continue studying on-site gold processing methods in order to reduce the operations’ environmental footprint.

The company’s projects in northern Greece have repeatedly stalled over licensing delays and environmental concerns. In 2017, the miner halted all operations in the country due to government delays in issuing permits for Skouries and Olympias, two of the company’s key assets.

While Eldorado resumed activities shortly after, progress at its projects has also been hindered by community opposition revolving around the possible environmental impacts of gold mining in a densely forested area.

The company has submitted revised proposals since, focusing on the use of best-available techniques (BAT) at the European Union level, as well as global best practices, such as dry-stack tailings.

The country’s government has responded by granting the miner some key permits.

Greece and Eldorado, the country’s biggest foreign investor, have been in talks for over a year as the state seeks higher royalties from mining projects a jobs creation.

The nation’s conservative government has vowed to attract foreign investment to boost an economy that shrank by a quarter during a decade-long financial crisis.

Eldorado also has mining, development and exploration operations in its home country, Turkey, Romania and Brazil.

Kerry Smith, who covers Eldorado Gold at Haywood Securities, said the signing of the amended investment agreement “is a hug step forward for the advancement of Eldorado’s Greek assets, and once the agreement is ratified by the Greek Parliament, Eldorado will have a clear and defined path ahead for its Greek assets.”

“Eldorado Gold remains undervalued, currently trading at 5.2 times EV/consensus 2021 cash flow versus peers at 6.6 times, and there is substantial upside from current levels, once the Investment Agreement with the Greek Government is ratified and Eldorado can move forward with construction of the Skouries project.”

Smith has a price target on Eldorado of $24 per share. At presstime in Toronto Eldorado was trading at $16.27 per share, up $1.52 on the day, within a 52-week trading range of $6.29 and $18.90 per share. The company has about 175 million common shares outstanding for a market cap of about $2.85 billion.

With files from The Northern Miner.

Be the first to comment on "Eldorado Gold inks revised investment contract with Greece"