Endeavour Mining (TSX: EDV; LSE: EDV), West Africa’s top gold producer, has unveiled an ambitious five-year plan to add between 15 and 20 million indicated ounces of gold through exploration over the next five years.

The company, which began trading in London in June, said the newly outlined program seeks to extend the life of its seven core assets beyond ten years. It also aims to discover new greenfield projects.

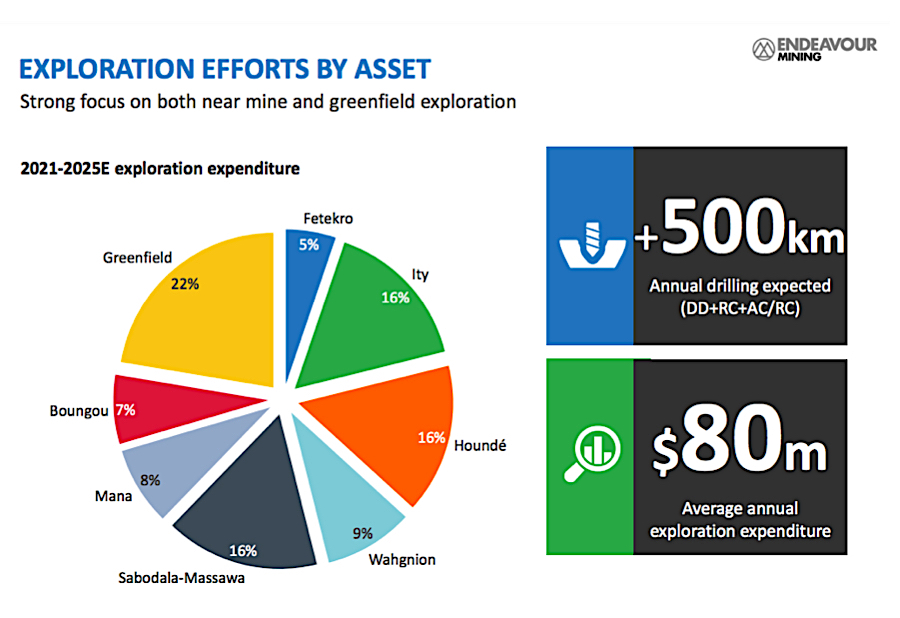

Endeavour will spend an average of US$80 million a year and it expects to add the resources at a cost of less than US$25 per oz., well below West Africa’s producers’ average of US$74 per oz. and the global mean of US$83 per ounce.

The miner, one of the world’s top ten gold producers, said it sees most potential at its Ity mine in Cote d’Ivoire, where it is targeting an output of between 3.5-4.5 million oz. gold by the end of 2025.

The other major contributors will be Houndé in Burkina Faso (3-4 million oz. expected), Sabodala-Massawa in Senegal (2.3-2.7 million oz.) and Wahgnion (1.5-2.0 million oz.)

“While we see significant opportunities across our portfolio, we are particularly pleased with the potential defined at our flagship mines — Sabodala-Massawa, Hounde and Ity,” CEO Sebastien de Montessus said in a statement.

“We believe these mines have the potential to be Tier 1 assets with over 10 million ounces resource endowment, inclusive of historical production.”

Endeavour’s boss said the company is also “very pleased” to demonstrate the opportunities identified at its newest assets, which it obtained through the acquisition of Teranga Gold less than a year ago. Montessus said they have the potential to grow Endeavour’s current resources by as much as 60%.

BMO Metals analyst Raj Ray said the 15-20 million gold oz. target could potentially translate to 10-14 million gold ounces in reserves, given Endeavour has historically achieved a resource to reserve conversion rate of about 70%.

In a note to investors, Ray described Endeavour’s organic growth plan as “bold”. He added that while it was still early days in terms of hitting its target, BMO sees “significant exploration potential within the company’s asset portfolio.”

Endeavour has added 8.5 million ounces of resources over the past four years. Besides Teranga, the company also bought smaller rival Semafo last year.

In a separate news release, the company announced the launch of an offering of fixed-rate senior notes due 2026 as well as the entry into a new revolving credit facility.

Proceeds of the notes will be used to repay all amounts outstanding under the group’s US$370 million bridge term loan facility, which was used to retire higher cost debt facilities acquired upon the acquisition of Teranga Gold; to repay the US$130 million drawn under the group’s existing revolving credit facility (RCF); and to pay fees and expenses in connection with the offering of the notes.

Be the first to comment on "Endeavour Mining outlines ambitious five-year exploration plan"