Cash is trickling into the Sierra Madre gold camps in Mexico as the rainy season draws to a close and juniors launch exploration programs designed to outline new resources or test the feasibility of production.

At the Uruachic camp in Chihuahua state,

At the other end of the exploration sequence,

Operating on a smaller scale,

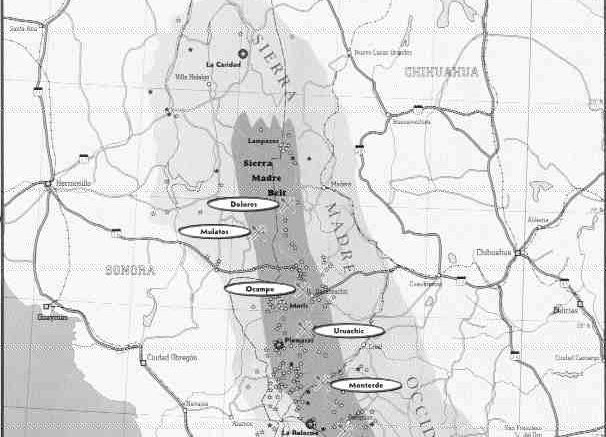

The junior sector’s ability to raise money for gold exploration and property acquisitions in these lean times testifies to the still-considerable potential of the Sierra Madre Occidental, a mountain range in northwestern Mexico that starts near the U.S.-Mexico border and trends southeast into the states of Zacatecas and Jalisco. The elusive search for gold in these mountains captured the public’s imagination as far back as 1935, when the mysterious B. Traven published his riveting novel The Treasure of the Sierra Madre (filmed 13 years later by John Huston), and changes to Mexican mining laws in the 1990s, combined with new exploration technology, have given rise to renewed activity in the area.

Cenozoic volcanic rocks, mostly tilting to the east, characterize the belt. The volcanics are divided into a lower andesitic unit (about 40-70 million years old) and an upper rhyolitic unit (20-40 million. years old). Most of the precious metal deposits are associated with, and below, the unconformable contact between the two volcanic sequences. The upper part of the lower sequence is the major host for gold. Mineralization occurs in hydrothermal stockworks, breccias and quartz veins.

Over the past 400 years, the belt has produced 40 million oz. gold and more than 1 billion oz. silver. Native groups were the first to exploit the silver and gold veins, followed by the early Spanish settlers, and modern exploration technologies, introduced in response to incentives for foreign investment in Mexico’s mineral sector during the past decade, are uncovering even more buried treasure.

Majors uncommitted

But despite the juniors’ success in outlining new resources, senior companies have yet to endorse the rush. Although majors like

One of the biggest players in the region is

Just as advanced is Minefinders’ Dolores gold-silver property, north of El Sauzal. Since discovering Dolores in 1996, Minefinders has drilled 292 holes to outline an indicated and inferred reserve of about 100 million tonnes. At gold and silver prices of US$300 and US$5 per oz., respectively, and a stripping ratio of 4.2-to-1, the open-pit portion of the reserve is estimated to contain 67.2 million tonnes grading 0.96 gram gold and 53.6 grams silver per tonne. A mine life of 13 years would provide annual production of 138,359 oz. gold and 6.3 million oz. silver. Pending financing, Minefinders is ready to launch a final feasibility study for Dolores.

Ocampo

Between Dolores and El Sauzal lies Gammon Lake’s Ocampo gold-silver property. The property contains several high-grade clavos, or oreshoots. In the process of drilling 300 holes, Gammon Lake has outlined a measured and indicated reserve of 21.7 million tonnes grading 1.4 grams gold and 57 grams silver per tonne, assuming a cutoff grade of 0.5 gram gold-equivalent, a gold price of US$260 per oz., and a silver price of US$5.20 per oz. A private placement of 2,138,462 special warrants priced at 52 per special warrant will finance a 7-month feasibility study at Ocampo.

The greatest upside potential in the Sierra Madre lies in the past-producing Uruachic camp, held by Golden Goliath. Last year, the junior raised $4.5 million to explore Uruachic in an oversubscribed initial public offering of units. Each 50 unit consists of one share and one full warrant, with the warrants being exercisable for two years at 75.

Sorbara, Goliath’s president, says the company has outlined nine targets, six of which will be drilled this fall. The $1 million allocated to the program will pay for 20-24 holes to depths of 200-250 metres. Some of the targets are coincident induced-polarization and soil geochemistry anomalies within larger zones of gold-bearing stockworks and breccias. Uruachic is on a large alteration system associated with a collapsed caldera structure, similar to the setting at the nearby El Sauzal.

South of Uruachic,

Be the first to comment on "End of rainy season lures juniors back to Sierra Madre"