Equinox Gold (TSX: EQX; NYSE-A: EQX) agreed to buy Calibre Mining (TSX: CXB) for about $2.56 billion in stock to become Canada’s second-largest gold producer.

Calibre shareholders will receive 0.31 Equinox common share for each Calibre common share held immediately before the transaction, according to a joint statement issued Sunday. At closing, existing Equinox shareholders would own about 65% of the combined company’s outstanding shares, compared with 35% for their Calibre counterparts.

The deal, which is expected to close in the second quarter, sets the stage for the creation of a Canadian mining powerhouse with two low-cost assets under the same roof – Equinox’s Greenstone property in Ontario, which achieved commercial production in November and is one of the country’s largest open-pit mines; and Calibre’s Valentine mine, which is nearing construction completion. First gold pour at Valentine is currently targeted for mid-2025.

“The impact of the two mines coming together, creating this Canadian gold power, that’s really as much as anything why we’ve done this,” Equinox chairman Ross Beaty told financial analysts Monday on a conference call. “It’s just going to have a fabulous long-term value creation for shareholders of both companies.”

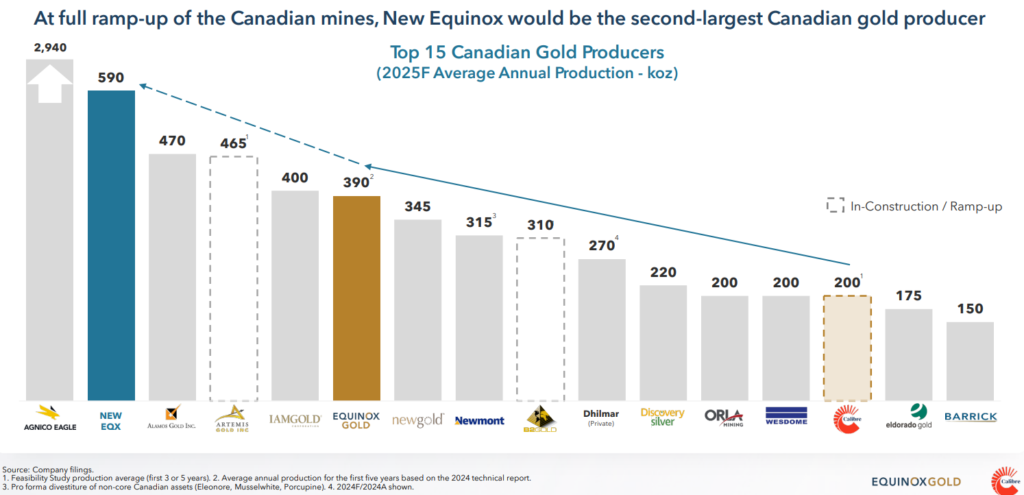

Together, Greenstone and Valentine, which are fully owned, are expected to produce an average of 590,000 oz. of gold per year when operating at capacity. That would vault Equinox into second place among Canadian gold producers – trailing only Agnico-Eagle Mines (TSX: AEM; NYSE: AEM) and its 2.9 million oz. output – and into the top 15 globally.

Transformative step

With Calibre in the fold, Equinox will have nine producing mines in five countries, with another property under construction and five expansion or development projects. It will have gold reserves of about 24 million oz.

“This merger represents a transformative step forward for both Equinox and Calibre, bringing together two complementary companies with strong production, growth potential, operational expertise, and a shared commitment to responsible mining,” Equinox CEO Greg Smith said in the statement. “By combining our assets, teams, and financial strength, we are creating a leading Americas-focused gold producer with enhanced scale, resilience, and the ability to generate significant long-term value for our shareholders and stakeholders.”

The proposed acquisition follows a series of other gold sector deals over the past year, including Gold Fields’s (NYSE: GFI; JSE: GFI) purchase of Osisko Mining and AngloGold Ashanti’s (NYSE: AU) acquisition of Centamin.

Calibre has about 852.5 million shares outstanding. That gives the all-stock offer a value of about $2.56 billion, based on Equinox’s Friday close of $9.69 in Toronto trading.

Shares of Calibre dropped 5.2% to $2.93 in early afternoon trading Monday, giving the company a market capitalization of about $2.5 billion. Equinox fell 1.4% to $9.55, valuing the company at about $4.4 billion.

Long life

Equinox data show Canada would account for more than half of the combined company’s annual gold output. That compares with 19% for Brazil, 13% for the U.S., 10% for Nicaragua and 5% for Mexico.

Newfoundland & Labrador’s Valentine has “the potential to be a long-life gold camp, multiple deposits along a shear zone and a beautiful infrastructure opportunity,” Beaty said. “It’s really got long life potential.”

Equinox produced a record 621,870 oz. of gold last year from seven operating mines in Canada, the U.S., Mexico, and Brazil.

Post-acquisition, Equinox is expected to produce about 950,000 oz. of gold in 2025 – a figure that doesn’t include any contribution from Valentine or Mexico’s Los Filos mine. Once Greenstone and Valentine reach full capacity, Equinox has the potential to produce more than 1.2 million oz. of gold annually, according to the company.

Some asset sales are probable once the deal has closed, Beaty stressed.

“We’re going to have a look at this after we conclude the transaction, and seeing what is the best fit for us and what might be returned to the market for a better company to run,” he said. “So definitely there will be rationalization, I just can’t say which exactly at this point.”

Equinox’s Los Filos mine is one of the assets that will come under the most scrutiny. Los Filos has been the target of frequent protests in recent years, including community blockades that led to production being suspended for several weeks.

Los Filos “is a significant question mark right now,” Beaty said. “It’s still up in the air, and we’ll have to just simply provide information to the market.”

Shareholder vote

Shareholders of both companies will be asked to vote on the transaction before the end of May. Two-thirds of Calibre shareholders will need to approve the deal, while Equinox will require a simple majority threshold of votes cast. Canadian and Mexican competition authorities will also need to authorize the combination.

Executives of both companies will be tasked with running operations. Smith will remain CEO while his counterpart at Calibre, Darren Hall, will be named president and chief operating officer.

Equinox’s board of directors will consist of 10 members, with Beaty continuing as chair. Five additional directors will come from Equinox, including Smith.

The company will continue to operate under the Equinox Gold name and remain headquartered in Vancouver.

I think Calibre is worth more than that, hope there is a competing bid.